Hostile Takeover

Charter Communications does not like the resistance it is getting from Time Warner Cable executives over its bid to acquire the company so Charter has nominated 13 new members for TWC’s board of directors in an effort to force executives to reconsider.

Charter calls the baker’s dozen a slate of “independent candidates” that will be willing to evaluate Charter’s offer of $132.50 a share. Time Warner Cable’s current management says it won’t negotiate with Charter unless they offer $160 a share.

“It is clear from our meetings with Time Warner Cable shareholders that there is an overwhelming desire to combine these two companies to increase Time Warner Cable’s competitiveness, grow market share and create shareholder value. Now is the time for the current Board and management of Time Warner Cable to respond to their shareholders and work with us to complete a merger to the benefit of shareholders while minimizing their execution and market risks,” said Tom Rutledge, Charter’s CEO. “We are nominating a full slate of highly qualified, independent directors to elect to the Time Warner Cable Board and believe that stockholders will use this opportunity to express their views. Our purpose in this proxy contest is to enable shareholders of TWC to raise their voice, and to provide a very capable board who will hear them.”

Charter has gotten a lucky break because all 13 current TWC board members are up for re-election at the same time this spring. Many companies avoid that practice to prevent a hostile bidder from taking control of an entire company’s board.

Charter’s roster of nominees includes a number of current or former CEOs, three former Wall Street lawyers and an ex-chief technology officer that used to work for Time Warner Cable. Many were associated with hedge funds, cable operators that sold out to larger players, or companies that either went bust during the Great Recession and were bailed out by U.S. taxpayers.

Charter Communications’ ‘Rescue Team’ for Time Warner Cable

- James Chiddix: A cable industry veteran who formally retired in 2007, Chiddix worked for Time Warner Cable from the mid-80s until 2001. He now serves as a director at Arris Group, a manufacturer of cable equipment. Chiddix served on the board of Virgin Media, acquired last year by Liberty Global — which also has an ownership interest in Charter Communications;

- Bruno Claude: Known primarily as a “turnaround” expert, Claude has a record of restructuring troubled telecom operators by cutting jobs and negotiating with the large investment banks that generously loaned the money that fueled overvalued takeovers to write down that debt when banks realize they have no hope of being repaid in full;

- Isaac Corre: Currently a lecturer at Harvard Law School, where he teaches a seminar on executive compensation and corporate governance, Corre spent a decade at Eton Park Capital Management, L.P., a global hedge fund. Corre specialized in “event-oriented” investments and “distressed corporate debt”;

Marwan Fawaz: Spent a year in a leadership role at Motorola Mobility/Motorola Home Division. He has the distinction of serving as an executive at two bankrupt cable operators: Charter Communications and Adelphia. Charter eventually emerged from bankruptcy, Adelphia did not and two members of its founding family are spending 15 years in the Allenwood federal prison, convicted of wire and securities fraud. Charter’s press release says Fawaz would be a valued addition to the board because he has “a deep understanding of the cable television industry”;

Marwan Fawaz: Spent a year in a leadership role at Motorola Mobility/Motorola Home Division. He has the distinction of serving as an executive at two bankrupt cable operators: Charter Communications and Adelphia. Charter eventually emerged from bankruptcy, Adelphia did not and two members of its founding family are spending 15 years in the Allenwood federal prison, convicted of wire and securities fraud. Charter’s press release says Fawaz would be a valued addition to the board because he has “a deep understanding of the cable television industry”;- Lisa Gersh: Lasted less than a year as CEO of Martha Stewart Living Omnimedia. Under her leadership, the company capped a year of turmoil that included layoffs, titles closing and the failure of Martha’s underwhelming Hallmark Channel show, according to Adweek. She was also a co-founder of Oxygen Media, which was sold to NBC;

- Dexter G. Goei: An investment banker at Morgan Stanley back when it was hip deep in sub-prime mortgages and a taxpayer bailout, Goei was gone by 2009 and became CEO of Altice, S.A., a multinational cable company growing through acquisitions and takeovers. Goei is raising more capital through a stock IPO managed by Goldman Sachs and… Morgan Stanley;

- Franklin (Fritz) W. Hobbs: In addition to serving as an adviser to private equity firms and director of Molson Coors Brewing Co., Hobbs has served as board chairman at Ally Financial, formerly GMAC, as GM declared Chapter 11 bankruptcy and was bailed out by U.S. taxpayers;

- Neil B. Morganbesser: An investment banker, Morganbesser worked on mergers and acquisitions at Bear Stearns & Co., until the company’s sub-prime hedge funds sank like the Titanic. The investment firm was seeking taxpayer assistance, but ended up being acquired by J.P. Morgan in a hastily arranged deal instead. Charter claims Morganbesser has 20 years of experience providing financial and strategic advice to a full range of clients, including entrepreneurs, large corporations, governments, etc., but evidently wasn’t much help to his employer during the global financial crisis.

- Eamonn O’Hare: Served as the chief financial officer of Virgin Media Inc., the UK’s leading cable television business, from 2009 until 2013. Unfortunately for him, most U.K. residents prefer satellite TV. But that didn’t hurt his bottom line. After Liberty Global acquired the operation in 2013, O’Hare got to share over $367 million in cash bonuses with certain other Virgin executives coming from a company that also has a vested interest in Charter Communications;

- David A. Peacock: Another beer guy, Peacock most recently served as the president of Anheuser-Busch;

- Michael E. Salvati: Another mergers and acquisitions guy, Salvati has been president at Oakridge Consulting, Inc., which provides interim management, management consulting and corporate advisory services to companies ranging in size from start-ups to multinational corporations, since February 2000. In short, he tries to promote financial growth at companies recently merged or acquired;

- Irwin Simon: Founder of the Hain Celestial Group, a leading “natural and organic products company.” Brands including Arrowhead Mills, Bearitos, Rosetto and Rice Dream are well-known in organic food sections of local supermarkets, although few customers probably realize they belong to a giant conglomerate. Other divisions, specializing in “woo-woo personal care” offer dubious “calming body washes” costing $13 or more that feature extract of marigold. Charter says Simon would bring “his unique perspective on all aspects of advertising and marketing services” to a newly merged Charter-Time Warner Cable;

- John E. (Jack) Welsh III: president of Avalon Capital Partners LLC — another private equity investment firm.

“If Time Warner Cable management refuses to negotiate on reasonable terms, we believe Charter will likely secure the votes required to win a proxy fight,” said Jonathan Chaplin, a research analyst with New Street Telco.

“If Time Warner Cable management refuses to negotiate on reasonable terms, we believe Charter will likely secure the votes required to win a proxy fight,” said Jonathan Chaplin, a research analyst with New Street Telco.

“It is clear that Charter is nominating a slate of directors for the sole purpose of pressuring our Board into accepting the same lowball offer that it previously considered and unanimously rejected,” said Time Warner Cable CEO Rob Marcus. “Our Board remains focused on maximizing shareholder value. We are confident in our strategic plan, which was detailed publicly on January 30, and we are not going to let Charter steal the company.”

Marcus may have one last card to play should Charter’s nominees end up on Time Warner Cable’s board of directors. All board members must serve the best interests of the company they oversee, not the company that helped get them elected. An independent evaluation of Charter’s offer must not be influenced by outsiders, or the board members may face lawsuits from angry shareholders. The Wall Street Journal notes this requirement has tripped up hostile bidders before. Air Products & Chemicals Inc. won three board seats at Airgas Inc. which Air Products had tried to buy back in 2010. Once on the board, the new board members recommended against the deal.

Although Charter Communications did not succeed in its bid to assume control of Time Warner Cable, it isn’t crying about its loss to Comcast either.

Although Charter Communications did not succeed in its bid to assume control of Time Warner Cable, it isn’t crying about its loss to Comcast either.

Subscribe

Subscribe Assuming Comcast doesn’t take over Time Warner Cable and change priorities, the city of Los Angeles is

Assuming Comcast doesn’t take over Time Warner Cable and change priorities, the city of Los Angeles is  The first Gigasphere pilot test will begin sometime next year. But a Comcast takeover could shift priorities away from offering the kinds of broadband speeds Time Warner is providing under its TWC Maxx upgrade program. Time Warner’s Internet speeds in upgraded areas are now substantially faster and cheaper than what Comcast offers in its service areas. Comcast could decide to retire the broadband upgrade program altogether and settle on offering speeds comparable to what it already sells across much of its national footprint.

The first Gigasphere pilot test will begin sometime next year. But a Comcast takeover could shift priorities away from offering the kinds of broadband speeds Time Warner is providing under its TWC Maxx upgrade program. Time Warner’s Internet speeds in upgraded areas are now substantially faster and cheaper than what Comcast offers in its service areas. Comcast could decide to retire the broadband upgrade program altogether and settle on offering speeds comparable to what it already sells across much of its national footprint.

Bright House Networks’ long standing relationship with Time Warner Cable — which negotiated programming deals on behalf of the smaller cable operator with operations in the south — may come to an end with an approval of a merger between Comcast and Time Warner. That could make Bright House a prime candidate for a takeover.

Bright House Networks’ long standing relationship with Time Warner Cable — which negotiated programming deals on behalf of the smaller cable operator with operations in the south — may come to an end with an approval of a merger between Comcast and Time Warner. That could make Bright House a prime candidate for a takeover. Charter is almost certain to buy at least some of the three million Time Warner Cable customers Comcast intends to cast-off if it wins regulator approval of its buyout deal. But Team Charter has assembled enough financing to go much farther than that.

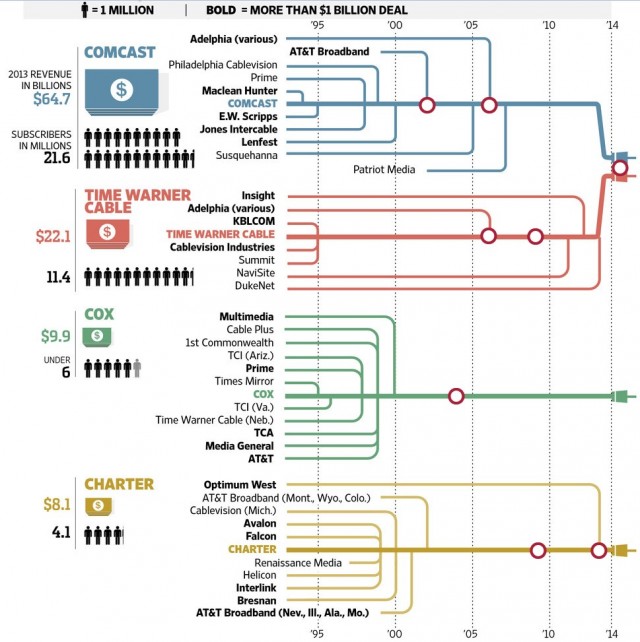

Charter is almost certain to buy at least some of the three million Time Warner Cable customers Comcast intends to cast-off if it wins regulator approval of its buyout deal. But Team Charter has assembled enough financing to go much farther than that. Cox, like Cablevision, has been closely controlled by its founding family for years, so rumors of sales of one or both have never come to fruition. But with the merger announcement of Comcast and Time Warner Cable, Wall Street pressure to consolidate is growing by the day. There is talk that if Comcast succeeds in its buyout effort, even satellite providers like DirecTV and DISH are likely to seek a merger. Even Cablevision, which serves suburban New York City may finally feel enough pressure to sell.

Cox, like Cablevision, has been closely controlled by its founding family for years, so rumors of sales of one or both have never come to fruition. But with the merger announcement of Comcast and Time Warner Cable, Wall Street pressure to consolidate is growing by the day. There is talk that if Comcast succeeds in its buyout effort, even satellite providers like DirecTV and DISH are likely to seek a merger. Even Cablevision, which serves suburban New York City may finally feel enough pressure to sell.

Marwan Fawaz: Spent a year in a leadership role at Motorola Mobility/Motorola Home Division. He has the distinction of serving as an executive at two bankrupt cable operators: Charter Communications and Adelphia. Charter eventually emerged from bankruptcy, Adelphia did not and two members of its founding family are spending 15 years in the Allenwood federal prison, convicted of wire and securities fraud. Charter’s press release says Fawaz would be a valued addition to the board because he has “a deep understanding of the cable television industry”;

Marwan Fawaz: Spent a year in a leadership role at Motorola Mobility/Motorola Home Division. He has the distinction of serving as an executive at two bankrupt cable operators: Charter Communications and Adelphia. Charter eventually emerged from bankruptcy, Adelphia did not and two members of its founding family are spending 15 years in the Allenwood federal prison, convicted of wire and securities fraud. Charter’s press release says Fawaz would be a valued addition to the board because he has “a deep understanding of the cable television industry”; “If Time Warner Cable management refuses to negotiate on reasonable terms, we believe Charter will likely secure the votes required to win a proxy fight,” said Jonathan Chaplin, a research analyst with New Street Telco.

“If Time Warner Cable management refuses to negotiate on reasonable terms, we believe Charter will likely secure the votes required to win a proxy fight,” said Jonathan Chaplin, a research analyst with New Street Telco.