Consolidation of the wireless industry into two or three mega-carriers is a dream come true… if you are one of those carriers (or Wall Street). But for everyone else, it’s a competition wasteland, where innovation and disruptive marketing wane into comfortable and predictable businesses where participants learn not to rock the boat. If they did, a lot of their accumulated money could fall overboard.

Consolidation of the wireless industry into two or three mega-carriers is a dream come true… if you are one of those carriers (or Wall Street). But for everyone else, it’s a competition wasteland, where innovation and disruptive marketing wane into comfortable and predictable businesses where participants learn not to rock the boat. If they did, a lot of their accumulated money could fall overboard.

AT&T believes consolidation is already upon us, despite their setback in failing to acquire T-Mobile USA.

John Stephens, AT&T’s chief financial officer, tried to calm Wall Street’s fears that the government has signaled its intent to preserve robust competition. At yesterday’s Nomura investment conference, Stephens said a reduction in the number of wireless companies in the United States is part of the natural order:

I think it is just logical that the industry is going to consolidate in some form or fashion. I think the marketplace has spoken to that with what it has done to pricing in the valuations on some of the companies. From an economic perspective and a highly CapEx-intensive business, I think it is logical to assume you’re going to have two or three and certainly not six and seven competitors in any marketplace. So I think consolidation is logical.

We’ve heard this argument before. It is commonly trotted out in opposition to community broadband initiatives when existing phone and cable companies fear a third player will ruin the market for everyone. AT&T joins the chorus with the same old excuses: the costs to build and run networks are too high for several players to comfortably compete. Consolidation reduces that pressure as customers are forced to choose among one or two providers, giving each a larger market share and healthier revenue to cover upgrades.

What companies like AT&T always obscure to their customers is the resulting pricing power, where price increases from one often lead to price increases from others. But Stephens has no trouble letting his investors know:

We are going to grow margins year-over-year. Last year’s margins were about 38.5% in wireless and our guidance says we are going to grow. I have said publicly, and some of my peers and coworkers have said publicly we expect we are going to have north of 40% margins this year in our wireless business and still believe that.

Margins = profits. In the absence of aggressive competition which forces companies to invest more in their networks, provide more value in their service offerings, or reduce pricing, increased profits are always the result.

Unfortunately, ZDNet’s editor in chief Larry Dignan seems to buy AT&T’s arguments and talking points, telling readers:

[…] It’s hard to argue against the idea. All industries boil down to two or three players eventually. The big question for wireless consolidation is timing. When will get to two or three carriers? And if so will this consolidation lead to price increases or will the mergers occur after wireless services is commoditized?

Stephens

It is actually very easy to argue against the idea, and the evidence is plainly visible if Dignan would take a look.

First, there is no evidence “all industries boil down to two or three players eventually.” Auto companies, banks, retailers of all kinds — even cell phone manufacturers all compete with more than just one or two other players in the market. A germinating monopoly or duopoly in any market is a signal federal regulators have failed to do the job assigned to them since the days of trust-busting railroads, oil, steel, and the securities business.

The drive to consolidation can be found first on Wall Street, where every industry is under pressure to cut costs, reduce profit-eroding competition, and return higher profits. The drumbeat for consolidation in the wireless industry starts there, is echoed in the executive offices of the cell phone companies themselves, and results in powerhouse deals that have picked off one competitor after another. That is why Cingular, Alltel, Cellular One, and Centennial Communications are no longer familiar names in wireless. They have all been swallowed nearly whole by AT&T or Verizon Wireless.

AT&T would argue that consolidation is a good thing, because through their willingness to sell, those companies indicated they wanted to exit the business. AT&T’s buyout of T-Mobile would have done everyone a favor because the company had lost interest in competing in the United States and wanted out.

The industry has held all of the cards of wireless consolidation until recently, primarily because supine regulators refused to provide a critical “check and balance” on industry pressure, accepting just about any premise to approve whatever wireless carriers wanted. Sure, a few companies had to divest certain assets, as Verizon Wireless did in certain Alltel markets. But AT&T ended up acquiring the majority of those divested territories. When AT&T bought Centennial Wireless, it had to divest a few markets in the southern United States. Verizon Wireless bought most of them. Customers were left in the middle, as always.

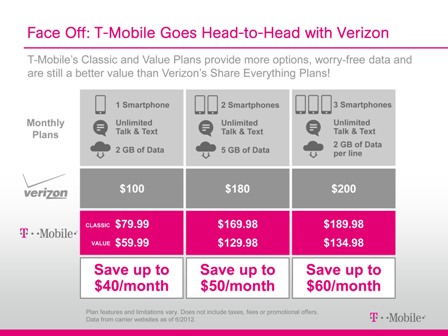

A remarkable thing happened when the federal government said no to AT&T over T-Mobile. Predictions of the smaller carrier’s imminent demise and its slow bleed to irrelevance has not happened. In fact, Deutsche Telekom picked its American asset up, shook the dust off, and is now investing in upgrades to keep the competition coming. At least $4 billion in improvements and some major network upgrades are on the way, and the company has even refreshed its marketing in a new, get-tough campaign against AT&T, Verizon Wireless, and Sprint. Now all three of those companies are watching to see what T-Mobile pulls next.

That is exactly the point.

The wireless world and Wall Street wants you to believe that consolidation is the only way the mobile phone marketplace of 2012 can work. Dignan has thrown in the towel, conceding they are likely right. But T-Mobile is proving they are exactly wrong. Instead of abandoning its asset, which DT still sees as valuable, it is investing in it to compete. Had the merger been approved, AT&T would never answer T-Mobile’s disruptive competition again. Rural America would still be waiting for better service. AT&T would have less pressure to keep prices down and upgrades up, and Wall Street would have turned its attention to the next targeted carrier ripe for the picking by AT&T or Verizon Wireless’ emerging duopoly.

Subscribe

Subscribe