Suddenlink is taking full advantage of a lax approach to regulatory oversight in Texas by laying its cables just about anywhere it pleases, and without talking to local officials about exactly what the cable system is doing.

Suddenlink is taking full advantage of a lax approach to regulatory oversight in Texas by laying its cables just about anywhere it pleases, and without talking to local officials about exactly what the cable system is doing.

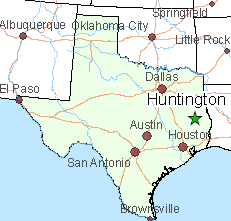

Huntington residents have been complaining to city officials about Suddenlink’s ongoing expansion of its cable system in the city, reporting the cable company is putting cables just about anywhere it wants, often leaving them drooping in yards and roadways. The Altice-owned cable company’s ultimate plans are a complete mystery to the city, because the cable company has said nothing specific about its expansion plans or where exactly the company’s crews are working.

The Lufkin Daily News reports Huntington City Manager Bill Stewart has been hearing second hand about Suddenlink’s expansion since March 2016, but the company has never approached the city formally to share details.

“For the most part, when they finally decided to do it they just started laying lines,” Stewart told the newspaper.

“For the most part, when they finally decided to do it they just started laying lines,” Stewart told the newspaper.

The quality of the construction work is what bothers residents, who complain Suddenlink’s lines are hanging low across yards and even across city streets, with no sign of repair crews willing to fix the problem.

“If they’re going to come in and do something, we expect it will be done right and will be taken care of correctly,” Stewart said. “We want to have a positive relationship with them. But things just need to be done differently if you’re going to come and do something like that. You need to fulfill what you say, and at this point a lot of people are upset because that’s not been done.”

Suddenlink’s response was a general statement:

“Since launching our Suddenlink by Altice broadband, TV, and phone services in Huntington earlier this year, we have seen great demand from residents and have been bringing additional resources to the area to ensure a positive experience for all of our new customers,” Suddenlink media representative Lindsey Angioletti said. “We thank our customers for their support and look forward to serving them with advanced products and services for many years to come.”

Subscribe

Subscribe Suddenlink first detected the problem on a Saturday in late May, but did not identify the fiber line as “shot” until a day later, at which point WPD officers responded to the scene. The cable company evidently did not start repairs until after a widespread service outage began.

Suddenlink first detected the problem on a Saturday in late May, but did not identify the fiber line as “shot” until a day later, at which point WPD officers responded to the scene. The cable company evidently did not start repairs until after a widespread service outage began. JPMorgan “still believes in the potential of an eventual merger of Charter Communications with Altice USA, despite a cool-down in tie-up talk,” according to

JPMorgan “still believes in the potential of an eventual merger of Charter Communications with Altice USA, despite a cool-down in tie-up talk,” according to  As AT&T continues to build out its fiber to the home network in its landline service areas, the company estimates it could achieve 50% market penetration by 2023, triggering a growing wave of consumers dropping cable in search of a better deal.

As AT&T continues to build out its fiber to the home network in its landline service areas, the company estimates it could achieve 50% market penetration by 2023, triggering a growing wave of consumers dropping cable in search of a better deal. Comcast and Charter Communications have no real interest in competing head-to-head in wireless with AT&T, Verizon, T-Mobile, or Sprint. Instead, the two cable companies hope to trap you in a bundled package of services too inconvenient to cancel.

Comcast and Charter Communications have no real interest in competing head-to-head in wireless with AT&T, Verizon, T-Mobile, or Sprint. Instead, the two cable companies hope to trap you in a bundled package of services too inconvenient to cancel.