Internet Overcharging schemes bring even more profits to a cable industry that already enjoys a 95% gross margin on broadband service.

At least one major national cable company plans to implement a usage-based billing system in the coming year, predicts Sanford Bernstein analyst Craig Moffett. Bloomberg News quotes Moffett in a piece that thinly references Time Warner Cable as that operator, whose CEO strongly believes in further monetizing broadband usage.

Moffett is among the chief cheerleaders hoping to see operators charge customers additional fees for their use of the Internet.

“In the end, it will be the best thing that ever happened to the cable industry,” Moffett said.

For customers, DISH Satellite chairman Charlie Ergen predicts it will lead to at least a $20 monthly surcharge for broadband users who watch online video, which could bring already sky-high broadband pricing to an unprecedented $70-80 a month, the same amount most cable operators now charge for standard digital cable-TV service.

The cable industry’s interest in being in the cable television business has waned recently as subscribers increasingly turn away from expensive cable packages. Now companies that used to consider broadband a mildly-profitable add-0n increasingly see Internet access as the new mainstay (and profit center) of their business.

Time Warner Cable, for example, wasn’t even sure its entry in the broadband business in the late 90s would ever amount to much. Fast forward a dozen years, and it is an entirely different story:

“We’re basically a broadband provider,” Peter Stern, chief strategy officer for New York-based Time Warner Cable, said Nov. 17 at the Future of Television conference in New York. “As a convenience for our customers, we package and distribute television and provide service around that.”

Bloomberg reports the cable industry profit margin on broadband is nearly 95 percent, a testament to the lack of competitive pressure on Internet pricing. The industry is going where the money is to make up for increasing challenges to their video business, which currently “only” brings them a 60 percent profit margin.

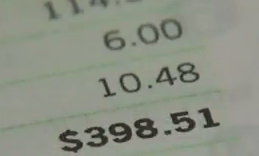

Suddenlink, already enjoying a 12 percent increase in broadband revenue in the last quarter alone, is implementing its own Internet Overcharging scheme, charging $10 for every 50GB a customer exceeds their arbitrary usage allowance. That, despite the fact CEO Jerry Kent admits Suddenlink’s broadband margins are double those earned from the cable company’s video business.

Complicit in the parade to Internet Overcharging is Federal Communications Commission chairman Julius Genachowski, who publicly supported usage-based pricing in public statements made last December. Cable operators were fearful Genachowski might lump the pricing scheme in with the Net Neutrality debate. Providers have since used Genachowski’s loophole in an end run around Net Neutrality. If providers cannot keep high volume video traffic from competitors like Netflix off their networks, they can simply make using those services untenable on the consumer side by increasing broadband pricing, already far more expensive than in other parts of the world.

That is a lesson already learned in Canada, where phone and cable companies routinely limit usage and slap overlimit fees on consumers who cross the usage allowance line. Canada’s broadband ranking has been deteriorating ever since.

Moffett - The chief cheerleader for Internet Overcharging

Bloomberg says such a pricing regime would discourage investment in online video products that currently are held responsible for some cable cord-cutting:

“It’s the reason why Apple or Google would inevitably be reticent about committing a significant amount of capital to an online video model,” Moffett told Bloomberg. “You can’t simply assume just because you can buy the content more cheaply, you can offer a product that’s cheaper to the end user.”

The only way around this might be video providers like Google getting into the broadband business themselves, something Google is experimenting with in Kansas City. Google’s “Think Big With a Gig” project is partly designed to prove gigabit broadband delivered over a fiber network is practical and doesn’t have to be unaffordable for consumers. It will also finally bring competitive pressure on a comfortable broadband duopoly, at least for residents in one city.

So far, video providers who depend on an Internet distribution model are not putting much money in the fight against usage-billing. Instead, companies like Netflix are releasing occasional press releases that decry the practice.

“[Usage billing] is not in the consumer’s best interest as consumers deserve unfettered access to a robust Internet at reasonable rates,” Steve Swasey, a Netflix spokesman, said previously.

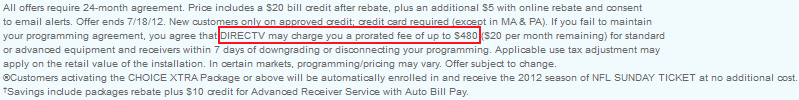

It is clear consumers despise usage pricing. In every survey conducted, a majority of respondents oppose limits on their broadband usage, especially at today’s prices. But that may not be enough to get companies like Time Warner Cable to back off. The company has reportedly been quietly testing usage meters since last summer. CEO Glenn Britt, with a considerable drumbeat of support from Wall Street analysts like Mr. Bernstein, has never shelved the concept of usage pricing, seeing it more lucrative than hard usage caps. The company retreated from a 2009 plan to charge up to $150 a month for flat rate access after consumers rebelled over planned trials in Texas, North Carolina, and New York.

But without a solid message of opposition from consumers, and an about-face from an FCC chairman that should know better, they’ll be back looking for more money soon enough.

[Thanks to regular Stop the Cap! reader Ron for sharing the news.]

Subscribe

Subscribe