Suddenlink’s Operating GigaSpeed has reached parts of Texas, Missouri and North Carolina — the first areas to get 1,000/50Mbps service from the cable company. But customers are not happy to learn it is accompanied by a 550GB usage cap.

Suddenlink’s Operating GigaSpeed has reached parts of Texas, Missouri and North Carolina — the first areas to get 1,000/50Mbps service from the cable company. But customers are not happy to learn it is accompanied by a 550GB usage cap.

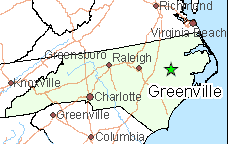

The first markets qualified for gigabit service include:

- Bryan-College Station, Texas;

- Nixa, Mo.;

- Greenville and Rocky Mount, N.C.

Customers learning about the faster speeds tell Stop the Cap! they are deeply disappointed Suddenlink has kept a cap on the premium-priced speed tier.

“Here in Greenville they are charging $110 a month for the service, $5 for a cable modem or $10 for a Wi-Fi router, and a $35 mandatory technician visit fee which sounded reasonable until they mentioned there was a 550GB data allowance on the service,” said Stop the Cap! reader J.J. Wallace. “That killed it for me. That is nothing short of outrageous to charge that kind of money and place a ridiculously low cap on it. It’s funny the local newspaper and Suddenlink’s press releases never bother to mention the usage cap.”

“Here in Greenville they are charging $110 a month for the service, $5 for a cable modem or $10 for a Wi-Fi router, and a $35 mandatory technician visit fee which sounded reasonable until they mentioned there was a 550GB data allowance on the service,” said Stop the Cap! reader J.J. Wallace. “That killed it for me. That is nothing short of outrageous to charge that kind of money and place a ridiculously low cap on it. It’s funny the local newspaper and Suddenlink’s press releases never bother to mention the usage cap.”

Wallace says he avoids usage caps by subscribing to Business Class service, which carries no usage allowance but forces him to a slower speed tier to keep things affordable. A 50/8Mbps business plan costs around $80 a month with modem rental and Suddenlink does not mind selling it to residential customers who refuse to deal with a usage cap.

“That is just about the most affordable plan they have that is tolerable,” Wallace writes. “If you want gigabit speeds on a business account, that will run you at least $575 a month plus equipment fees.”

“Suddenlink is no Google Fiber,” adds Pitt County resident Jennifer Davis. “Google is coming to the Triangle and Charlotte and can easily sell gigabit service for $40 less with absolutely no usage cap or equipment fees. Suddenlink wants another shake of our pocketbooks to grab even more money from us. You can’t even buy your own modem for gigabit service. You have to rent theirs. My area of the county is stuck with Suddenlink like a punishment. As a small business owner who depends on the Internet I am tired of being jerked around by these people.”

Some Suddenlink customers have managed to score better deals for broadband by threatening to leave Suddenlink for the phone company, often CenturyLink, AT&T, or Windstream.

“If you impress on them they are charging too much, they will often find a promotion for you, but so far I’ve had no luck getting them to waive the caps unless you switch to business service,” said Wallace. “They always act like you are the first person to complain about usage caps, but if you read their social media pages, there are many others very upset to find they’ve lost unlimited use service after Suddenlink introduced speed upgrades. Most of my friends would rather have unlimited than faster service you can’t use.”

“If you impress on them they are charging too much, they will often find a promotion for you, but so far I’ve had no luck getting them to waive the caps unless you switch to business service,” said Wallace. “They always act like you are the first person to complain about usage caps, but if you read their social media pages, there are many others very upset to find they’ve lost unlimited use service after Suddenlink introduced speed upgrades. Most of my friends would rather have unlimited than faster service you can’t use.”

As for speed upgrades, the communities now qualified for gigabit service will find some changes as Suddenlink adjusts their Internet tiers:

- Internet 50: 50/5Mbps is the new base speed with a 250GB cap

- Internet 100: 100/10Mbps comes with a 350GB cap (current 75Mbps customers upgraded to this tier)

- Internet 200: 200/20Mbps comes with a 450GB cap (current 100Mbps customers upgraded to this tier)

- Internet 1 Gig: 1,000/50Mbps comes with a 550GB cap

- Overlimit Fee: $10 per 50GB of usage, not pro-rated

Suddenlink is pushing existing DOCSIS 3.0 technology to its practical limit offering gigabit service. The latest DOCSIS 3.0 chipsets in newer model cable modems can bond up to 32 downstream channels, enough to support up to 1.2Gbps. To make room for gigabit speeds, Suddenlink needs to migrate its cable television offering to an all-digital format in the cities where it offers the fastest service. It also needs to retire any remaining legacy DOCSIS 2 modems still in use.

Operation GigaSpeed will offer gigabit broadband to all Suddenlink customers in the markets where the service is offered. The company considers that an advantage over Google Fiber and AT&T U-verse with GigaPower, which is only available in certain neighborhoods.

DOCSIS 3.1, expected to make gigabit speeds available more widely on cable systems, is expected to begin market trials as early as later this year with an expectation it will begin to see wider deployment in 2016.

Subscribe

Subscribe Today’s offer by Altice SA to spent $11 billion to acquire France’s Bouygues Telecom and combine it with Altice-owned Numericable-SFR to create France’s largest wireless operator

Today’s offer by Altice SA to spent $11 billion to acquire France’s Bouygues Telecom and combine it with Altice-owned Numericable-SFR to create France’s largest wireless operator

French lawmakers, particularly those aligned with France’s labor unions, accuse Drahi of acting like a bulimic debtor and feared his splurge would eventually lead to a banker-forced purge and government bailout if he cannot meet his debt obligations in the future.

French lawmakers, particularly those aligned with France’s labor unions, accuse Drahi of acting like a bulimic debtor and feared his splurge would eventually lead to a banker-forced purge and government bailout if he cannot meet his debt obligations in the future.

A tiny Madison Avenue investment bank (so small its only web presence is

A tiny Madison Avenue investment bank (so small its only web presence is