Consumers who refuse to pay for cable television today still won’t pay for it tomorrow, even if they are offered a slimmed-down “skinny bundle” of cable networks for less money.

Consumers who refuse to pay for cable television today still won’t pay for it tomorrow, even if they are offered a slimmed-down “skinny bundle” of cable networks for less money.

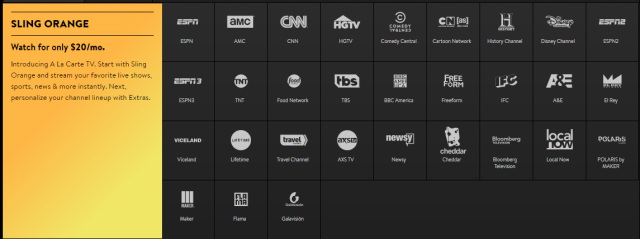

Sanford Bernstein media analyst Todd Juenger continued a series of focus groups with consumers to find if alternatives to cable television are attractive to consumers. The under-40 sample mixed cord-cutters and current cable and satellite customers and presented them with a range of recently available options from Sling, DirecTVNow and YouTube TV and asked if they would subscribe.

Once again, Juenger discovered the group most likely to subscribe to a cable-TV alternative already had pay television and often paid for the top-tier of service. So far, many of those customers are sampling different services but have not taken the last step of dropping their existing cable television package.

Multichannel News reports most won’t disconnect because of the lack of DVR service from most cable-TV alternatives. Until robust cloud-based DVR service is widely available and not hobbled by a lack of fast-forwarding functionality, new streaming services like DirecTVNow probably will never replace cable television.

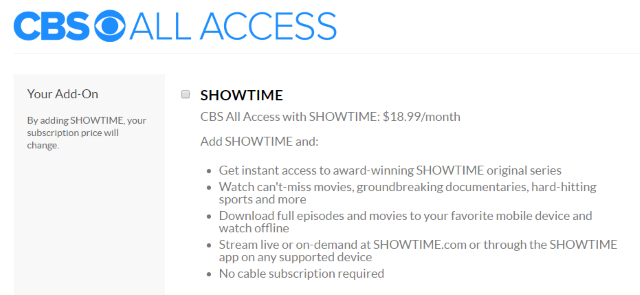

Cable-nevers — mostly younger consumers that have never paid for cable television, still don’t seem to be willing to pay for online alternatives either. Most cited the fact they watched individual shows, not channels, and most “skinny bundles” invariably lacked certain networks with the programming they wanted to watch. Many would prefer to subscribe to television shows, not networks.

Cable TV pricing, widely slammed by many customers as too high, didn’t seem to matter as much to those participating in the series of focus groups. When asked what cable networks they would be willing to pay $5 a month each to watch, ESPN was rated on top, followed by Food Network, FX, HGTV, Logo, NBCSN, Syfy and VH1 — many carrying niche shows and original content not available elsewhere. If all eight networks were bundled together, that would cost $40, considerably more than the per channel price of much larger packages.

While older cable subscribers tend to watch programming from the same 6-10 cable networks, younger viewers seek out specific shows, and may not be able to identify what cable networks air them. They also watch on-demand more than older viewers.

Subscribe

Subscribe