AT&T has created a streaming television bundle that cable and satellite subscribers can appreciate. Replicating the kind of promotions familiar to DirecTV subscribers, AT&T debuted its new streaming TV service nationwide this morning with three promotionally priced packages that start at a relatively low price and end with a very high one.

AT&T has created a streaming television bundle that cable and satellite subscribers can appreciate. Replicating the kind of promotions familiar to DirecTV subscribers, AT&T debuted its new streaming TV service nationwide this morning with three promotionally priced packages that start at a relatively low price and end with a very high one.

AT&T TV is intended to fill the gap between bare bones, slimmed-down packages offered by services like Sling TV and the bloated television packages offered by traditional cable and satellite providers. The new service is part of AT&T’s plan to gradually wind down DirecTV satellite service and U-verse TV, delivering video content over the internet instead of by cable or satellite. AT&T has already ceased marketing its U-verse TV service and intends to do the same with DirecTV, which had been heavily advertised for years. The best new customer promotions will likely be targeted towards its new streaming service as well.

AT&T TV’s set-top box and remote control.

Unlike AT&T’s cord-cutting package — AT&T TV Now, AT&T TV features hundreds of channels, a 500-hour DVR that will store recordings up to 90 days, and over 40,000 on-demand shows. AT&T TV carries just about every cable channel imaginable, along with a healthy amount of regional and national sports, most local stations, scores of international channels in several languages, and premium movie channels galore. AT&T TV does not have the bandwidth and capacity constraints U-verse and DirecTV have, so the service can offer as many channels as customers can afford.

To watch, you need an internet connection with at least 8 Mbps for “optimal viewing.” If you want to bundle AT&T’s gigabit fiber service with AT&T TV, the company offers an extra $10/mo off for the first 12 months of your 24 month contract.

One of AT&T’s biggest selling points for its new TV service is its bundled set-top box, powered by Google’s Android TV. That gives subscribers access to apps in the Google Play Store, which means integrating Netflix, Hulu, and just about any other music or video streaming app is easy. Customers also can benefit from AT&T’s voice remote, which uses Google Assistant.

A careful review of the terms and conditions quickly reveals that this new service is not intentioned for cord-cutters. For starters, AT&T TV channel lineups are larger than other cord-cutting services, and are priced accordingly. The cheapest package on offer — Entertainment (~73 channels), is priced at $93 a month after the new customer promotion expires. AT&T TV also includes a two-year term contract satellite users are well familiar with. If you cancel early, you are subject to an early cancellation penalty of $15 for each month remaining on your contract. A sports programming fee of up to $8.49/mo is charged separately for some customers. A $19.95 setup fee also applies, along with equipment fees of $10/mo for each additional set-top box (the first one is included). Customers can also buy the box outright for $120.

AT&T protects its other video services from revenue cannibalization by disallowing new customer discounts for existing DirecTV and U-verse TV customers. For everyone else, here is what you can expect to pay:

- Entertainment: $49.99/mo for months 1-12, $93/mo for months 13-24.

- Choice: $54.99/mo for months 1-12, $110/mo for months 13-24.

- XTRA: $64.99/mo for months 1-12, $124/mo for months 13-24.

- Ultimate: $69.99/mo for months 1-12, $135/mo for months 13-24.

- Optimo Más: $54.99/mo for months 1-12, $86.99 for months 13-24.

Some other points:

- AT&T TV allows up to three concurrent streams.

- Regional Sports Fee of up to $8.49/mo. applies to Choice and higher packages.

- Additional set-top boxes are $10/mo or can be purchased for $120.

- A $50 AT&T Visa® Reward Card is available if you order AT&T TV online. Expires: 3/31/2020. For new residential customers only. Residents of select multi-dwelling units not eligible.

- Save an additional $10/mo. for 12 months on TV when you bundle with internet or wireless.

- $19.95 activation fee.

- Early termination fee of $15/mo for each month remaining on agreement.

- Equipment non-return fee may apply if you fail to return equipment when ending service.

Subscribe

Subscribe Large media companies and streaming services are on to many of you.

Large media companies and streaming services are on to many of you. “I think we continue to monitor it,” said Gregory K. Peters, Netflix’s chief product officer, on the 2019 third quarter earnings call. “We’ll see those consumer-friendly ways to push on the edges of that, but I think we’ve got no big plans to announce at this point in time in terms of doing something differently there.”

“I think we continue to monitor it,” said Gregory K. Peters, Netflix’s chief product officer, on the 2019 third quarter earnings call. “We’ll see those consumer-friendly ways to push on the edges of that, but I think we’ve got no big plans to announce at this point in time in terms of doing something differently there.” Streaming providers are more interested in stopping the pervasive sale of stolen account credentials on services like eBay and shutting down stolen accounts used to harvest content for unauthorized resale. But as sharing grows, so will calls from stakeholders to curtail the practice. Those in favor of vigorous crackdowns on password sharing argue billions of dollars of lost revenue will be lost. If a service like Netflix blocked password sharing, that could lead to dramatic increases in account sign-ups. But less established brands like Disney+ seem more concerned about losing the unofficial extra viewers that are watching and buzzing about shows on its new streaming platform. Find the

Streaming providers are more interested in stopping the pervasive sale of stolen account credentials on services like eBay and shutting down stolen accounts used to harvest content for unauthorized resale. But as sharing grows, so will calls from stakeholders to curtail the practice. Those in favor of vigorous crackdowns on password sharing argue billions of dollars of lost revenue will be lost. If a service like Netflix blocked password sharing, that could lead to dramatic increases in account sign-ups. But less established brands like Disney+ seem more concerned about losing the unofficial extra viewers that are watching and buzzing about shows on its new streaming platform. Find the  Comcast video customers will be the first to get Comcast/NBCUniversal’s new streaming platform, dubbed “Peacock,” featuring over 400 TV series and 600 movies, mostly from the library of Universal Studios, beginning this spring.

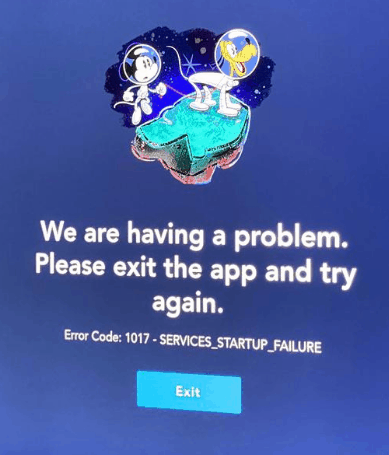

Comcast video customers will be the first to get Comcast/NBCUniversal’s new streaming platform, dubbed “Peacock,” featuring over 400 TV series and 600 movies, mostly from the library of Universal Studios, beginning this spring. (Reuters) – Walt Disney Co said demand for its much-anticipated streaming service, Disney+, was well above its expectations in a launch on Tuesday marred by complaints from users about glitches and connection problems.

(Reuters) – Walt Disney Co said demand for its much-anticipated streaming service, Disney+, was well above its expectations in a launch on Tuesday marred by complaints from users about glitches and connection problems. Ironically, one of the few a-la-carte providers available is a very large cable company you may already know. Charter’s Spectrum has been quietly selling

Ironically, one of the few a-la-carte providers available is a very large cable company you may already know. Charter’s Spectrum has been quietly selling