Ad supported free streaming of current TV shows and movies on Hulu will come to an end over the next several weeks as it converts to an all-paid subscription service.

Ad supported free streaming of current TV shows and movies on Hulu will come to an end over the next several weeks as it converts to an all-paid subscription service.

For the last few years, Hulu has progressed towards a goal of creating an online streaming alternative to cable television that is owned and operated by content creators, cutting out the middlemen — traditional distributors like cable, phone, and satellite companies.

When it launched in 2007, Hulu offered a central website for television shows from three of the four major networks – ABC/Disney, NBCUniversal, and 21st Century Fox all offered full-length shows and clips on Hulu. (CBS has always preferred to showcase its own content in-house or through very restrictive contracts with third-party distributors.)

Hulu began with a limited commercial load, but has gotten progressively more ad-heavy over the last nine years. Most of Hulu’s free content has been limited to a maximum of the five most recent episodes of a current show, each appearing about a week after it originally airs. Those looking to view Hulu on a variety of wireless devices have been required to subscribe to a subscription tier since 2010, dubbed Hulu Plus. Subscribers still saw commercials, but also received access to more content viewable on more devices.

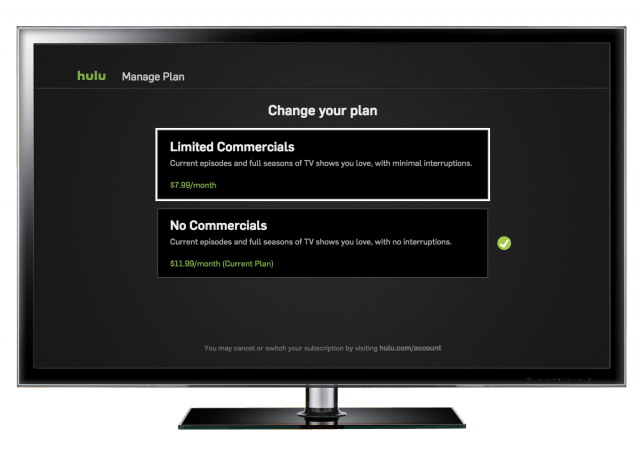

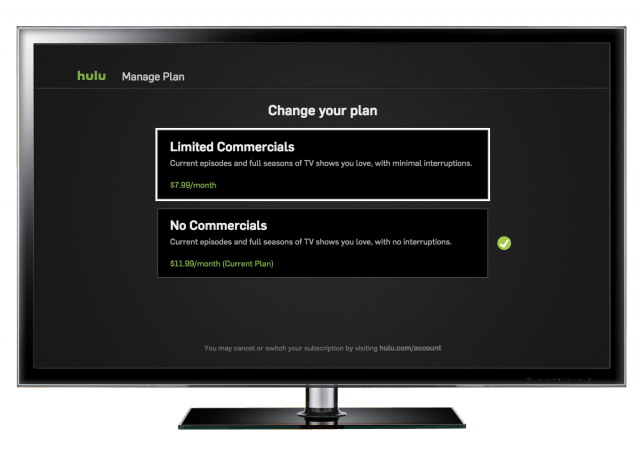

Hulu’s growth has always been stunted by its marketing — charging a subscription fee and continuing to show 15-20 minutes of ads each viewing hour. In 2015, Hulu began offering customers an ad-free option for $11.99 a month, as much as $3 more than Netflix. But Hulu began adding new customers willing to pay their price to avoid commercials.

In the last two years, Hulu’s content library has grown substantially, and relying on viewers watching free content has become less important to a service with 12 million paying subscribers.

“For the past couple years, we’ve been focused on building a subscription service that provides the deepest, most personalized content experience possible to our viewers,” said Ben Smith, Hulu senior vp and head of experience. “As we have continued to enhance that offering with new originals, exclusive acquisitions, and movies, the free service became very limited and no longer aligned with the Hulu experience or content strategy.”

It has gotten so limited that new site visitors have trouble even finding the remaining free content.

Hulu is also preparing to launch a $40/month cable-TV replacement service sometime next year that will offer dozens of live cable channels bundled with Hulu’s on-demand content. The service could become a significant threat to traditional cable TV and promote more cord-cutting.

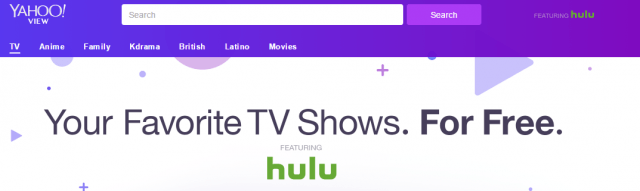

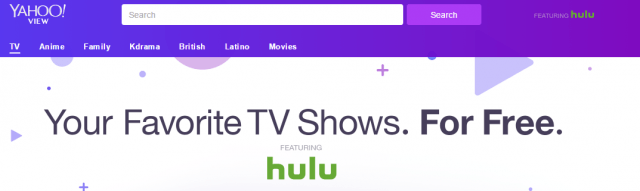

Hulu’s free content is moving to Yahoo View

Hulu has shown no interest in slowing down. In fact, in response to increasing competition for content, last week Hulu agreed to sell a 10% interest in itself to Time Warner (Entertainment) in a deal worth $583 million. That deal assures Time Warner-owned channels (TNT, CNN, Turner Classic Movies, TBS, etc.) will be on Hulu’s cable-TV service next year. Hulu is expected to spend that money on licensing more content for subscribers.

Current free Hulu viewers need not worry about the change in Hulu’s status. Visitors will be offered free trials of Hulu’s premium options and Yahoo has agreed to adopt Hulu’s player and its existing free ad-supported library of TV shows, movies and clips for its Yahoo View service, which launched this morning.

Later this year, Comcast customers will be able to watch Netflix content with the cable company’s X1 set-top box.

Later this year, Comcast customers will be able to watch Netflix content with the cable company’s X1 set-top box.

Subscribe

Subscribe Walmart is recommending customers consider cutting off cable television for good with

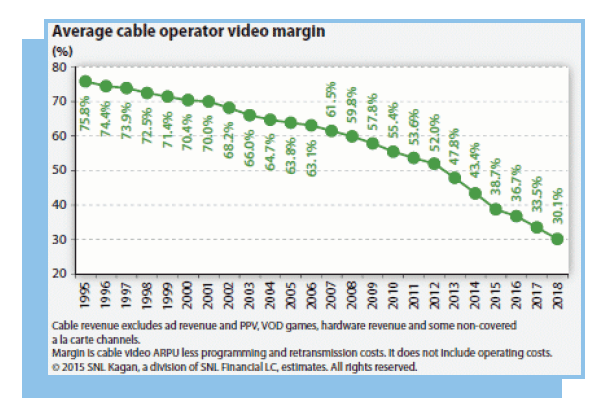

Walmart is recommending customers consider cutting off cable television for good with  Hulu’s still-to-be-announced live TV streaming service designed to give subscribers an alternative to bloated and expensive cable-TV packages will lose “real money” if it is priced at around $40.

Hulu’s still-to-be-announced live TV streaming service designed to give subscribers an alternative to bloated and expensive cable-TV packages will lose “real money” if it is priced at around $40.

CBS may have discovered consumers don’t like to pay $5.99 for the company’s streaming service only to be inundated with just as many commercials as an over-the-air viewer encounters without having to pay a penny.

CBS may have discovered consumers don’t like to pay $5.99 for the company’s streaming service only to be inundated with just as many commercials as an over-the-air viewer encounters without having to pay a penny.