Google’s forthcoming online TV streaming service will cost too much for too little and includes a cloud-based DVR that will replace many of your recordings with unskippable-ad-laced alternatives.

Google’s forthcoming online TV streaming service will cost too much for too little and includes a cloud-based DVR that will replace many of your recordings with unskippable-ad-laced alternatives.

YouTube TV was previewed for reporters Tuesday, despite the fact it won’t debut until late spring or early summer, with a lineup of 40 channels for $35 a month. The “skinny bundle” from Google has managed to put together a very incomplete lineup of major cable networks and for most of the country, on-demand-only access of network shows about a day after they air.

YouTube TV Tentative Lineup

- Disney: ABC, ESPN, ESPN2, ESPN31, ESPNU, ESPNews, SEC Network, Disney Channel, Disney Junior, Disney XD, Freeform

- NBCUniversal: NBC, Telemundo, Bravo, Chiller, CNBC, E!, Golf Channel, MSNBC, NBC Universo2, NBCSN, Oxygen, Sprout, SyFy, Universal HD, USA. In some regions: Comcast Regional Sports Networks, NECN (New England Cable News)

- CBS: CBS, The CW, CBS Sports Network

- Fox: FOX, FS1 (Fox Sports 1), FS2 (Fox Sports 2), BTN (Big Ten Network), FX, FXX, FXM, Nat Geo, Nat Geo Wild, Fox News, Fox Business. In some regions: Fox Regional Sports Networks

- The Weather Channel: Local Now (rolling weather forecasts)

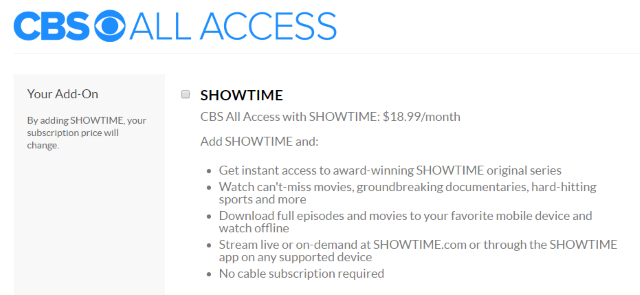

- YouTube TV members can also add Showtime for $11 a month and Fox Soccer Plus for $15 a month.

- Availability of local TV/live network streaming limited to residents of New York, Los Angeles, Chicago and Philadelphia.

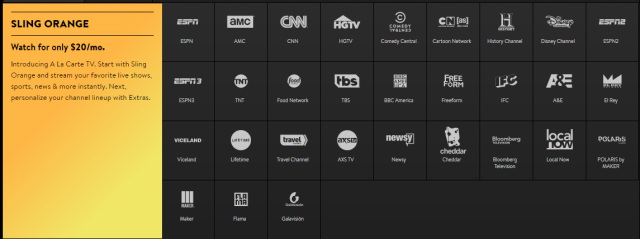

Prospective customers will have to tough it out with no access to AMC, HBO, MTV, Comedy Central, Nickelodeon, MTV/VH1, CNN, Cartoon Network, Discovery, TBS, TNT, PBS, Food Network, and HGTV among many other missing networks.

One potentially interesting feature – an unlimited cloud-based DVR service, is rendered almost unusable with the imposition of prioritized video-on-demand. In short, this means that once a video-on-demand version of the show you recorded on your DVR becomes available, you can no longer access your recording. Your only option is to watch the ad-heavy, on-demand version with advertising you cannot skip. In most cases, that will give customers about 12-24 hours to watch their DVR recordings before they become inaccessible, at least until the on-demand version is removed.

Wojcicki

That’s a challenging proposition when consumers have other choices including AT&T’s DirecTV Now, Sling TV, and PlayStation Vue. The premise of YouTube TV, like many others, is to appeal to cord cutters and cable-nevers — especially millennials.

“There’s no question millennials love great TV content,” said YouTube chief executive Susan Wojcicki. “But what we’ve seen is they don’t want to watch it in the traditional setting.”

What Wojcicki ignores is the fact millennials prefer to watch their shows on-demand. Relying on live television as the primary source of scripted television shows is already inconvenient and unnecessary. The viewing experience is increasingly an individual one, catering to the whims of a single viewer watching on a tablet, smartphone, or connected TV. Of all the websites on the internet, YouTube should already understand the trend towards individualized viewing better than most.

Just as important, YouTube TV is a lousy deal. Hulu subscribers can binge watch all the series they want with no ads for $11.99 a month. YouTube TV will charge nearly three times the price and force customers to sit through up to 18 minutes of ads an hour. Hulu doesn’t require customers to use Google’s Chromecast as the only stream-to-TV option either. A premium YouTube Red subscription also won’t get you a better deal or fewer ads. You may already pay to watch YouTube commercial free but now you will pay more to watch YouTube TV filled with ads.

Analyst Michael Nathanson said Google’s real goal here is to get into the television advertising market. Because customers will be held captive by a disabled fast-forward button, they will see Google-targeted ads playing in ad slots normally reserved for use by local cable operators. Getting a lot of people to watch those ads means YouTube TV will at least be generous about something. A subscription will include access for six accounts with separate login information, but only three users can watch simultaneously, if they bother.

Subscribe

Subscribe

Google’s forthcoming online TV streaming service will cost too much for too little and includes a cloud-based DVR that will replace many of your recordings with unskippable-ad-laced alternatives.

Google’s forthcoming online TV streaming service will cost too much for too little and includes a cloud-based DVR that will replace many of your recordings with unskippable-ad-laced alternatives.