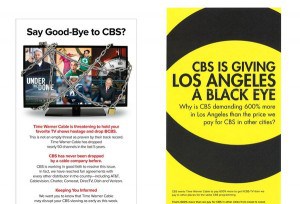

After repeated extensions, Time Warner Cable yanked several channels from your cable dial today, and before you ask, you are -not- entitled to any refunds. So don’t ask. (Actually, ask anyway.)

After repeated extensions, Time Warner Cable yanked several channels from your cable dial today, and before you ask, you are -not- entitled to any refunds. So don’t ask. (Actually, ask anyway.)

The affected channels are:

- CBS Owned-and-Operated TV stations in the following cities:

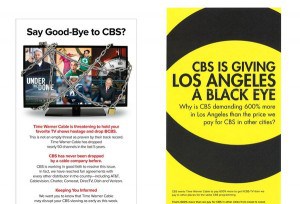

Los Angeles: KCBS and KCAL-Ind.

New York: WCBS

Dallas-Ft. Worth: KTVT-CBS and KTXA-Ind.

Boston: WBZ-CBS and WSBK-Ind. (carried in parts of NH and MA)

Chicago: WBBM-CBS (carried in parts of WI)

Denver: KCNC-CBS (carried in Gunnison and Telluride)

Detroit: WKBD-CW (carried in parts of OH)

Pittsburgh: KDKA-CBS and WPCW-CW (carried in parts of OH)

- Showtime

- The Movie Channel (TMC)

- Flix

- Smithsonian Channel

Phillip “FAQ” Dampier

If your local CBS station is not on this list, you will still be able to watch CBS programming because the dispute only affects local stations directly owned/operated by CBS. But cable subscribers nationwide may notice the loss of the cable networks and premium movie channels, if one subscribes.

As a courtesy, Time Warner Cable has elected to throw Showtime subscribers a bone (and avoid having to pay any refunds) by turning on Starz and Encore for affected customers. (If you happen to find anything worthwhile to watch on Starz, please post a comment and let the rest of us know what we are missing.) Encore is a better choice, but customers should feel free to arrange their own “credit” by canceling Showtime until the dispute is resolved. Time Warner Cable was running a promotion offering HBO and Cinemax for $5 a month each for six months to a year. Inquire if that option is still available if you are feeling premium movie channel withdrawal.

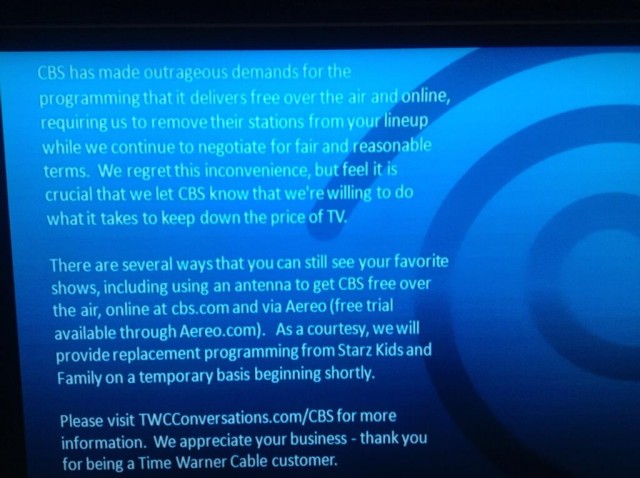

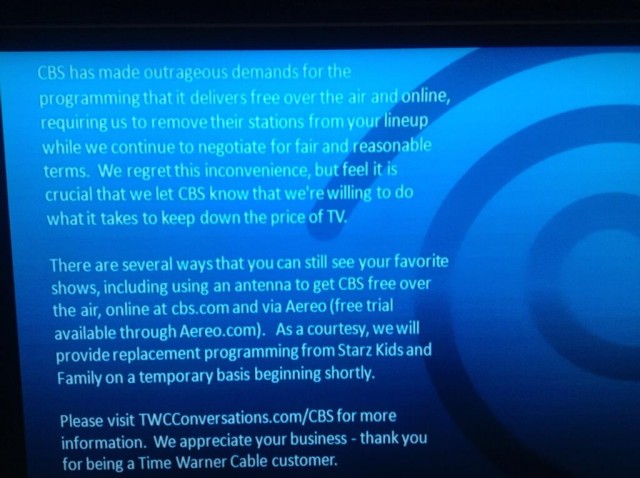

“We deeply regret being forced into this position by CBS, but we’re prepared to stand by our customers and do what it takes to fight these unreasonable demands,” writes Time Warner Cable.

In the meantime, we’ve helped massage Time Warner’s FAQ and rubbed in some truth extract:

Q: Dear Time Warner Cable Assassins of Joy: Now that you’ve stopped carrying the channels I am still paying for, where can I find the darn shows I’m missing?

A: There are any number of places, including free over-the-air using an antenna, if you remember what that looks like, plus some places online for free. In addition, in NYC only, CBS is available through Aereo, which is currently offering a one-month-free-trial at www.aereo.com. Just don’t think about dropping your entire cable television package once you discover Aereo works well enough for you and you don’t need us to delete $70 a month from your wallet and recreate it in ours. Pretty please.

Courtesy: Rich Greenfield, BTIG

For national network prime time shows:

- Visit www.CBS.com to see recent airings (mostly repeats except for Stephen King’s ‘Small Town Under Glass’) of their primetime shows. Thank us we are not capping your Internet usage, sticking it to you for watching unauthorized shows (the ones we don’t own) for free.

- In addition, many primetime programs are available via national online services like Amazon.com, Hulu.com, iTunes.com, or Netflix.com, some for free, some as part of a subscription fee that is almost always far less than the pillaging prices we charge.

For daytime soap operas if you still bother to watch those: www.cbs.com for free

For local news, weather, and sports: Remember that your other local broadcast stations remain available on the Time Warner Cable lineup, along with NY1/YNN in select markets (because you want to get your local news from a wholly owned Time Warner Cable news network — the one that often shills our own products). And some of the local CBS stations stream their local newscasts for free over the Internet. Again, worship us for not capping your broadband. Check your local station’s website for information.

For syndicated shows like Dr. Oz, Ellen, Katie, and others: They are probably all repeats anyway and how many times do you need to be told you are living your life all wrong. It’s summer. Go outside. Be happy. If you insist, most of those shows share either full episodes or highlights via their own websites, for free.

For shows that appear on Showtime, or movies: Showtime makes some episodes and clips available for free at Sho.com and at Hulu.com. Because nothing equals the experience of watching an entire show like a 30 second clip! Other episodes can be found at paid services like Amazon.com, Netflix.com, and on iTunes. So while you are still paying us for those premium movie channels, go and pay someone else too. And remember that, as a courtesy so we don’t actually have to refund your money, we are providing replacement programming from Starz and Encore on a temporary basis. Showtime and TMC customers should look in your onscreen guide for the Starz and Encore channel numbers.

For shows on Smithsonian: If you can find the channel on our 1,000 channel lineup, you are better than us. If you actually watched any shows on Smithsonian, you can get by with similar shows on Discovery, National Geographic, TLC, Animal Planet, and many others, as long as you steer well clear of Honey Boo Boo. She’s a national treasure too, we know, but not enough to be on the Smithsonian Channel.

Frequently Asked Questions Not Well-Answered

Q. Why is this happening?

A: $$$. We collect, count and stack your money for the pleasure of our executives and shareholders and now other programmers dare to want some of it. We’re not going to let that happen unless you give us more than enough to replace what we’re giving them.

Q: This kind of blackout seems to happen to Time Warner Cable all the time; Screw you, I’m going to switch to another provider.

A: Screw you right back. Unfortunately, these kinds of blackouts have occurred more often over the past few years—last year, over 80 broadcast TV stations withheld their channels from all kinds of video providers, including cable, satellite, and telephone companies because they smell the cash we currently get to play patty-cake with. It’s not just Time Warner Cable, silly—every provider is at risk for losing the right to carry these channels that are available for free over the air to an antenna. Because when this kind of money is involved, all sorts of hell breaks loose. Switching to another provider won’t prevent similar blackouts from happening to you in the future, and you could miss some of your favorite programming, like… NY1 in New York City. (Really.) We’ve been raising your rates and making you pay for hundreds of channels you never watch for years. Remember, sometimes the evil you know is better than the evil you don’t. We’re talking to you AT&T U-verse.

Q: It seems odd that CBS SportsNet is still available, when the main CBS channel isn’t. Why is that?

A: Wait.

Q: I live in Los Angeles; with KCAL not available, how do I see the Dodgers games?

A: Get your lazy butt in the car, go to the stadium and buy tickets.

Q: I’m an NFL fan, and I’m going to miss my team’s pre-season games. Where else can I see them?

A: See above.

Subscribe

Subscribe

“We are focused on providing the best content experience for our customers and continually evaluate which channels meet their needs and preferences relative to the cost of the programming imposed by content owners,” Altice officials said in a statement. “Given that Starz is available to all consumers directly through Starz’ own over-the-top streaming service, we don’t believe it makes sense to charge all of our customers for Starz programming, particularly when their viewership is declining and the majority of our customers don’t watch Starz. We believe it is in the best interest of all our customers to replace Starz and StarzEncore programming with alternative entertainment channels that will provide a robust content experience at a great value.”

“We are focused on providing the best content experience for our customers and continually evaluate which channels meet their needs and preferences relative to the cost of the programming imposed by content owners,” Altice officials said in a statement. “Given that Starz is available to all consumers directly through Starz’ own over-the-top streaming service, we don’t believe it makes sense to charge all of our customers for Starz programming, particularly when their viewership is declining and the majority of our customers don’t watch Starz. We believe it is in the best interest of all our customers to replace Starz and StarzEncore programming with alternative entertainment channels that will provide a robust content experience at a great value.” Premium movie channels Starz and Encore

Premium movie channels Starz and Encore  Years of broadcast and cable networks relying on cheap reality TV fare, game shows, and lurid news magazines to save money are coming to an end as media companies realize the only way to stop the viewing shift to Netflix, Hulu, and Amazon is to create better programming viewers want to see.

Years of broadcast and cable networks relying on cheap reality TV fare, game shows, and lurid news magazines to save money are coming to an end as media companies realize the only way to stop the viewing shift to Netflix, Hulu, and Amazon is to create better programming viewers want to see. Bloomberg News

Bloomberg News  Some Wall Street analysts like Rich Greenfield at BTIG Research have gone as far as predicting the traditional cable TV bundle is threatened with extinction as cost conscious viewers continue to abandon linear/live television for on-demand content like that offered by Netflix instead. That has delivered a three-way punch: pressures on revenue as program creation spending increases, growing cord-cutting, and cable rate inflation cable executives are increasingly desperate to control.

Some Wall Street analysts like Rich Greenfield at BTIG Research have gone as far as predicting the traditional cable TV bundle is threatened with extinction as cost conscious viewers continue to abandon linear/live television for on-demand content like that offered by Netflix instead. That has delivered a three-way punch: pressures on revenue as program creation spending increases, growing cord-cutting, and cable rate inflation cable executives are increasingly desperate to control. Starz, dwarfed by HBO and Showtime, is spending $250 million on its own original programming including Outlander, Survivor’s Remorse and Power. Subscribers who want more will get it as Starz increases budgets enough to allow producers to create 80-90 original episodes this year, up from 75 in 2015. To introduce subscribers to the shows, Starz commonly offers cable subscribers free trials as part of ongoing cable company promotions.

Starz, dwarfed by HBO and Showtime, is spending $250 million on its own original programming including Outlander, Survivor’s Remorse and Power. Subscribers who want more will get it as Starz increases budgets enough to allow producers to create 80-90 original episodes this year, up from 75 in 2015. To introduce subscribers to the shows, Starz commonly offers cable subscribers free trials as part of ongoing cable company promotions.

After repeated extensions, Time Warner Cable yanked several channels from your cable dial today, and before you ask, you are -not- entitled to any refunds. So don’t ask. (Actually, ask anyway.)

After repeated extensions, Time Warner Cable yanked several channels from your cable dial today, and before you ask, you are -not- entitled to any refunds. So don’t ask. (Actually, ask anyway.)