The New York State Attorney General has argued that Sprint’s failure to pay at least $100 million in owed sales taxes to New York taxing authorities may leave its customers in the state on the hook for past taxes, interest, and fees the company never paid.

The New York State Attorney General has argued that Sprint’s failure to pay at least $100 million in owed sales taxes to New York taxing authorities may leave its customers in the state on the hook for past taxes, interest, and fees the company never paid.

As the state continues its lawsuit against Sprint-Nextel for what it argues is deliberate underpayment of New York sales tax, Sprint’s lawyers argued Thursday that the entire case should be dismissed because the state is selectively interpreting state and federal law.

The case originally began as a whistleblower action through a private company, Empire State Ventures, which is seeking a 25% share of any lawsuit proceeds. N.Y. Attorney General Eric Schneiderman is seeking $300 million in damages from Sprint for knowingly violating tax laws.

A review of the lawsuit shows there are serious implications for Sprint’s customers in New York if the company loses the suit or fails to pay sales taxes the state claims are owed.

Over three million current and former Sprint customers could be liable for sales tax underpayments representing a portion of their monthly bills dating back to 2005, potentially including accumulating interest charged at 14.5% annually, and penalties amounting to double the amount of the unpaid taxes or up to 30 percent of the underpayment.

Sprint has also misled millions of New York customers who purchased Sprint flat-rate plans. In its customer contracts, on its website and elsewhere, Sprint represented that it would collect and pay all applicable sales taxes. Yet Sprint did not, and it concealed this fact from its New York customers. As a result, Sprint exposed these customers to the risk of having to pay the unpaid taxes, for they are also liable under the law if Sprint fails to pay.

Although Sprint misrepresented how it would handle sales taxes, it has locked its customers into contracts with early termination fees. The customers must remain in these contracts sold under false pretenses unless they pay hundreds of dollars to Sprint.

Schneiderman

Schneiderman’s office appears to have a strong case, with evidence showing Sprint allegedly conspiring to undertax customers using an arbitrary formula to gain a competitive advantage over other wireless carriers with the promise of a lower monthly bill, in part because the company was not collecting the proper amount of state sales tax.

The lawsuit claims Sprint repeatedly ignored warnings from state taxing authorities, including senior tax officials, that declared Sprint’s creative way of determining applicable taxes was putting the company at serious risk of adverse tax department action.

That adverse action came in April when the state filed the lawsuit against Sprint seeking back taxes and triple damages.

A careful reading of the lawsuit reveals just how much bureaucracy America’s wireless industry maintains to seek out any edge it can find against regulators, tax authorities, and local, state, and federal elected officials.

Sprint, the third largest wireless company in the country, can afford to maintain that bureaucracy with $33 billion in annual revenues partly at stake.

Wireless Industry’s Tax Employees Go to Vail to Ski Discuss Tax-Avoidance Strategies

The wireless industry employs hundreds of workers who spend their days pouring over tax laws in all 50 states looking for loopholes, strategies, and creative solutions to the ongoing problem of paying local, state, and federal taxes. Sprint, a considerably smaller wireless carrier than either Verizon or AT&T, still has the resources to maintain more than 100 workers in their State and Local Tax Group. It includes a well-defined management chain, with an assistant vice-president that runs the unit reporting to Sprint’s vice president of Tax, who, in turn, reports to Sprint’s chief financial officer.

These employees, and similar ones working at every other wireless phone company, try to figure out how to pay the least amount of owed tax possible, and kick tax strategies around in regular sessions and conferences at posh resorts in places like Vail (come for the corporate meeting, stay for the skiing), Colorado.

At the 2002 Communications Tax Executive Conference in Vail, Sprint executives told other wireless carriers that tax avoidance strategies like “unbundling” posed risks of audits by taxing authorities and litigation.

The wireless industry sends their tax experts to posh resorts in Vail, Colorado to discuss tax-avoidance strategies.

The following year, a Sprint executive turned up at another industry-backed conference run by “the Wireless Tax Group,” alerting other wireless companies that “unbundling for taxes causes significant assessment risk.” He told the group that his “marching orders” at Sprint were to “mitigate tax issues by pursuing legislation or pre-audit agreements that allow for component taxing.”

In Schneiderman’s view, Sprint never followed those marching orders in New York.

In fact, the lawsuit argues even as Sprint was lecturing other phone companies about the importance of being conservative when dealing with tax authorities, the company was conspiring to use its own creative tax interpretations to undercut their competitors with a lower monthly cell phone bill.

How to Lower Your Prices Without Risking Profits

The technique Sprint uses to this day to hand customers that lower bill is based on selectively applying sales taxes only to certain portions of a customer’s voice plan. Sprint is the only company engaged in this practice in New York. Verizon, T-Mobile, Cricket, AT&T, and MetroPCS won’t go near the concept.

New York tax law says that phone companies must collect taxes on the monthly voice plans wireless companies sell customers. If Sprint sells you 450 minutes a month for $39.99 a month, New York taxing authorities expect customers will be charged the prevailing state and local tax rate on the fixed amount of $39.99 each month. Only Sprint does not do this. Sprint leverages federal rules which state that telephone calls placed to numbers outside of the state (also known as an “interstate call”) cannot be taxed. Therefore, in Sprint’s view, customers deserve a tax break for those interstate, non-taxable calls.

But Sprint does not actually review individual calling records to figure out what specific out-of-state numbers were called. Instead it created what New York officials argue is “an arbitrary formula” to guesstimate how much the average customer spends talking to in-state vs. out-of-state numbers. But those percentages varied wildly from 2005 to the present day, with different amounts for Sprint-Nextel customers living in upstate and downstate New York:

- July 2005-October 2008: Sprint did not pay state or local sales taxes on 28.5% of its fixed monthly voice service charge;

- April 2006-October 2008: Nextel of New York did not pay state or local taxes on 13.7% of its fixed monthly voice service charge;

- May 2006-October 2008: Nextel Partners of Upstate New York did not pay state or local taxes on 15% of its fixed monthly voice service charge;

- October 2009-Present Day: Sprint does not pay state or local taxes on 22.5% of its fixed monthly voice service charge.

Here comes the taxman.

In January 2005, an internal Sprint memo obtained by New York State found the company could save $4.6 million per month using this tax avoidance strategy, without costing the company a cent in profits.

It implemented the strategy later that summer.

New York’s lawsuit makes it clear the company was warned about the practice before the suit was filed:

Sprint continues to not collect and pay New York state and local sales taxes on the full amount of its receipts from its fixed monthly charges for wireless voice services, despite being specifically informed of the illegality of this practice by a field-auditor of the New York Tax Department in 2009, and then, in 2011, by a senior enforcement official of the New York Tax Department.

Customers Caught in the Middle?

As the case winds its way through court, New York has informally put Sprint customers on notice they could be held responsible for the unpaid taxes and penalties if Sprint reneges on the owed amounts. Schneiderman’s office recognizes customers are caught in the middle, partly because Sprint decided to keep the tax changes “secret” to keep customers off the phone to Sprint customer service:

[…] In its contracts with these customers, on its website and elsewhere, Sprint represented that it would collect and pay all applicable sales taxes on its calling plans. […] Sprint’s representations in the contracts, on its website and elsewhere were false because Sprint knew it would not collect and pay the applicable sales taxes in New York.

Contrary to its promises, Sprint failed to collect and pay sales taxes on substantial portions of the fixed monthly charges for voice services under its flat-rate calling plans. As a result of this non-payment, Sprint left its New York customers liable for those unpaid amounts of sales taxes under New York law.

At no point did Sprint disclose to its New York customers that it was leaving them liable for the sales taxes that Sprint failed to collect from the customers and pay to the government, as promised.

Before Sprint began unbundling, members of its State and Local Tax Group and its marketing group considered in the early part of July 2005 whether to communicate with customers about the fact that Sprint was unbundling and that the unbundling would affect taxes for some customers. They jointly opted not to communicate the change. Sprint’s Director of External Tax was concerned that disclosing the information would “drive too many calls” to Sprint’s customer care division.

In November 2005, just months after Sprint began unbundling, a Sprint employee in the Customer Billing Services department questioned a member of Sprint’s State and Local Tax Group about whether unbundling was “presented to the customer as part of the Subscriber agreement, shown in the invoice and/or available to Customer Care Rep.” The response was simply that “we have not educated our customers on how we are de-bundling transactions for their tax relief.”

Sprint continues to misinform its current and prospective customers about sales taxes, and to subject them to undisclosed sales tax liability even today.

Sprint’s position in court is that New York’s tax laws give the company the option of unbundling its tax obligations and that the state was trying to collect money it was not owed.

“The New York Attorney General’s complaint seeks to impose liability for practices that do not violate New York law,” said Sprint’s response to the lawsuit.

Luckily for Sprint’s tax experts, many states foreclose the possibility of creatively escaping taxes by imposing a “gross receipts tax” on the total gross revenues of a company, regardless of their source. That makes it difficult, if not impossible to escape the kind of sales taxes Sprint has been maneuvering around for nearly a dozen years in New York. With fewer loopholes to find, that leaves the wireless industry’s tax experts more time on the ski slopes.

It is safe to assume Sprint hopes for a positive outcome of the case, if only to avoid the inevitable avalanche of customer complaints from New York customers who might find a notice of apparent tax liability in their mailbox one day in the future.

Subscribe

Subscribe Sprint has

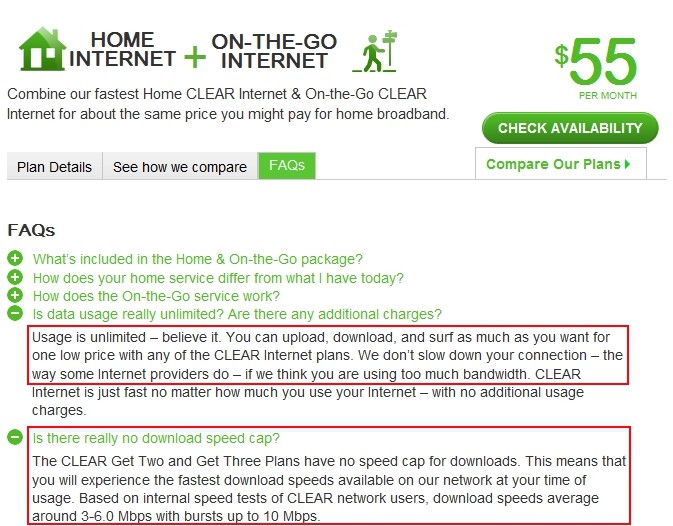

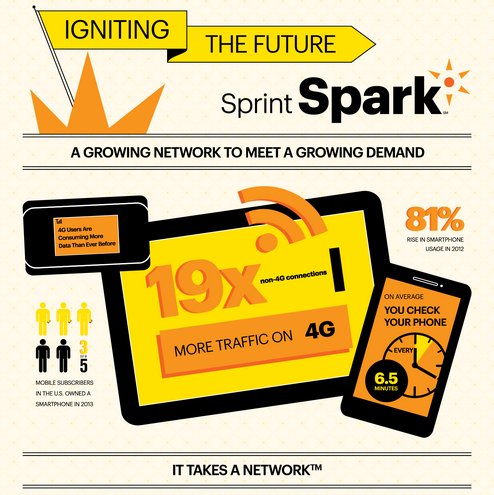

Sprint has  In practice, WiMAX in the United States never achieved great success. Sprint and Clearwire’s network was never built out sufficiently to provide nationwide coverage, and because it relied on very high frequencies, even customers inside claimed service areas often dealt with reception problems, especially indoors. Clearwire’s home broadband replacement often required reception equipment be placed near a window, preferably one without a thermal coating that could block or degrade the signal.

In practice, WiMAX in the United States never achieved great success. Sprint and Clearwire’s network was never built out sufficiently to provide nationwide coverage, and because it relied on very high frequencies, even customers inside claimed service areas often dealt with reception problems, especially indoors. Clearwire’s home broadband replacement often required reception equipment be placed near a window, preferably one without a thermal coating that could block or degrade the signal. Despite the promise of greatly enhanced data speeds with the next generation of WiMAX, dubbed WiMAX 2, many of the world’s largest wireless carriers were already preparing to move on. In particular, China Mobile (and its 600 million customers) became the decisive factor that turned WiMAX 2 into a bad bet. China Mobile decided the better choice was TD-LTE, a variant of LTE technology. With China Mobile providing service to 10 percent of the world’s mobile users all by itself, support for TD-LTE grew and attracted equipment manufacturers that saw the earnings potential from selling tens of millions of base stations.

Despite the promise of greatly enhanced data speeds with the next generation of WiMAX, dubbed WiMAX 2, many of the world’s largest wireless carriers were already preparing to move on. In particular, China Mobile (and its 600 million customers) became the decisive factor that turned WiMAX 2 into a bad bet. China Mobile decided the better choice was TD-LTE, a variant of LTE technology. With China Mobile providing service to 10 percent of the world’s mobile users all by itself, support for TD-LTE grew and attracted equipment manufacturers that saw the earnings potential from selling tens of millions of base stations.