Glenice Maclellan, Telstra's point person on broadband, has recently discovered Australians don't just want to browse the web and read e-mail on their broadband service.

Telstra, Australia’s largest telecommunications company, has responded to customers leaving their broadband service over its fraudband speeds and paltry usage caps by increasing both, but not nearly enough to change perceptions that Australian providers still serve up slow, overpriced and restrictive service.

Telstra’s CEO David Thodey, who replaced the oft-despised Sol Trujillo, told investors what every Australian contemplating broadband service already knows: “In some parts of the market we’ve gone too far out of line and we need to come back. We must focus on our core business and our customers, this is where we create value for shareholders. At its simplest, the next stage in Telstra’s long-term strategy is to focus on satisfying customers, invest in new capabilities, and drive growth in new businesses.”

Thodey’s approach is to do away with the company’s downright lousy “broadband” service in many rural areas of Australia. More accurately called “fraudband,” there are still many Australians suffering with Telstra BigPond service that tops out at a ridiculously slow 256kbps. And because company officials suspect you’ll even use that too much, they slapped a usage cap as low as 200 megabytes on the service, with a war crime overlimit fee of $0.15 per megabyte thereafter. Your low price? $27US a month. For that. But you can double your allowance to 400 megabytes for a mere $9US more per month. Grab the bargain.

Effective December 1st, Telstra will move its rural customers to 1996-level broadband service, offering 1.5Mbps minimum to those doing their web surfing over DSL lines. For those paying $27 a month, they’re increasing your usage allowance to a still-paltry 2 gigabytes per month, and leaving the $0.15/mb overlimit fee in place. Most DSL customers stuck on these plans will be herded up to the $36 a month plan which is “generous” in comparison with a new download quota of 12 gigabytes per month and no overlimit fee. Instead, once you hit your limit, they cut your speed to 64kbps for the rest of the month.

Oh but wait, there are some more gotchas:

- Unless you are bundling your molasses-slow Internet service with a phone line package that brings Telstra at least $81US per month in revenue, add $9 to these plan prices. You wouldn’t want Telstra management to go home hungry, would you?

- Uploads are also a part of your usage allowance.

- Many of their plans lock you in with a 24-month service commitment. They’ve got you right where they want you.

If you find Telstra’s Oliver Twistian-usage allowances leave you hungry for more, no worries. Telstra will happily upgrade your service to a higher usage plan, with correspondingly higher prices, by the following day. That’s good to know if Microsoft obliterated a good part of your usage allowance for the month with critical Windows updates.

Or you could always take your business elsewhere, as many budget conscious Australians have. Thodey’s fear about out-of-touch broadband pricing is real when considering Telstra’s competitor iiNet offers 4GB (2GB peak/2GB off peak) for just about the same price Telstra charges for its $27 a month/200 megabyte plan.

The company has also recently discovered that Australians want to use their broadband service for more than just web browsing and e-mail. That’s apparently news to Telstra management, who threw this into their PR push:

“Telstra’s new plans cater for the changing ways Australians use broadband for communications and entertainment at home. Gone are the days when broadband was used only to check email or internet surf. Australian families now also use broadband to download videos, play online games, or check social networking sites all at the same time”. — Glenice Maclellan, the Acting Group Managing Director of the Consumer division, Telstra

Thanks, Glenice. The only problem here is that Australians didn’t get to do those things much because of your rationed broadband plans which either overcharged them if they tried, or speed throttled them back to dial-up as a reminder not to be a naughty data hog.

Now, Australians can at least feed at the trough… for a little while.

Telstra offers other plans, which vary on whether you qualify for ADSL 1 service (original DSL) or live in an urban/suburban area upgraded for ADSL 2 or cable modem service. All prices hereafter are in Australian dollars – $10AUD = $0.91US at time of writing):

New Broadband Pricing for full service fixed phone customers

|

Monthly MB allowance+ |

Standard preselect pricing on a 12 month plan ^ |

Price incl $10 discount on a 24 month plan#,^ |

Price incl $20 discount with on a 24 month plan and one other eligible Telstra service~,^ |

Standard preselect pricing on a 12 month plan ^ |

Price incl $10 discount on a 24 month plan#,^ |

Price incl $20 discount on a 24 month plan and one other eligible Telstra service~,^ |

|

BigPond Turbo ADSL & Cable |

BigPond Elite ADSL & Cable |

|||||

| 2GB (excess usage charged at $0.15MB) | $39.95 | $29.95 | n/a | $49.95 | $39.95 | $29.95 |

| BigPond Liberty 12GB** | $59.95 | $49.95 | $39.95 | $69.95 | $59.95 | $49.95 |

| BigPond Liberty 25GB** | $79.95 | $69.95 | $59.95 | $89.95 | $79.95 | $69.95 |

| BigPond Liberty 50GB** | $99.95 | $89.95 | $79.95 | $109.95 | $99.95 | $89.95 |

| BigPond Liberty 100GB** | $119.95 | $109.95 | $99.95 | $129.95 | $119.95 | $109.95 |

| BigPond Liberty 200GB** | $169.95 | $159.95 | $149.95 | $179.95 | $169.95 | $159.95 |

# Requires Single Bill and combined minimum monthly access fee of at least $59.

~ Other eligible service types are a Telstra mobile, BigPond wireless broadband or FOXTEL from Telstra on a single bill, with a minimum combined monthly access fee of at least $89.

+Unused allowance expires monthly.

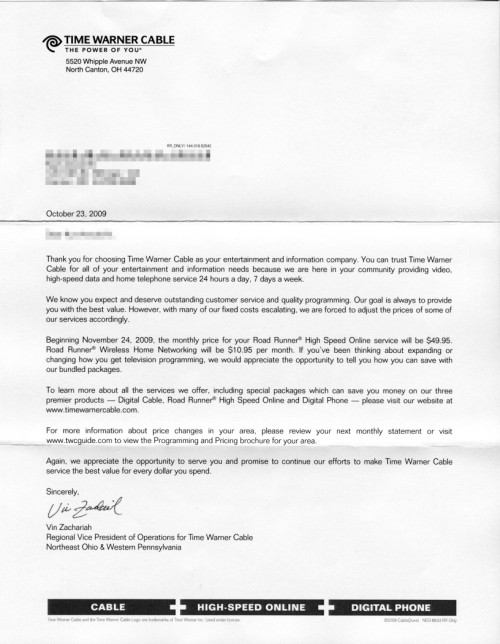

Those prices are enough to give North American providers dreams of Money Parties in their heads forever. Only Time Warner Cable came close with their infamous $150 unlimited usage plan they tried to stick customers with in several cities this past April.

That platinum-deluxe BigPond Liberty 200GB plan bundled with a TV package will cost you more than $4,560US over the life of the 24-month contract.

Australians continue to wait for a National Broadband Network plan that the government says should finally free Australians from a life of being told you have to spend more… a lot more, to save just a little from companies like Telstra.

A spoof on Telstra’s BigPond Internet Support Call Center (1 minute)

Subscribe

Subscribe