Frontier Communications continues to lose access line customers at a rate of 8.5 percent overall, 9.8 percent in the former Verizon service areas they acquired more than a year ago. The company’s third quarter results show lackluster performance as revenue declines of 30 percent impacted both their residential and business customer units.

Frontier Communications continues to lose access line customers at a rate of 8.5 percent overall, 9.8 percent in the former Verizon service areas they acquired more than a year ago. The company’s third quarter results show lackluster performance as revenue declines of 30 percent impacted both their residential and business customer units.

Company officials spent most of the question and answer session responding to Wall Street concerns about revenue, spending, promotions, customer churn, the company’s pension fund, and the outright defection of Frontier FiOS TV customers away from the fiber network the phone company inherited from Verizon.

Mike McCormack of Nomura Securities suggest the weak figures should concern investors because it may show Frontier unable to compete effectively with cable companies, which also offer phone service.

Frontier CEO Maggie Wilderotter put her best face forward trying to promote the company’s successes, particularly bringing DSL broadband to former Verizon service areas:

“Our broadband expansion reached an additional 126,000 new homes in the acquired properties during the quarter, bringing our year-to-date total to 352,000 which is on track to reach our 2011 goal of increasing broadband availability to more than 400,000 additional homes. Broadband availability in the acquired properties is now 80%, a significant increase from the mid-60% range when we acquired them. As a result of our expansion and sales efforts, we had a very strong quarter for broadband growth, adding 16,900 total DSL subscribers, a 38% sequential increase from Q2. We also added 2,300 wireless data customers. This growth reflected the effectiveness of our local engagement model, as well as organic demand for broadband in both legacy and acquired properties.

“We have also largely completed our efforts to migrate middle mile congestion, which now gives us the ability to more effectively market higher speeds in markets that were already enabled.”

Frontier executives sought to portray West Virginia as their biggest success story.

Daniel J. McCarthy, Frontier’s chief operating officer and executive vice-president, claims Frontier’s installation of 12 integrated fiber rings throughout the state provides broadband capacity and integrated network capability beyond what is available anywhere else in the United States from a state-wide perspective. McCarthy claims Frontier is on track to turn West Virginia from one of the least connected states in the nation to one of the most connected.

But Margaret Kings from MacArthur, W.V. says she’ll believe it when she sees it, and she hasn’t seen it yet.

But Margaret Kings from MacArthur, W.V. says she’ll believe it when she sees it, and she hasn’t seen it yet.

“My extended family has experienced endless problems dealing with Frontier in this state, and I have relatives in the Panhandle to boot,” Kings says. “We have collectively won more than $300 in service credits for out of service broadband and phone service, slow speeds when it rains, and missed appointments, billing errors, sneaky charges, and contract disputes.”

Kings’ immediate family left Frontier for Suddenlink more than a year ago when she moved.

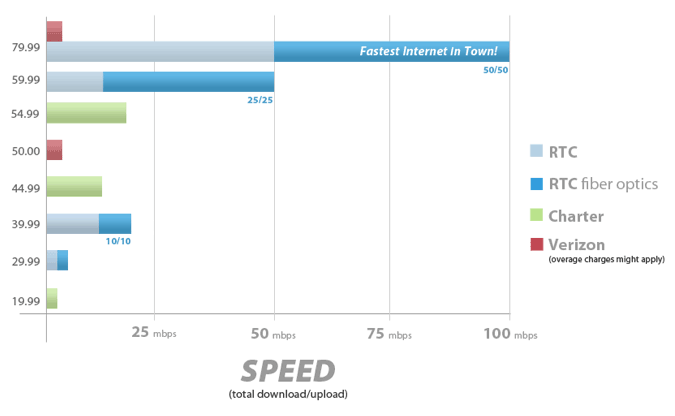

“Why pay Frontier more for phone service and 1.7Mbps broadband when I can pay Suddenlink less for their phone service and 10Mbps Internet access,” she asks.

Frontier hopes to win back former customers with new broadband services, such as their newly-introduced “Second Connect” service, which delivers a second DSL line for existing broadband homes for what the company claims is $14.99 a month. Frontier says a few thousand customers have signed up for the service, which is now being pitched aggressively by Frontier’s call centers.

But some customers who have signed up for the service are accusing Frontier of billing fraud for wildly misleading customers about the true cost of the service.

The $14.99 price tag Frontier advertises omits modem rental fees, taxes, surcharges, and other fees customers first discover on their monthly bill.

Chris Photoni discovered, after five calls and a combined two hours on hold, the true out-the-door price for Frontier Second Connect is actually $48 for him. The Broadband Reports reader elaborates:

Don’t waste your time. Even after the ‘corrections’ the Second Connect line cost around $48. I say ‘around,’ [because] I haven’t met a staff member yet that could correctly calculate tax. How convenient for you Frontier. Their computer system can calculate it for your bill, but is unable to calculate it when inquiring about the service.

The new ‘taxes’ come to $27.64!

Frontier is one of the worst phone companies. They have terrible customer service, and the wait times usually seem to be 20-30 minutes per call. Most issues take at least THREE calls to resolve. I’ve actually have been on hold for 25 minutes as I’m writing this.

Kings said she wouldn’t have bothered inquiring about Second Connect in the first place.

“Let me understand this,” she writes. “The same phone company that offers 1.7Mbps to my house wants another $15 a month to ‘double my speed?’ I could pay $100 a month to Frontier for 3Mbps broadband along with my phone line or pay Suddenlink $100 for 10Mbps broadband, phone and cable-TV service.”

Other highlights from the conference call:

- Frontier is getting into the home security business in a two state trial with ADT and Protection 1. Customers will be strongly encouraged to bundle the home security service with other telecommunications products to hold them in contracts and provide discounts up to 15 percent;

- Frontier will begin to resell AT&T wireless voice and data services in bundles with existing products. Frontier plans to trial this service during the first half of 2012 before expanding it nationally. This service is only going to be available to bundled service customers. Why customers wouldn’t pursue an agreement with AT&T themselves, without the phone company’s involvement, isn’t well-explained;

- The company plans no significant high-value promotional offers for the 4th quarter. They didn’t pitch any during the 3rd quarter either. Customers with pre-existing promotions, including “free satellite TV for 2011” or “six months of free DSL” will find their bills rising considerably as those promotions expire in the next few months;

- Frontier’s pension plan is not in the best shape. The company had to contribute $58 million of real estate to the plan fund to manage investment losses for the year;

- Frontier’s $500 FiOS installation fee has effectively kept new customers away from the fiber network. Although the company claims it wants to maintain support for FiOS, video customers have left in droves and a smaller number of broadband customers have left as well, primarily for Comcast;

- Frontier plans to continue investment in its middle mile network to handle broadband traffic growth in 2012 and 2013.

The economic planning agency of the People’s Republic of China says it suspects the country’s two dominant telecommunications companies — China Telecom and China Unicom — have created a cozy duopoly between themselves and are overcharging consumers for broadband Internet access. That’s a fact of life many Americans and Canadians are also familiar with, but in China, regulators are preparing to do something about it.

The economic planning agency of the People’s Republic of China says it suspects the country’s two dominant telecommunications companies — China Telecom and China Unicom — have created a cozy duopoly between themselves and are overcharging consumers for broadband Internet access. That’s a fact of life many Americans and Canadians are also familiar with, but in China, regulators are preparing to do something about it. Although some large Chinese cities now have access to broadband service at speeds far faster than what American and Canadian consumers can purchase, the Chinese government agency tasked with ensuring compliance of the country’s anti-monopoly laws reports most Chinese consumers buy slow speed, high-priced DSL.

Although some large Chinese cities now have access to broadband service at speeds far faster than what American and Canadian consumers can purchase, the Chinese government agency tasked with ensuring compliance of the country’s anti-monopoly laws reports most Chinese consumers buy slow speed, high-priced DSL.

Subscribe

Subscribe