T-Mobile is proving once again that as an independent cell phone provider, it is prepared to be a scrappy competitor for your wireless dollar. America’s fourth largest cell phone company today announced it was getting into an emerging “unlimited data” war with its larger competitor Sprint and smaller contender MetroPCS, announcing it will bring back a truly unlimited data plan for its customers.

“We want to double-down on worry-free (marketing),” said Harry Thomas, T-Mobile’s director of marketing. “We want to eliminate the situation of ‘Do I want to stream Netflix for kids or worry about data overage?’ ”

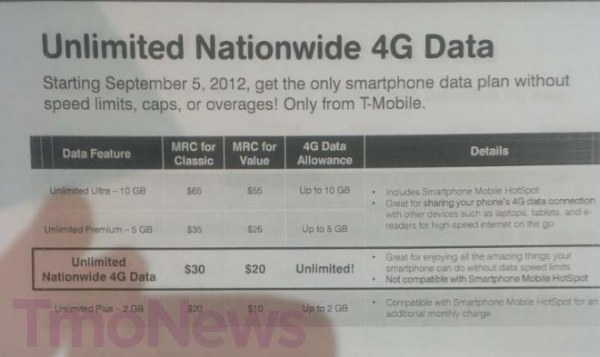

Starting Sept. 5, T-Mobile’s Unlimited Nationwide 4G Data plan will be available for $20 per month when added to a Value voice and text plan or $30 per month when added to a Classic voice and text plan. For example, a single line Value plan with unlimited talk and text combined with unlimited nationwide 4G data will cost $69.99 or a single line Classic plan with unlimited talk, unlimited text and unlimited nationwide 4G data will cost $89.99. The plan cannot be combined with Smartphone Mobile Hotspot/tethering. Customers who want to share their phone’s data service with other devices will have to choose between a 5GB or 10GB add-on option instead.

T-Mobile says their new unlimited 4G data plan comes without tricks or traps, promising no data caps, speed limits/throttles or bill shock from overlimit fees. But like every provider, T-Mobile will have a provision in its terms of use that allows it to cut the data usage party short in cases of exceptionally extraordinary usage, but the company says it will enforce that only in the most extreme cases.

“We’re big believers in customer-driven innovation, and our Unlimited Nationwide 4G Data plan is the answer to customers who are frustrated by the cost, complexity and congested networks of our competitors,” said Kevin McLaughlin, vice president, marketing, T-Mobile USA. “Consumers want the freedom of unlimited 4G data. Our bold move to be the only wireless carrier to offer an Unlimited Nationwide 4G Data plan reinforces our value leadership and capitalizes on the strength of our nationwide 4G network.”

T-Mobile doesn’t consider Sprint’s “truly unlimited” plan in the same class, because it currently operates on a much slower “4G” standard called WiMAX, which Sprint is moving rapidly away from. Many T-Mobile customers use the company’s 4G-like HSPA+ network for data, which offers respectable speeds if your phone supports the standard (the Apple iPhone, for example, does not.) T-Mobile is moving forward on its own upgrade to 4G LTE starting in 2013.

T-Mobile’s announcement comes one day after MetroPCS, a regional carrier, announced its own limited-time promotion offering unlimited talk, text, and data for $55 a month (up to three additional lines can be added for $50 a month each). Once a customer signs up for the unlimited service promotion, they can keep it as long as they remain a customer.

The two attention to unlimited data plans from the three carriers are in marked contrast to AT&T and Verizon Wireless, which have both moved to curb unlimited use plans — switching customers to usage allowances and overlimit fees. Both companies, considerably larger than any of their competitors, claim unlimited data is impossible to offer because of wireless spectrum shortages and the expense of continually upgrading networks to meet demand.

But this does not seem to pose any problem for Sprint, T-Mobile, or MetroPCS.

Wall Street believes the new interest in unlimited data is a marketing move to differentiate the smaller companies from the two dominant providers.

Wall Street believes the new interest in unlimited data is a marketing move to differentiate the smaller companies from the two dominant providers.

Wells Fargo analyst Jennifer Fritzsche wrote in a research note to her investor clients that T-Mobile is strategically re-positioning itself in the market to attract new customers.

“We believe T-Mobile felt the need to make some change in order to attract attention,” wrote Fritzsche.

Other analysts believe T-Mobile needed a “game-changing” marketing move to help it recover from its ongoing losses of contract customers. The company has been losing just over 500,000 “branded” contract customers every quarter for the last year.

The pricing and service changes may require Sprint to revisit its current rates.

Sprint’s $109.99 Simply Everything plan offers unlimited data, text, and voice — and runs $20 higher per month than T-Mobile’s forthcoming offer, $55 more than MetroPCS.

Subscribe

Subscribe