.

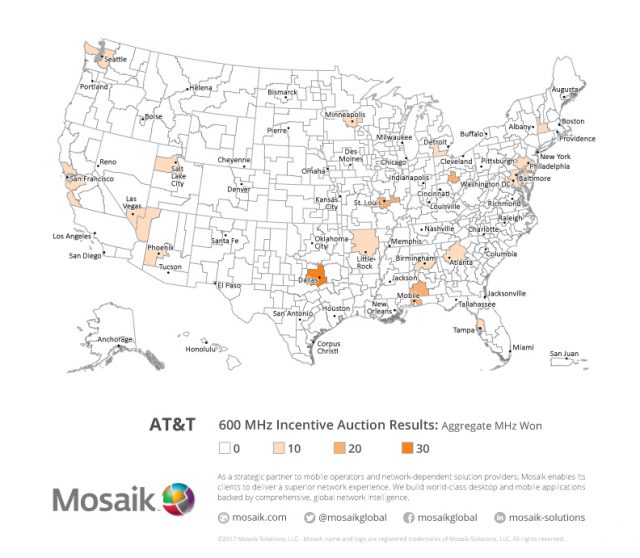

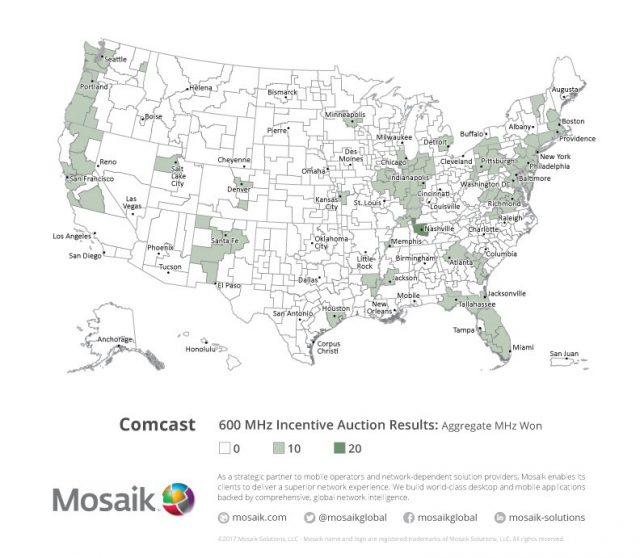

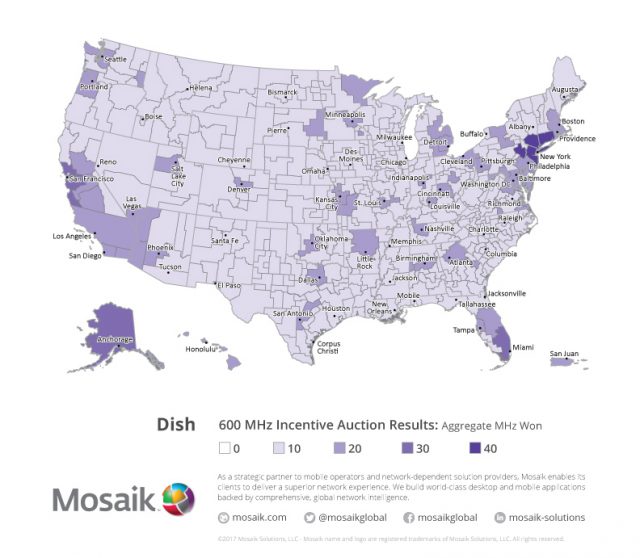

An unprecedented 175 free over-the-air television signals will sign off on their current channels for good in return for an average of tens of millions in compensation paid by Comcast, Dish Networks, and various wireless companies that want their frequencies to bolster their mobile networks.

The UHF dial compression comes courtesy of the latest FCC spectrum auction, which allowed bidders to entice over-the-air television stations to give up their frequencies to make room for wireless companies trying to bolster their 4G LTE networks. At least 957 stations across the country will have to move to new channels as the FCC compresses the TV dial to make room for wireless providers.

Virtually all the affected stations won’t disappear from free over-the-air TV for good, however. Of the 175 stations, 133 plan to make a deal with another local station to relaunch as a secondary digital channel, 29 will move from a UHF channel to a new VHF channel (2-13), and one channel will move from a high VHF channel to a low numbered one.

The move was very profitable to some major market stations, where the TV dial is already crowded with signals. WWTO-TV, a TBN affiliate airing Christian TV programming in LaSalle/Chicago, Ill. won the highest amount of any station in the country to put its transmitter off the air – $304 million. The biggest non-commercial auction winner was New Jersey’s Public Broadcasting Authority, which won $194 million to switch off WNJN in Montclair, N.Y.

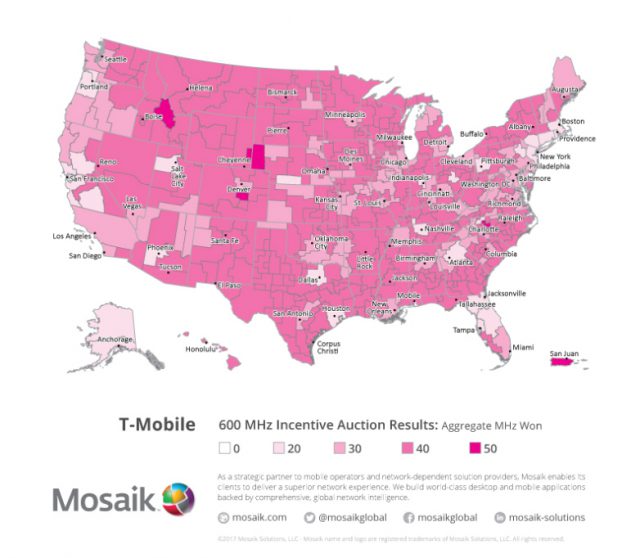

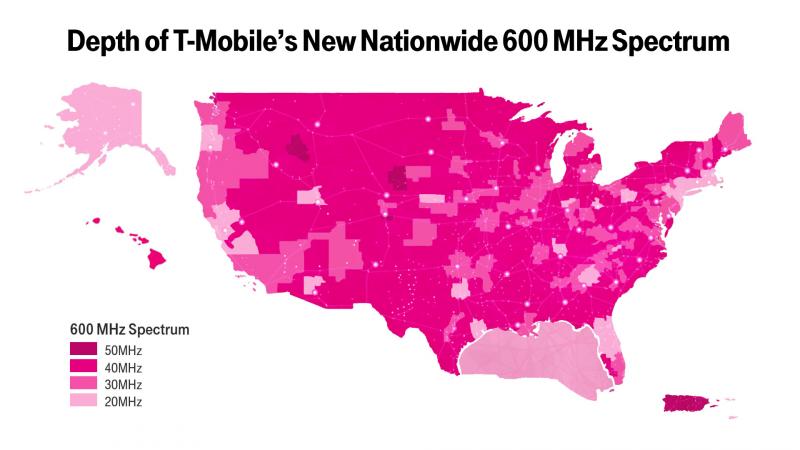

The winners are 50 wireless bidders who want the frequencies to improve their wireless networks by increasing the amount of spectrum they can use in the coveted 600MHz band. Signals at these frequencies do a better job penetrating buildings and around natural obstacles and terrain. The result will be improved coverage and signal quality, with fewer dropped calls.

“The conclusion of the world’s first incentive auction is a major milestone in the FCC’s long history as steward of the nation’s airwaves,” said FCC chairman Ajit Pai. “Consumers are the real beneficiaries, as broadcasters invest new resources in programming and service, and additional wireless spectrum opens the way to greater competition and innovation in the mobile broadband marketplace.”

Stations can begin vacating their frequencies this year. Among the 957 stations that have to change channel numbers, the first of a series of channel changes will begin on Nov. 30, 2018. The last changes should take place just over three years from now.

Are you affected? Here is the list of channels going off the air or relocating to a different band:

Albany-Schenectady-Troy, N.Y.

- WCDC-TV UHF Going off the air

Augusta, Ga.

- WAGT-TV UHF Going off the air

Baltimore, Md.

- WUTB-TV UHF Going off the air

Boston, Mass.

- WBIN-TV UHF Going off the air

- WDPX-TV UHF Going off the air

- WFXZ-CD UHF Going off the air

- WGBH-TV UHF Moving to Low VHF Channel

- WLVI-TV UHF Going off the air

- WMFP-TV UHF Going off the air

- WYCN-CD UHF Going off the air

- WYDN-TV UHF Going off the air

Buffalo, N.Y.

- WIVB-TV UHF Going off the air

- WNYB-TV UHF Moving to Low VHF Channel

- WVTT-CD UHF Moving to High VHF Channel

Burlington, Vt.-Plattsburgh, N.Y.

- WNNE-TV UHF Going off the air

- WVTA-TV UHF Going off the air

Charleston-Huntington, W.V.

- WPBO-TV UHF Going off the air

- WTSF-TV UHF Moving to High VHF Channel

Charlotte, N.C.

- WLNN-CD UHF Going off the air

- WMYT-TV UHF Going off the air

- WTBL-CD UHF Going off the air

Charlottesville, Va.

- WVIR-TV UHF Moving to Low VHF Channel

Chattanooga, Tenn.

- WNGH-TV UHF Moving to Low VHF Channel

- WTNB-CD UHF Moving to Low VHF Channel

Chicago, Ill.

- WOCH-CD UHF Going off the air

- WPWR-TV UHF Going off the air

- WSNS-TV UHF Going off the air

- WWTO-TV High VHF Channel Going off the air

- WXFT-TV UHF Going off the air

- WYCC-TV UHF Going off the air

Cincinnati, Oh.

- WOTH-CD UHF Going off the air

Cleveland-Akron, Oh.

- WAOH-CD UHF Going off the air

- WDLI-TV UHF Going off the air

- WGGN-TV UHF Moving to Low VHF Channel

- WRLM-TV UHF Going off the air

- WUAB-TV UHF Going off the air

Columbus, Ga.

- WJSP-TV UHF Moving to Low VHF Channel

Columbus, Oh.

- WOUC-TV UHF Moving to Low VHF Channel

- WSFJ-TV UHF Going off the air

Dallas-Ft. Worth, Tex.

- KATA-CD UHF Going off the air

Dayton, Oh.

- WBDT-TV UHF Going off the air

- WKOI-TV UHF Going off the air

Flint-Saginaw-Bay City, Mich.

- WCMZ-TV UHF Going off the air

Greensboro-High Point-Winston, N.C.

- WCWG-TV UHF Going off the air

- WLXI-TV UHF Going off the air

Greenville-New Bern-Washington, N.C.

- WFXI-TV High VHF Channel Going off the air

Greenville-Spartanburg, S.C.

- WGGS-TV UHF Moving to Low VHF Channel

- WRET-TV UHF Going off the air

- WYCW-TV UHF Going off the air

Harrisburg-Lancaster-Lebanon-York, Pa.

- WGCB-TV UHF Going off the air

- WLYH-TV UHF Going off the air

- WPMT-TV UHF Going off the air

Harrisonburg, Va.

- WAZH-CD UHF Going off the air

- WVPY-TV UHF Going off the air

Hartford-New Haven, Conn.

- WCTX-TV UHF Going off the air

- WEDY-TV UHF Going off the air

- WRDM-CD UHF Going off the air

- WUVN-TV UHF Going off the air

Huntsville-Decatur-Florence, Ala.

- WHDF-TV UHF Moving to Low VHF Channel

Indianapolis, Ind.

- WCLJ-TV UHF Going off the air

- WHMB-TV UHF Moving to High VHF Channel

- WNDY-TV UHF Going off the air

Johnstown-Altoona, Pa.

- WKBS-TV UHF Moving to Low VHF Channel

Knoxville, Tenn.

- WAGV-TV UHF Going off the air

Lansing, Mich.

- WHTV-TV UHF Going off the air

- WLNS-TV UHF Going off the air

Lima, Oh.

- WTLW-TV UHF Moving to Low VHF Channel

Los Angeles, Calif.

- KAZA-TV UHF Going off the air

- KBEH-TV UHF Going off the air

- KDOC-TV UHF Moving to High VHF Channel

- KILM-TV UHF Going off the air

- KJLA-TV UHF Going off the air

- KLCS-TV UHF Going off the air

- KNET-CD UHF Going off the air

- KOCE-TV UHF Going off the air

- KRCA-TV UHF Going off the air

- KSFV-CD UHF Going off the air

- KVCR-TV UHF Moving to Low VHF Channel

- KWHY-TV UHF Moving to Low VHF Channel

Louisville, Ky.

- WBKI-TV UHF Going off the air

- WWJS-CD UHF Going off the air

Madison, Wisc.

- WISC-TV UHF Moving to High VHF Channel

Memphis, Tenn.

- WWTW-TV UHF Going off the air

Miami-Ft. Lauderdale, Fla.

- WDLP-CD UHF Going off the air

- WIMP-CD UHF Going off the air

- WLPH-CD UHF Going off the air

Milwaukee, Wisc.

- WCGV-TV UHF Going off the air

- WMLW-TV UHF Going off the air

- WMVT-TV UHF Going off the air

- WVCY-TV UHF Going off the air

Minneapolis-St. Paul, Minn.

- KCCO-TV High VHF Channel Going off the air

Monterey-Salinas, Calif.

- KSMS-TV UHF Going off the air

Myrtle Beach-Florence, S.C.

- WGSI-CD High VHF Channel Going off the air

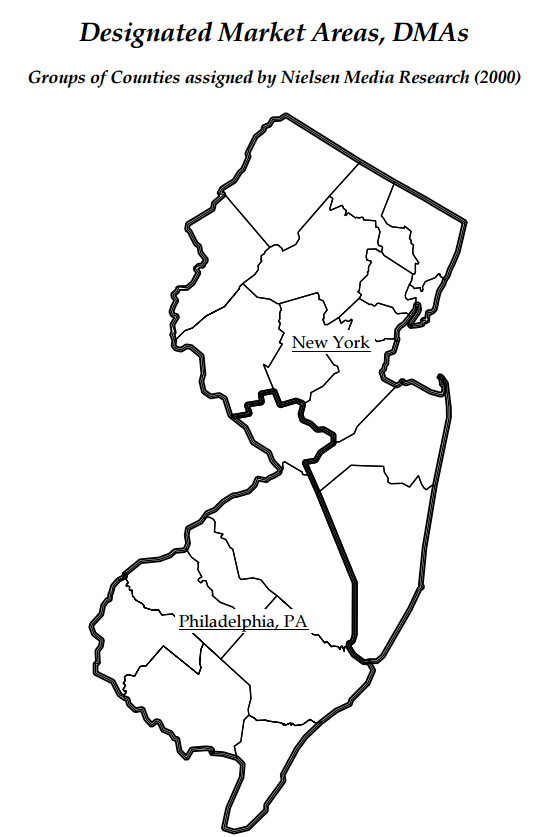

New York, N.Y.

- WEBR-CD UHF Going off the air

- WMBQ-CD UHF Going off the air

- WMUN-CD UHF Going off the air

- WNBC-TV UHF Going off the air

- WNJN-TV UHF Going off the air

- WNYJ-TV UHF Going off the air

- WRNN-TV UHF Going off the air

- WTBY-TV UHF Going off the air

- WXTV-TV UHF Going off the air

- WZME-TV UHF Going off the air

Orlando-Daytona Beach-Melbourne, Fla.

- WACX-TV UHF Moving to High VHF Channel

- WTGL-TV UHF Going off the air

Philadelphia, Pa.

- WFMZ-TV UHF Going off the air

- WGTW-TV UHF Going off the air

- WLVT-TV UHF Going off the air

- WMCN-TV UHF Going off the air

- WNJT-TV UHF Going off the air

- WTSD-CD UHF Going off the air

- WTVE-TV UHF Going off the air

- WUVP-TV UHF Going off the air

- WWSI-TV UHF Going off the air

- WYBE-TV UHF Going off the air

Pittsburgh, Pa.

- WBOA-CD UHF Going off the air

- WEMW-CD UHF Going off the air

- WEPA-CD UHF Going off the air

- WNNB-CD UHF Going off the air

- WPCP-CD UHF Going off the air

- WQED-TV High VHF Moving to Low VHF Channel

- WQVC-CD UHF Going off the air

- WVTX-CD UHF Going off the air

Providence, R.I.-New Bedford, Mass.

- WLWC-TV UHF Going off the air

- WRIW-CD UHF Going off the air

- WSBE-TV UHF Moving to Low VHF Channel

Puerto Rico

- WDWL-TV UHF Going off the air

- WELU-TV UHF Going off the air

- WIRS-TV UHF Going off the air

- WKPV-TV UHF Going off the air

- WMEI-TV UHF Going off the air

- WSJU-TV UHF Going off the air

- WTCV-TV UHF Going off the air

Raleigh-Durham, N.C.

- WFPX-TV UHF Going off the air

- WHFL-CD UHF Moving to High VHF Channel

- WNCN-TV UHF Moving to High VHF Channel

- WRAY-TV UHF Going off the air

- WZGS-CD UHF Going off the air

Richmond-Petersburg, Va.

- WUPV-TV UHF Moving to High VHF Channel

Roanoke-Lynchburg, Va.

- WFFP-TV UHF Going off the air

Rockford, Ill.

- WIFR-TV UHF Going off the air

San Diego, Calif.

- K35DG-TV UHF Going off the air

- KSEX-CD UHF Going off the air

San Francisco-Oakland-San Jose, Calif.

- KEMO-TV UHF Going off the air

- KEXT-CD UHF Going off the air

- KMPT-TV UHF Going off the air

- KOFY-TV UHF Going off the air

- KQEH-TV UHF Going off the air

- KRCB-TV UHF Moving to Low VHF Channel

- KRON-TV UHF Moving to High VHF Channel

- KTLN-TV UHF Going off the air

- KTNC-TV UHF Going off the air

- KTSF-TV UHF Going off the air

Santa Barbara-Santa Maria-San Caballero, Calif.

- KMMA-CD UHF Going off the air

Springfield, Mo.

- KSPR-TV UHF Going off the air

Springfield-Holyoke, Mass.

- WGBY-TV UHF Moving to High VHF Channel

Syracuse, N.Y.

- WNYI-TV UHF Moving to High VHF Channel

Tampa-St. Petersburg-Sarasota, Fla.

- WUSF-TV UHF Going off the air

- WTTA-TV UHF Going off the air

Tri-Cities, Tenn.

- WAPG-CD UHF Going off the air

- WMSY-TV UHF Going off the air

- WSBN-TV UHF Going off the air

Tyler-Longview, Tex.

- KCEB-TV UHF Going off the air

Washington, D.C.

- WAZF-CD UHF Going off the air

- WDCA-TV UHF Going off the air

- WDCW-TV UHF Going off the air

- WJAL-TV UHF Going off the air

- WMDO-CD UHF Going off the air

- WNVC-TV UHF Going off the air

- WNVT-TV UHF Going off the air

- WZDC-CD UHF Going off the air

West Palm Beach-Ft. Pierce, Fla.

- WFGC-TV UHF Moving to High VHF Channel

- WXEL-TV UHF Going off the air

Wilkes Barre-Scranton, Pa.

- WKBN-TV UHF Going off the air

- WVIA-TV UHF Going off the air

Time Warner Cable and Bright House Networks customers are now getting a taste of the frustration that original Charter Communications customers have experienced for years in dealing with the company’s complicated TV packages.

Time Warner Cable and Bright House Networks customers are now getting a taste of the frustration that original Charter Communications customers have experienced for years in dealing with the company’s complicated TV packages. Charter Communications may sell you a Silver or Gold package to restore your old lineup, but there is a better way to get channels back without spending money on premium movie channels you may not want.

Charter Communications may sell you a Silver or Gold package to restore your old lineup, but there is a better way to get channels back without spending money on premium movie channels you may not want.

Subscribe

Subscribe