Comcast is inviting controversy launching a new live streaming TV service targeting cord-cutters while exempting it from its own data caps.

Comcast is inviting controversy launching a new live streaming TV service targeting cord-cutters while exempting it from its own data caps.

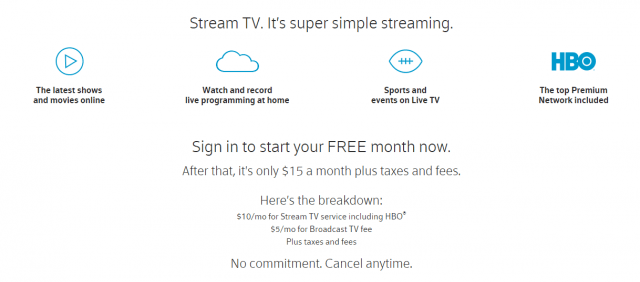

Comcast’s Stream TV is comparable to Comcast’s Limited Basic lineup, only instead of using a set-top box, Stream TV delivers online video over the Internet to Comcast’s broadband customers in Massachusetts, New Hampshire, Maine and the Greater Chicago area. For $15 a month, Stream TV offers a large package of local over the air stations, broadcast networks, and HBO, along with thousands of on-demand titles and cloud DVR storage. In Boston, the lineup includes:

WGBH (PBS), HSN. WBZ (CBS), NECN, WHDH (NBC), Community Programming, BNN-Public Access, WWDP-Evine Live, WLVI (CW), WSBK (MyTV), WGBX (PBS), WBIN (Ind.), WBPX (Ion), WMFP (Ind.), The Municipal Channel, Government Access, WFXT (FOX), WCEA (MasTV), WUNI (Univision), EWTN, C-SPAN, CatholicTV, POP, QVC, WYDN (Daystar), WUTF (UniMas), WNEU (Telemundo), Jewelry TV, XFINITY Latino, WGBH World, WGBH Kids, Trinity Broadcasting Network, WGBH Create, Leased Access, WBIN-Antenna TV, WBIN-GRIT TV, WNEU-Exitos, WLVI-BUZZR, WCVB (Me-TV), WFXT-MOVIES!, WHDH-This TV, WFXZ-CA, WUNI-LATV, WFXZ (Mundo Fox), WBZ-Decades, and WFXT-Laff TV + HBO. The package also qualifies the customer as an authenticated cable TV subscriber, making them eligible to view TV Everywhere services from many cable networks.

Comcast is offering the first month of Stream TV for free with no commitment to its broadband customers subscribed to at least XFINITY Performance Internet (or above). Up to two simultaneous streams are allowed per account and some channels may not be available for viewing outside of the home. Comcast claims it will expand Stream TV to Comcast customers nationwide in 2016. Comcast will not be selling the service to customers of other cable or phone companies, limiting its potential competitive impact.

Competitors like Sling TV offer their own alternatives to bloated cable TV subscriptions at a similar lower price, and they will sell to anyone with a broadband connection. Sling alone is partly responsible for Comcast’s loss of hundreds of thousands of cable TV customers who don’t want to pay for hundreds of channels many never watch. That Comcast might want to launch its own alternative online video package to retain customers is not a surprise. But Comcast’s decision to exempt Stream TV from the company’s data caps while leaving them in place for competitors is sure to spark a firestorm of controversy.

Comcast claims it is reasonable to exempt Stream TV from its 300GB data cap being tested in a growing number of markets.

Comcast claims it is reasonable to exempt Stream TV from its 300GB data cap being tested in a growing number of markets.

“Stream TV is a cable streaming service delivered over Comcast’s cable system, not over the Internet,” wrote Comcast in its FAQ. “Therefore, Stream TV data usage will not be counted towards your Xfinity Internet monthly data usage.”

More precisely, Comcast claims it relies on its own internal IP network to distribute Stream TV, not the external Internet competitors use to reach ex-Comcast cable TV subscribers. Comcast’s premise is it is less costly to deliver content over its own network while Internet traffic comes at a premium. Critics will argue Comcast has found an end run around Net Neutrality by relying on usage caps to influence customer behavior.

For the moment, Netflix is reserving comment after being contacted by Ars Technica. But Sling TV and other services that depend on Comcast’s broadband to reach customers will likely not remain silent for long.

Comcast could effectively deter consumers from using competing online video services with the threat of overlimit fees if customers exceed their usage allowance. The cable company could even use the fact its services don’t count against that allowance as a marketing strategy.

Stop the Cap! has warned our members about that prospect for years. Preferential treatment of certain content over others by playing games with usage caps and overlimit fees could have a major impact on emerging online video competition. Since Comcast owns both the broadband lines and the online video service, it can engage in anti-competitive price discrimination. Competitors will also argue that Comcast’s internal IP network is off-limits to them, making it impossible to deliver content on equal terms over a level playing field.

The next move will likely come from the FCC in response to complaints from Comcast’s competitors. As Ars Technica notes, the Federal Communications Commission’s Net Neutrality rules allow for complaints against so-called zero-rating schemes, with the commission judging on a case-by-case basis whether a practice “unreasonably interferes” with the ability of consumers to reach content or the ability of content providers to reach consumers.

With Comcast’s usage caps and overlimit fees, the only reaching will be for your wallet. Consumers need not wait for Sling TV and others to complain to the FCC. You can also share your own views about Comcast’s usage caps by filing a complaint with the FCC here.

Subscribe

Subscribe LOS ANGELES (Reuters) – Local TV stations are plugging one of the last major holes in mobile video: streaming their news to phones and tablets. The move presents yet another challenge to cable and satellite providers, which are grappling with the widespread online availability of content.

LOS ANGELES (Reuters) – Local TV stations are plugging one of the last major holes in mobile video: streaming their news to phones and tablets. The move presents yet another challenge to cable and satellite providers, which are grappling with the widespread online availability of content. Pay TV still reaches 100 million households, but the industry lost 0.5 percent of its customers in the 12 months through March, according to MoffettNathanson analysts. Distributors have countered by offering customers their own apps with broadcast and cable networks.

Pay TV still reaches 100 million households, but the industry lost 0.5 percent of its customers in the 12 months through March, according to MoffettNathanson analysts. Distributors have countered by offering customers their own apps with broadcast and cable networks. In Cincinnati, E.W. Scripps sells a subscription for ABC-affiliated station WCPO with additional stories not seen on TV, as well as free movie screenings and other perks. It has an on-demand news app in Phoenix on Microsoft’s Xbox and Apple Inc’s set-top box.

In Cincinnati, E.W. Scripps sells a subscription for ABC-affiliated station WCPO with additional stories not seen on TV, as well as free movie screenings and other perks. It has an on-demand news app in Phoenix on Microsoft’s Xbox and Apple Inc’s set-top box. Comcast will challenge cord cutting and entice cord-nevers with

Comcast will challenge cord cutting and entice cord-nevers with  Comcast will deliver Stream over the same network it uses for content delivery to game consoles that does not count against Comcast’s

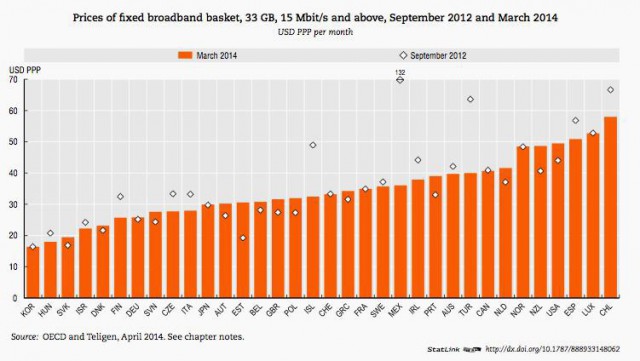

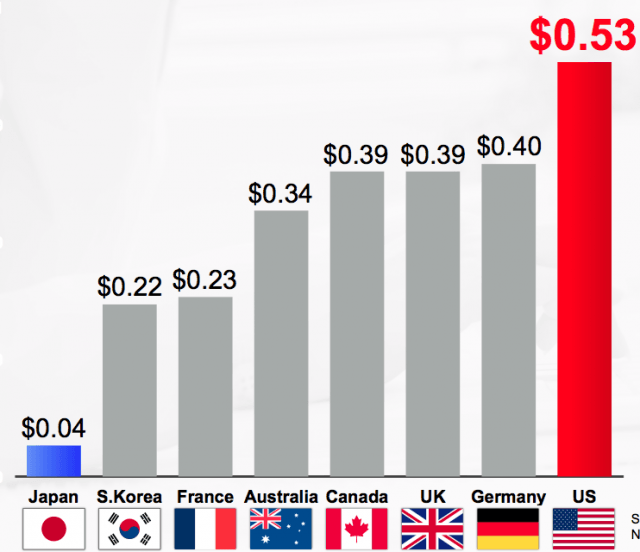

Comcast will deliver Stream over the same network it uses for content delivery to game consoles that does not count against Comcast’s  In the last three years, several Wall Street analysts have called on cable and telephone companies to raise the price of broadband service to make up for declining profits selling cable TV. As shareholders pressure executives to keep profits high and costs low, dramatic price changes may be coming for broadband and television service that will boost profits and likely eliminate one of their biggest potential competitors — Sling TV.

In the last three years, several Wall Street analysts have called on cable and telephone companies to raise the price of broadband service to make up for declining profits selling cable TV. As shareholders pressure executives to keep profits high and costs low, dramatic price changes may be coming for broadband and television service that will boost profits and likely eliminate one of their biggest potential competitors — Sling TV.

“Our work suggests that cable companies have room to take up broadband pricing significantly and we believe regulators should not oppose the re-pricing (it is good for competition & investment),”

“Our work suggests that cable companies have room to take up broadband pricing significantly and we believe regulators should not oppose the re-pricing (it is good for competition & investment),”  Neither would Sling CEO Roger Lynch, who has a package of 23 cable channels to sell broadband-only customers for $20 a month.

Neither would Sling CEO Roger Lynch, who has a package of 23 cable channels to sell broadband-only customers for $20 a month.