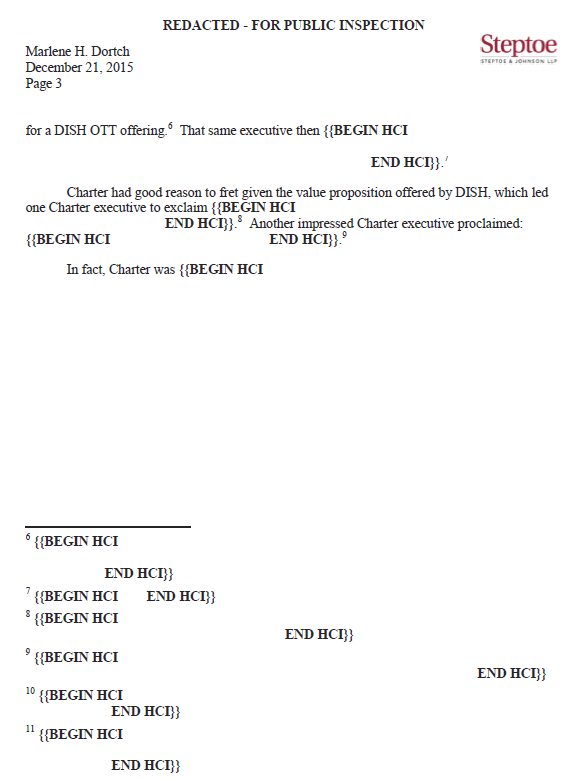

Sling TV subscribers that prepay for three months of Sling TV’s $20/mo “Orange” 30-channel streaming cable TV plan can get an AirTV Player + Adapter for $50, a discount of $79.99 off the $129.99 retail price.

Dish Network’s Sling TV service rebranded its service today, in light of competitive pressure from AT&T’s DirecTV Now and new streaming services from YouTube and Hulu. The company ditched its “basic TV” marketing pitch and has now recast the service as “A La Carte TV,” but the changes are in name-only. There is nothing different about the packages or pricing, just the marketing message pushing their packages.

“A La Carte TV is choice in an industry that prevents it,” the Sling TV website states. “Personalize your own channel lineup. Start with the service that’s best for you, then customize with Extras in your favorite TV genres like Sports, Comedy, Kids, News, Lifestyle, Hollywood Movies, and Spanish TV. Change your service online anytime.”

“As we expected, competitors are coming out of the woodwork,” wrote Sling TV CEO Roger Lynch in a blog post. “However, we didn’t expect that they’d drag three key pieces of Old TV baggage with them: bloated bundles, higher prices and lack of flexibility. The only choices these competitors give consumers is a big bundle or even bigger bundles. That isn’t the choice consumers want. Plus, they’re making people pay for features and channels they may not want. The ‘new guys’ are missing the point and re-creating the sins of Old TV.”

Lynch admits Sling TV isn’t true “a la carte,” because subscribers still end up with channels they don’t want.

“Every consumer would love to just pay $20 and then choose the twenty channels they want,” Lynch wrote. “And we would love that too. We would do that in a heartbeat if programmers would let us…but they won’t.”

Sling TV is also attempting to find a niche targeting international audiences with packages of international networks that are either not available on cable, or can cost a fortune.

“Sling TV is the only pay-TV service that offers the ability to subscribe only to programming from a specific region, including Mexico, Spain, South America and the Caribbean,” Lynch wrote, adding the service now offers more than 300 channels across more than 20 language groups.

The total price of the three-months of prepaid Orange service and the AirPlay TV + Adapter is $124.97, before state and local sales taxes are applied. Subscribers can also qualify for the deal with other packages:

- Prepay for four months of Sling TV if your monthly payment is between $15-$20 and get AirTV Player and AirTV Adapter for $50.

- Prepay for six months of Sling TV if your monthly payment is under $15 and get AirTV Player and AirTV Adapter for $50.

Sling TV customers can visit sling.com/devices/airtv to buy the bundle. A separate deal offering a 25% discount off an RCA indoor TV antenna was not working at the time this article was written. Existing Sling TV customers can also qualify for this promotion by writing to the company’s social media team on Sling TV’s Facebook page.

The AirTV Player allows users to combine over-the-air free TV with streaming services without having to change viewing sources on your television.

Subscribe

Subscribe

While Burke’s prediction has yet to slash the cable dial by more than a few networks so far, it has slowed down the rate of new network launches considerably. One millennial-targeted network, Pivot, will never sign on because it failed to attract enough cable distribution and advertisers, despite a $200 million investment from a Canadian billionaire. Time, Inc.’s attempts to launch three new networks around its print magazines Sports Illustrated, InStyle and People have gone the Over The Top (OTT) video route, direct to consumers who can stream their videos from the magazines’ respective websites.

While Burke’s prediction has yet to slash the cable dial by more than a few networks so far, it has slowed down the rate of new network launches considerably. One millennial-targeted network, Pivot, will never sign on because it failed to attract enough cable distribution and advertisers, despite a $200 million investment from a Canadian billionaire. Time, Inc.’s attempts to launch three new networks around its print magazines Sports Illustrated, InStyle and People have gone the Over The Top (OTT) video route, direct to consumers who can stream their videos from the magazines’ respective websites. DirecTV Now is expected by the end of this year and will likely offer a 100 channel package of programming priced at between $40-55 a month, viewable on up to two screens simultaneously. The app-based service will be available for video streaming to televisions and portable devices like tablets and phones. No truck rolls for installation, no service calls, and no equipment to buy or rent are all attractive propositions for AT&T, hoping to cut costs.

DirecTV Now is expected by the end of this year and will likely offer a 100 channel package of programming priced at between $40-55 a month, viewable on up to two screens simultaneously. The app-based service will be available for video streaming to televisions and portable devices like tablets and phones. No truck rolls for installation, no service calls, and no equipment to buy or rent are all attractive propositions for AT&T, hoping to cut costs. Despite clamoring for more competition in the cable industry, FCC chairman Thomas Wheeler is reportedly ready to circulate a draft order granting Charter Communications’ $55 billion dollar buyout of Time Warner Cable, with conditions.

Despite clamoring for more competition in the cable industry, FCC chairman Thomas Wheeler is reportedly ready to circulate a draft order granting Charter Communications’ $55 billion dollar buyout of Time Warner Cable, with conditions. Critics of the deal contend that might be an effective strategy… if Charter was the only cable company in the nation. Many cable operators include similar restrictive terms in their contracts, which often also include an implicit threat that offering cable channels online diminishes their value in the eyes of cable operators. Programmers fear that would likely mean price cuts as those contracts are renewed.

Critics of the deal contend that might be an effective strategy… if Charter was the only cable company in the nation. Many cable operators include similar restrictive terms in their contracts, which often also include an implicit threat that offering cable channels online diminishes their value in the eyes of cable operators. Programmers fear that would likely mean price cuts as those contracts are renewed. Most of the other deal conditions will likely formalize Charter’s voluntary commitments not to impose data caps, modem fees, interconnection fees (predominately affecting Netflix) or violate Net Neutrality rules for the first three years after the merger is approved. As readers know, Stop the Cap!

Most of the other deal conditions will likely formalize Charter’s voluntary commitments not to impose data caps, modem fees, interconnection fees (predominately affecting Netflix) or violate Net Neutrality rules for the first three years after the merger is approved. As readers know, Stop the Cap!  A behind the scenes struggle between DISH Networks and Charter Communications over DISH’s online video service Sling TV has led to an admission by a Wall Street analyst that “usage-based billing” is an important tool for stifling over-the-top online video competition.

A behind the scenes struggle between DISH Networks and Charter Communications over DISH’s online video service Sling TV has led to an admission by a Wall Street analyst that “usage-based billing” is an important tool for stifling over-the-top online video competition.