Charter Communications last week filed its 362 page redacted Public Interest Statement laying out its case to win approval of its acquisition of Time Warner Cable and Bright House Networks, to be run under the Charter banner.

Charter Communications last week filed its 362 page redacted Public Interest Statement laying out its case to win approval of its acquisition of Time Warner Cable and Bright House Networks, to be run under the Charter banner.

“Charter may not be a household name for all Americans, but it has developed into an industry leader by implementing customer and Internet-friendly business practices,” its statement reads.

The sprawling document is effectively a sales pitch to federal regulators to accept Charter’s contention the merger is in the public interest, and the company promises a range of voluntary and committed service upgrades it says will improve the customer experience for those becoming a part of what will be America’s second largest cable operator.

Charter’s proposed upgrades fall under several categories of direct interest to consumers:

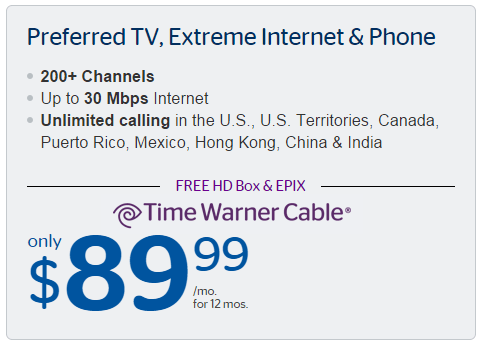

Broadband: Charter will commit to upgrade customers to 60Mbps broadband within 30 months (about 2.5 years) after the deal is approved. That could mean some Time Warner Cable customers will still be serviced with standard speeds of 15Mbps as late as 2018. Time Warner Cable’s Maxx upgrade program will be effectively frozen in place and will continue in only those areas “consistent with Time Warner Cable’s existing deployment plans.” That will leave out a large sections of the country not on the upgrade list. Charter has committed to impose no data caps, usage-based pricing or modem fees, but only for three years, after which it will be free to change those policies at will.

Wi-Fi: Charter promises to build on Time Warner’s 100,000 Wi-Fi hotspots, most in just a few cities, and Bright House’s denser network of 45,000 hotspots with a commitment to build at least 300,000 new hotspots across Charter’s expanded service area within four years. Charter will also evaluate deploying cable modems that also act as public Wi-Fi hotspots. Comcast already offers over 500,000 hotspots with plans for many more, making Charter’s wireless commitment less ambitious than what Comcast today offers customers.

Cable-TV: Charter has committed to moving all Time Warner and Bright House systems to all-digital service within 30 months. Customers will need to lease set-top boxes designed to handle Charter’s encryption system for all cable connected televisions. Among those boxes includes Charter’s new, IP-capable Worldbox CPE and cloud-based Spectrum Guide user interface system.

Video on the Go: Charter will adopt Time Warner Cable’s streaming platform and apps to provide 300 streaming television channels to customers watching from inside their homes (a small fraction of those channels are available while outside of the home). Customers will not be able to watch on-demand recorded DVR shows from portable devices, but can program their DVRs from apps or the website.

Discount Internet for the Poor: Charter references the fact its minimum entry-level broadband speed is 60Mbps so that does not bode well for Time Warner Cable’s Everyday Low Priced Internet $14.99 slow-speed Internet plan. Instead Charter will build upon Bright House Networks’ mysterious broadband program for low-income consumers.

Based on Charter’s initial proposal, Stop the Cap! will urge state and federal regulators to require changes of these terms before approving any merger. Among them:

- All existing Time Warner Cable and Bright House service areas should be upgraded to meet or exceed the levels of service offered by Time Warner Cable’s Maxx program within 30 months. It is not acceptable to upgrade some customers while others are left with a much more modest upgrade program proposed by Charter;

- Charter must commit to Net Neutrality principles without an expiration date;

- Regardless of any usage-cap or usage-based pricing plans Charter may introduce after its three-year “no caps” commitment expires, Charter must permanently continue to offer unlimited, flat rate Internet service at a reasonable price as an alternative to usage-priced plans;

- Customers must be given the option of opting out of any leased/provided-modem Wi-Fi hotspot plan that offers a wireless connection to outside users without the customer’s consent;

- Charter must commit to a more specific Wi-Fi hotspot program that details towns and cities to be serviced and proposed pricing for non-customers;

- Charter must allow customers to use their own set-top equipment (eg. Roku, Apple TV, etc.) to receive cable television service without compulsory equipment/rental fees. The company must also commit to offering discount alternatives such as DTAs for secondary televisions and provide an option for income-challenged customers compelled to accept new equipment to continue receiving cable television service;

- Charter must retain Time Warner Cable’s Everyday Low Priced $14.99 Internet plan regardless of any other low-income discount program it offers. If it chooses to adopt Bright House’s program, it must broaden it to accept applications year-round, simplify the application process and eliminate any waiting periods;

- Charter must commit to independent verification of customer quality and service standards and adhere to any regulatory guidelines imposed by state or federal regulators as a condition of approval.

- Charter must commit to expansion of its cable network into a reasonable number of adjacent, unserved areas by committing a significant percentage (to be determined) of measurable financial benefits of the merger to the company or its executives towards this effort.

Stop the Cap! will closely monitor the proceedings and intends to participate on both the state (New York) and federal level to guarantee any merger provides consumers with an equitable share of the benefits. We will also be examining the impact of the merger on existing Time Warner Cable and Bright House employees and will promote merger conditions that protect jobs and limit outsourcing, especially overseas.

Subscribe

Subscribe Time Warner Cable

Time Warner Cable  If you are a long time Optimum customer, the CEO, management, and shareholders of Cablevision would like to thank you for driving average monthly cable revenue per customer 4.8% higher from a year ago to $155.34 a month.

If you are a long time Optimum customer, the CEO, management, and shareholders of Cablevision would like to thank you for driving average monthly cable revenue per customer 4.8% higher from a year ago to $155.34 a month. “The main drivers of our increased revenue per customer came from a combination of rate increases, but also lower proportion of subscribers on promotion,” said Brian G. Sweeney, chief financial officer. “We had a number of fixed rate increases January 1 of this year related to cable box fees, an increase in our sports and broadcast TV surcharge, as well as the pass-through of PEG fees to certain customers.”

“The main drivers of our increased revenue per customer came from a combination of rate increases, but also lower proportion of subscribers on promotion,” said Brian G. Sweeney, chief financial officer. “We had a number of fixed rate increases January 1 of this year related to cable box fees, an increase in our sports and broadcast TV surcharge, as well as the pass-through of PEG fees to certain customers.”

To further combat promotion-bouncing, Cablevision is embracing its broadband product line and marketing new cord-cutting packages to customers that offer reduced-size cable television packages and free over the air antennas for local stations. The cable company also recently announced it would offer cable customers Hulu subscriptions. Jim Dolan, Cablevision CEO, believes broadband is where the money is and customers are willing to pay higher prices to get Internet access even when video package pricing has its limits.

To further combat promotion-bouncing, Cablevision is embracing its broadband product line and marketing new cord-cutting packages to customers that offer reduced-size cable television packages and free over the air antennas for local stations. The cable company also recently announced it would offer cable customers Hulu subscriptions. Jim Dolan, Cablevision CEO, believes broadband is where the money is and customers are willing to pay higher prices to get Internet access even when video package pricing has its limits. Your credit worthiness now plays a more important factor in determining whether you can sign up for service with Charter Communications, and if you fail to pay the company has stepped up collection efforts to bring past due or canceled accounts up to date.

Your credit worthiness now plays a more important factor in determining whether you can sign up for service with Charter Communications, and if you fail to pay the company has stepped up collection efforts to bring past due or canceled accounts up to date.