No TV for you until you sign here.

Charter Communications is asking owners of apartment complexes, nursing homes, independent living/assisted care residences, and hotel and motel owners to sign new agreements allowing Spectrum to lock owners into a 10-year contract that includes a provision allowing retroactive rate increases and a requirement to turn over personal information on every resident to the cable company.

A number of apartment complexes bundle “free cable TV” into the lease as a selling point for renters. Others pay a discounted rate that is part of a resident’s monthly rent payment or service fee. These agreements are part of the murky world of “bulk service contracts” for cable service, and disputes between a property owner and Spectrum can cause the loss of cable service for every resident without warning.

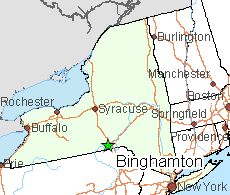

Most of the disputes involve apartment complexes, assisted-living facilities, and hotels/motels formerly served by Time Warner Cable. Most are still under relatively short-term contracts with Time Warner Cable, which was acquired in 2016 by Charter Communications. Good Shepherd Fairview Nursing Home in Binghamton, N.Y. and Good Shepherd Communities, a senior living center in Endwell, N.Y., are good examples.

Mike Keenan has been involved in long-term senior care for 30 years, and over that time he has negotiated hundreds of contracts. But as WICZ in Binghamton reports, nothing prepared him for dealing with Spectrum and Charter Communications.

Good Shepherd Village is a senior living center in Endwell, N.Y.

Charter is using its ongoing digital conversion program as a tool to force “bulk contract” holders to sign new agreements with Charter Communications, often replacing still-valid contracts with Time Warner Cable. Many are not happy about the new terms Charter is offering, particularly one that locks them in with Spectrum service for the next decade and another that allows the cable company to raise rates retroactively.

Those unwilling to sign new contracts have been threatened with service being shut off, usually as digital conversion and TV signal encryption reaches their area, which requires new equipment to keep watching. Those complex owners that still refuse to sign are required to share each tenant’s personal details and address with the cable company.

“Spectrum had taken the position that even though we had a contract in force until December 2018 that we needed to sign a new contract immediately,” said Keenan, president and CEO of Good Shepherd Communities. “If not, they threatened that we would lose service at our Good Shepherd Fairview in Binghamton location and our Good Shepherd Villages at our Endwell location.”

Charter was true to its word. Efforts to negotiate obtaining digital adapters or set-top boxes under the old Time Warner Cable contract failed and with no warning, all 161 nursing home residents at Good Shepherd Fairview lost their cable television on Feb. 27. Two weeks later, 264 residents at Good Shepherd Village — the senior living center — also lost their television and internet service.

The loss was devastating to residents, especially at the nursing home.

The loss was devastating to residents, especially at the nursing home.

“Many of the residents are frail, some of them may be bedridden and their TV means everything to them,” Keenan said.

Keenan’s contract with Time Warner Cable was still valid, and its terms made it clear as long as Good Shepherd kept their payments current, they were owed service that Charter ultimately took away from hundreds of residents.

Apartment complex owners around the country are reviewing new contracts from Charter Communications and many are dropping “free cable TV” after decades of offering the service as an amenity included in the rent. Many who are ending their contracts believe a growing number of tenants neither need or want traditional cable service.

The deal-breaker for many is Charter’s insistence on offering a bulk discount only if the entire building signs up for service, which means owners will have to pay out-of-pocket for Spectrum service in vacant units or in apartments where the tenant has service with another provider.

WICZ in Binghamton, N.Y. reports Charter Communications used nursing home residents as pawns to force the hand of a nursing home manager to sign a new Spectrum contract, even though the current one with Time Warner Cable has not expired. (3:11)

Keenan

“Let’s say you’re paying for Spectrum” – the brand name for Charter’s service – “for 100 percent of the units,” attorney Tara Snow, a partner at Novitt, Sahr & Snow, told Habitat. “You may have 90 or 95 percent of the apartments signing up, but you always have some units that don’t.”

That leaves someone on the hook, either tenants or the property owner, to pay for cable service that nobody is watching. Under Time Warner Cable just a few years ago, the cable company would pay a co-op, condo association, or apartment owner an upfront cash bonus and ongoing “revenue-share fees” for getting a majority of residents — but not all — to sign up for service. It also allowed the company to market holdouts door to door.

No such luck with Charter, which wants to be paid for every unit no matter who is at home. For property owners staying loyal to Spectrum, some are absorbing the extra costs while others pass them on to tenants as part of their rent or monthly maintenance/service surcharges. A few are trying cost sharing arrangements that divide up the total bill equally among all tenants. But as younger renters move in and increasingly show no interest in cable television, the dwindling number who have cable are paying more and more to cover those that don’t.

“People are cord-cutting,” says Brian Scally, vice president of Garthchester Realty, a management firm. “Most people who still want cable want to select their own cable/internet/telephone provider.”

Of the 64 properties he manages, Scally told Habitat fewer than a dozen have signed up for a bulk rate, and those deals were signed years ago.

Of the 64 properties he manages, Scally told Habitat fewer than a dozen have signed up for a bulk rate, and those deals were signed years ago.

“I haven’t brought anybody new to bulk rate,” he says.

The other deal breaker for many is Spectrum’s 10-year contract, which locks owners in with a cable company a lot of tenants despise.

As a result, a growing number of apartment complexes and condos are terminating their bulk cable contracts as they expire, and have no intention of renewing under Charter’s draconian terms. Affected tenants are informed the “free” cable television they were receiving is ending and they should make individual arrangements with Spectrum to maintain service going forward.

Hotel and motel owners are also finding fault with Charter Communications, and some are taking their disputes to the Federal Communications Commission.

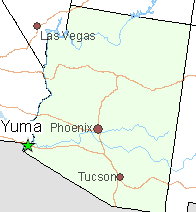

Yvonne Peach, who owns the Historic Coronado Motor Hotel in Yuma, Ariz., says dealing with Charter has been a nightmare since the merger.

After Charter converted commercial Time Warner Cable and Bright House customers to Spectrum plans and pricing, she lost service to all of her motel rooms for more than a week.

Historic Coronado Motor Hotel – Yuma, Ariz. (Image courtesy of owner)

“When they did the change over we didn’t have any cable TV in the hotel for 12 days,” Peach told KYMA-TV.

Spectrum advised her best solution would be to install leased set-top boxes in the hotel’s 126 rooms, a solution she claims caused even more problems. It seems Spectrum’s equipment doesn’t appreciate Yuma’s southwest Arizona heat, and the boxes regularly fail when air conditioning is switched off in unoccupied rooms.

“We’ve had over 100 of them replaced probably in the last I don’t how many months,” she said. “It’s a box that if the room isn’t rented every night it becomes deactivated.”

Those paying to stay in the motel are not happy to reach their rooms and find the television isn’t working either.

“We’ve lost thousands of dollars with people that would move out because of no TV in their room,” Peach said. “It comes and it will say dial an 800 number or something. But you know the guest. They are paying a certain amount for the room and they’re not going to call.”

KYMA-TV in Yuma, Ariz. reports Charter told this hotel owner her cable boxes were not working because they are not being kept air-conditioned. (2:29)

Spectrum ignores her complaints, she claims, transferring her from call center to call center in search of a solution. She finally took her complaint to the FCC, something she does not think should be required after paying the company $1,600 a month for cable television.

Spectrum ignores her complaints, she claims, transferring her from call center to call center in search of a solution. She finally took her complaint to the FCC, something she does not think should be required after paying the company $1,600 a month for cable television.

In response, Spectrum blamed the lack of air conditioning for its box failures, in addition to the “relocation of the digital adapters by hotel staff, which are dedicated to a particular room on the account.”

In other words, if you move equipment between hotel rooms, Spectrum claims that equipment will deauthorize. Spectrum effectively wants motel guests placed in rooms where their cable equipment is still functioning, preferably where air conditioning is left running.

“If you’ve been driving all day and you get in your pajamas and you’re ready for bed and you’re watching TV and the TV doesn’t work, do you want to move to another room without complaining? No, nobody does,” said Peach.

In upstate New York, heat isn’t a significant problem, but having a bulk account representative in Rochester, 2.5 hours away by car from Binghamton is. The representative did not understand Binghamton and Endwell are two different communities about seven miles apart.

“This whole thing could have been avoided,” Keenan said. He called the New York Public Service Commission to complain and within a day multiple Spectrum trucks arrived loaded with set-top boxes — one per residence, potentially finally resolving the dispute, but not the bad feelings that emerged as a result.

“Time Warner Cable was saying ‘we need our customers,’” Keenan said. “The experience I have had with Spectrum is Spectrum is saying ‘you need me.’”

WICZ-TV follows up the next day with this report explaining why it is important to stay wary of cable companies offering long contracts. (1:09)

Subscribe

Subscribe Comcast is on track to lose more than double the number of cable-TV cancellations it experienced in 2017 due to cord-cutting, predicted a Wall Street analyst.

Comcast is on track to lose more than double the number of cable-TV cancellations it experienced in 2017 due to cord-cutting, predicted a Wall Street analyst.

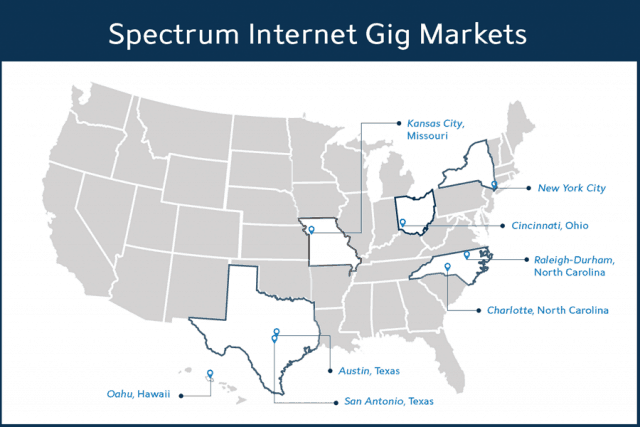

It will take until 2019 to fully integrate all of Charter’s customers onto a single platform that will no longer distinguish if a customer was a long-standing Charter customer or a former TWC or BH subscriber.

It will take until 2019 to fully integrate all of Charter’s customers onto a single platform that will no longer distinguish if a customer was a long-standing Charter customer or a former TWC or BH subscriber. Charter did not restart its digital television conversion program until June of 2017, and 30% of Time Warner Cable and 50% of Bright House Networks customers are still watching analog cable television as a result. Company officials promise digital conversion will be completed nationwide by the end of this year, the first step the company will take to make dramatic broadband speed increases possible.

Charter did not restart its digital television conversion program until June of 2017, and 30% of Time Warner Cable and 50% of Bright House Networks customers are still watching analog cable television as a result. Company officials promise digital conversion will be completed nationwide by the end of this year, the first step the company will take to make dramatic broadband speed increases possible. News that Google

News that Google