KJRH’s newsroom has been spending a lot of time this spring dealing with viewers ripped off by their telecommunications providers. When Tulsa residents can’t get satisfaction from the local cable or satellite company, they often call Channel 2’s Problem Solvers for help.

KJRH’s newsroom has been spending a lot of time this spring dealing with viewers ripped off by their telecommunications providers. When Tulsa residents can’t get satisfaction from the local cable or satellite company, they often call Channel 2’s Problem Solvers for help.

DirecTV’s Phantom Gift Cards: The Promised Rebate That You Qualify For, Until You Don’t

Satellite TV companies are increasingly aggressive pitching discounts and rebates to win customers away from traditional cable TV or the phone company’s new IPTV service. In addition to cheap teaser rates, many providers also sweeten the deal with high value rebate cards for customers signing multi-year service contracts.

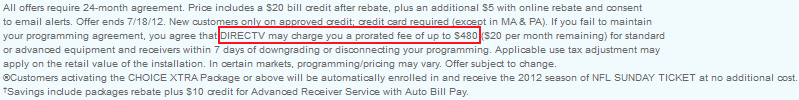

Local resident Michael was attracted to DirecTV’s $200 Visa card rebate offer and signed up for satellite service. Weeks later, with no rebate card in hand, he called the company to find out why, only to be told he did not qualify. When Michael tried to cancel service because the company didn’t deliver what it promised, the customer service representative informed him he would owe $480 in early cancellation penalties.

DirecTV initially stonewalled KJRH when they called on Michael’s behalf, eventually claiming he was told he did not qualify for a rebate a week after signing up for service. But when KJRH asked to hear a recording of the call DirecTV routinely makes when customers sign up for service, they changed their tune.

“The next day, we were told Michael had been given the wrong information about the promotion and he could cancel without that $480 penalty,” the Problem Solvers’ team reports.

Michael says it is important to get everything in writing — including the names of representatives you speak with — because that can make all the difference when a company tries to squeeze out of its own promotional promises. He’s now an ex-DirecTV customer for free, and decided to watch his favorite shows over local broadcast TV.

[flv width=”360″ height=”290″]http://www.phillipdampier.com/video/KJRH Tulsa TV gift card 3-19-12.mp4[/flv]

KJRH got called by Michael when DirecTV reneged on a $200 rebate offer that locked him into a contract that could cost him $480 to escape. (2 minutes)

Suddenlink: Suddenly Owe $400 in April for Service You Canceled In January

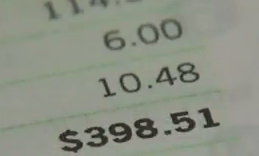

Tulsa resident Lucille got the shock of her life this month when she opened a bill from Suddenlink charging her $400 for cable service she canceled in early January.

Tulsa resident Lucille got the shock of her life this month when she opened a bill from Suddenlink charging her $400 for cable service she canceled in early January.

The past due bill came without warning and Lucille says she never received any phone call, bill, or letter notifying her charges were still accumulating on her account.

When she called Suddenlink, they told her that service was never discontinued, and she owed the money.

Lucille may have been born at night, but not last night.

Angered by Suddenlink’s intransigence, she called KJRH for help. The station went to the top — calling Suddenlink’s corporate headquarters.

Angered by Suddenlink’s intransigence, she called KJRH for help. The station went to the top — calling Suddenlink’s corporate headquarters.

In short order, a company representative researching the dispute found Lucille’s cancellation request, as well as the customer service representative who never processed it.

That representative will be attending Customer Service 101 re-training classes, and a company executive called Lucille directly to apologize.

Not only that, a local Tulsa Suddenlink worker arrived with a $100 refund check — the credit balance owed her for service she paid one month ahead to receive.

While both Lucille and Michael benefited from the threat of both companies being portrayed in a bad light on the evening news, an unknown, uncounted number of customers may not win similar satisfaction.

Many customers simply give up pursuing unpaid rebate promotions (or forget about them altogether), and DirecTV’s nearly $500 early termination fee is a strong incentive to grudgingly stay with the satellite provider until your contract runs out. Lucille, 88 years old, was not going to be intimidated by Suddenlink’s insistence she owed the money (or the implications of being called a past due deadbeat — an especially scandalous notion for older Americans).

Both consumers did something else: they wrote down names, times, and dates of their communications with the companies. That can go a long way to winning satisfaction. So can filing complaints with the Better Business Bureau, which can usually prompt a contact from a higher-level customer service representative more willing to give a complaining customer the benefit of the doubt.

[flv width=”360″ height=”290″]http://www.phillipdampier.com/video/KJRH Tulsa Past due cable bill 4-18-12.mp4[/flv]

KJRH got a call from Lucille about an unexpected $400 Suddenlink cable bill for April… for service she canceled in January. (2 minutes)

Subscribe

Subscribe