Dream On: WildBlue's home page shows a user thrilled about an Internet experience she'll never truly enjoy with a monthly usage limit at low as 2.3GB. Exceed it and face the consequences: WildBlue's Time Out Corner: a speed throttle delivering 128kbps downstream and just 28kbps upstream.

When is broadband not broadband? When it is delivered by hopelessly overloaded and underpowered satellite providers that annoy their subscribers with high prices and low usage allowances.

For many customers of WildBlue and HughesNet, getting high speed Internet access remains a far off dream. No broadband Internet service is more rationed and speed throttled than satellite “fraudband.”

Most satellite broadband customers live in America’s most rural areas, literally miles away from the nearest telephone exchange and often hundreds of miles away from a town with cable broadband. Even wireless Internet providers can’t find enough customers to justify the costs of delivering service.

For America’s most rural, there are three choices:

- Go without.

- Use dial-up service.

- Choose the least annoying satellite provider you can afford.

Just over one million Americans have stuck it out with choice number three, paying twice as much wired Americans pay for broadband and getting just a fraction of the speed and use.

But both providers claim that is all about to change.

WildBlue and HughesNet are in a hurry to launch brand new satellites with dramatically improved capacity that will deliver, they claim, “speeds as fast as fiber.”

For Stop the Cap! reader Adele in a rural part of Arizona, she’ll believe it when she sees it.

“As Stop the Cap! has said all along, anyone who thinks satellite ‘broadband’ is a useful alternative to DSL or cable Internet should be condemned to use it,” she writes. “Everyday brings a new frustration, especially with so-called ‘Fair Access Policies’ that effectively restrict your use to web page browsing and e-mail.”

HughesNet explains how their satellite service uses your satellite dish to send and receive Internet data. (click to enlarge)

For many people running Microsoft Windows, the company’s monthly gift of bug fixes, service packs, and updates is just a minor nuisance. For satellite Internet customers, it can sometimes mean the “day of no Internet.”

Adele explains:

If you have multiple computers and Microsoft determines it has a lot of screw-ups to fix, the monthly updates can easily run into the hundreds of megabytes when every computer receives their individual updates. HughesNet’s “budget” Home and Pro Plans cost up to $70 a month and only include a daily allowance of up to 300 megabytes. It’s no trouble at all to exceed that usage on increasingly large web pages loaded down with video advertising, pop-ups, and other content. Now deal with Microsoft Update Day and in our house, that means you get a good book and stay offline.

If she doesn’t, HughesNet inflicts a stinging punishment — 24 hours in the time out corner with barely dial-up speed penalties for exceeding the limit.

But both satellite providers promise better days ahead when their newest satellites are launched into space.

The New York Times notes WildBlue’s next generation of satellites will bring 10 times the capacity of its three current satellites combined. That opens the door for faster satellite broadband, according to both companies, without price increases.

HughesNet believes satellite broadband’s best days lie ahead, especially as a contender in the rural broadband market.

“One advantage satellite has is ubiquity,” Arunas G. Slekys, vice president for Hughes Network Systems, said. “The cost of reaching you with a satellite dish is independent of where you are. Fiber or cable is labor-intensive and dependent on distance.”

As to satellite’s potential in rural regions, “clearly, there’s an unserved market,” Mr. Slekys said. “And it’s not as though they have terrestrial or satellite. They only have satellite as a choice.”

One question the Times didn’t ask is whether increased capacity will mean the end of so-called “Fair Access Policies” that strictly ration the amount of browsing customers can manage before the speed throttle punishment begins. Neither company is saying.

“When pigs fly,” Adele thinks. “Sometimes these satellite companies think rural people are just plain stupid. When you live this far out in the country, you learn to recognize snake oil salesmen when you see them. Why give us more access when nobody else will provide the service?”

The sudden interest in satellite broadband in the nation’s paper of record is no coincidence. Both HughesNet and WildBlue are upset they are not getting a bigger piece of the broadband stimulus pie. The Times notes just $100 million out of $2.5 billion in U.S. Department of Agriculture grants for rural broadband will go to satellite companies. Raising the question in a newspaper widely read in Washington can’t hurt your cause.

Thomas E. Moore, chief of WildBlue, said satellite technology would be able to serve thousands more rural residents than terrestrial services at a fraction of the cost. He cited a $28 million grant to a nonprofit group in North Carolina to extend fiber to 420 schools and libraries. That same grant could have instead directly served 70,000 residents in North Carolina through satellite service, Mr. Moore said.

“For every one of those people, there are literally hundreds more who won’t have access to stimulus funds,” he said.

But Joseph Freddoso, president of MCNC, the nonprofit group that manages North Carolina’s public education technology network, said satellites were not an ideal primary service for his users, who require a more reliable network for their research and data-heavy applications.

“To compare what we do with what satellite does as a service is an apples-to-oranges comparison,” Mr. Freddoso said, adding that the grant will serve one million students in 37 counties.

Adele is concerned that means even more people will fight for the limited resources satellite has until the next generation of satellites get launched, especially for rural customers trying to share a spot beam in North Carolina.

“These companies have really stopped heavily promoting themselves in parts of rural America because both are already at or over capacity in many places,” she says. “The advertised speeds for some parts of the country are straight out of Alice in Wonderland — total fiction, and with the lag time that comes naturally from sending and receiving data over a distance of 22,000 miles, it’s not getting any better.”

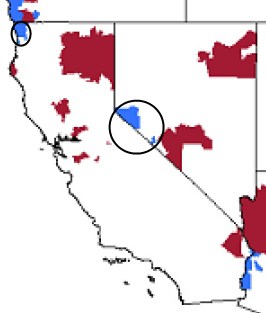

Adele is referring to the satellite providers’ regionally-directed signals. Much like how satellite TV companies can deliver local stations within limited regions of the country, satellite Internet service can be divided up and delivered to certain parts of the United States. One beam might serve rural Louisiana, another could be directed to northern California, and so on. Once a region’s capacity nears saturation, speed and performance suffers. In areas where capacity remains underused, the service performs better.

Adele is referring to the satellite providers’ regionally-directed signals. Much like how satellite TV companies can deliver local stations within limited regions of the country, satellite Internet service can be divided up and delivered to certain parts of the United States. One beam might serve rural Louisiana, another could be directed to northern California, and so on. Once a region’s capacity nears saturation, speed and performance suffers. In areas where capacity remains underused, the service performs better.

Regardless of the promises for enhanced satellite broadband, most cable and fiber broadband providers spend no time pondering the competitive impact, because there is none. They plan to continue ignoring the likes of WildBlue and HughesNet for years to come.

Kevin Laverty from Verizon told the Times their FiOS fiber network is expensive to deploy but is light years ahead of satellite when it comes to speed and easy upgrades.

“Fiber optic is virtually an unlimited technology,” he said. “All you have to do is change the electronics on either end.”

A spokesman for Time Warner Cable said cable broadband speeds already easily exceed the satellite providers’ proposed new speeds, so they have nothing to worry about.

For most satellite customers, WildBlue and HughesNet are not choices, they are realities if rural Americans want to participate in the broadband revolution.

“Nobody chooses these satellite providers over DSL, cable, fiber, or even most wireless ISPs,” Adele says. “They choose satellite because of the absence of these other providers.”

Should Adele’s local phone company offer her DSL or a wireless broadband provider arrive to deliver service, would she switch away from HughesNet?

“In a shot,” she says. “I dream about throwing their dish into the biggest bonfire I can build and then my neighbors and I visit their headquarters to horse-whip them for years of horrible service and throttled speeds.”

[flv width=”640″ height=”500″]http://www.phillipdampier.com/video/Satellite Fraudband.flv[/flv]

We’ve assembled some examples of advertising for both HughesNet and WildBlue, typically seen on networks catering to rural Americans, a brief interview with a representative from WildBlue, and some actual customer… uh… “testimonials” about the quality of service actually received. Finally, we’ve included the most painful speed test ever encountered. The original video was silent and some might think it’s actually stuck. It’s not. We’ve added some music to spice things up or to increase your pain and suffering. You might want to get a piece of cake for this. Oh, and one last thing: If you are using a satellite provider to access Stop the Cap!, forget about the video. Watching it will eat almost a quarter of your daily usage allowance. (6 minutes)

Subscribe

Subscribe