AT&T has sent the Federal Communications Commission a bait and switch checklist that, despite the stated purpose of modernizing telecommunications networks, would also allow the company to completely abandon its landline network and win near-complete deregulation of its broadband service.

AT&T has sent the Federal Communications Commission a bait and switch checklist that, despite the stated purpose of modernizing telecommunications networks, would also allow the company to completely abandon its landline network and win near-complete deregulation of its broadband service.

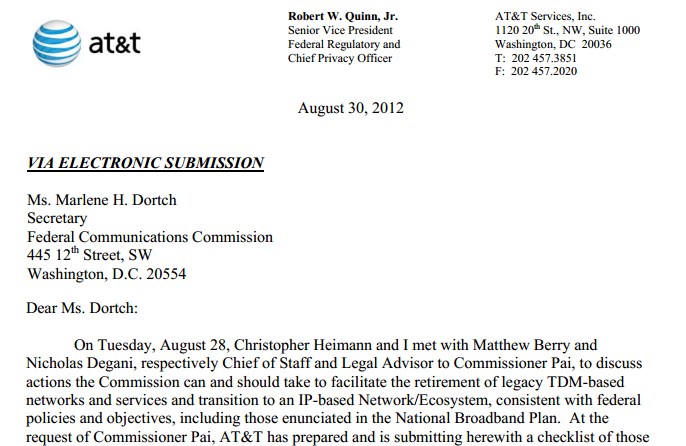

On Tuesday, August 28, Christopher Heimann and I met with Matthew Berry and Nicholas Degani, respectively Chief of Staff and Legal Advisor to Commissioner Pai, to discuss actions the Commission can and should take to facilitate the retirement of legacy TDM-based networks and services and transition to an IP-based Network/Ecosystem, consistent with federal policies and objectives, including those enunciated in the National Broadband Plan.

At the request of Commissioner Pai, AT&T has prepared and is submitting herewith a checklist of those actions, which identifies the critical first steps the Commission should undertake without delay to begin the transition as well as additional steps that would facilitate completion of that transition.

Under the existing statutory and regulatory framework, carriers already can undertake the steps necessary to make the transition, including, in some cases, steps requiring Commission approval (such as withdrawing legacy TDM-based services). But, insofar as the transition raises a number of novel and likely contentious issues, Commission action on the items included on the attached list would greatly facilitate and thus hasten completion of the transition. The steps we identify implicate an array of issues raised in the above-referenced dockets. Accordingly, we are filing the checklist in each such docket.

Respectfully submitted,

Robert W. Quinn, Jr.

AT&T’s letter and attached checklist are documents only a policy wonk or careful observer of Big Telecom could easily navigate. Despite the thicket of opaque terms like “TDM” and the not-immediately-apparent importance of the difference between an “information service” and a “telecommunications service,” AT&T has, to borrow a phrase from President Obama, some brass ones making its intentions perfectly clear.

With the help of Bruce Kushnick, executive director of New Networks Institute and a former telecom industry insider, we will guide you through AT&T’s filing and what it really means.

AT&T lists several “critical first steps” (we have put them in bold) to achieve the transition to an all-IP telecom world, retiring the traditional “public switched telecommunications network” (PSTN) which you know better as a landline.

1. Establish a date certain for an official TDM-services sunset, after which no carrier would be required to establish and maintain TDM-based services/networks, and purchasers of such services (including circuit-switched and dedicated transmission services) would have to switch to IP or other packet-based services.

No casual observer of FCC filings would be expected to understand the implication of setting a date to officially sunset “TDM services.” TDM is synonymous with the landline network Ma Bell established more than 100 years ago — the one that gives you a dial tone, DSL, and access to dial-up Internet where broadband is unavailable. AT&T wants the FCC to manage what the company has not been able to consistently accomplish on the state level: setting a final date when traditional landline service can be permanently disconnected, preferably at the convenience of the phone company.

2. Clarify that any state requirements forcing service providers to maintain TDM networks and services […] following the TDM sunset are preempted. Such requirements could deter investment in broadband, and thus are inconsistent with and pose an obstacle to federal law and policies encouraging the transition to all IP networks and services.

This provision would effectively eliminate any existing state laws or regulations that require AT&T to deliver a fairly-priced, well-run landline service for customers throughout its service area. Some states have not bought into AT&T’s lobbying juggernaut, often delivered with the help of the American Legislative Exchange Council (ALEC). Despite the enormous sums spent lobbying legislators, some states have kept oversight in place requiring AT&T to serve everyone that wants phone service. With this provision, those state laws and regulations would be pre-empted.

AT&T claims state requirements somehow deter broadband investment, a curious conclusion considering AT&T has already largely ceased its expansion of DSL and U-verse services.

3. Complete action in the IP-enabled services proceeding, and classify such services as information services, subject to minimal regulation only at the federal level. The Commission could permit service providers to offer DSL or other broadband transmission services on a common carrier basis if they so choose, but in no event should a provider be required to do so.

Quinn

This is AT&T’s provision to kill regulation and destroy competition. Government rules, regulations, and oversight apply largely to “PSTN” landline services, not to IP-based or broadband networks. Basic landline service is designated a “telecommunications service” by the FCC, which makes it subject to regulator review. Broadband, on the other hand, and anything else using IP, is typically classified as an “information service,” where most oversight regulations do not apply.

AT&T’s plan is to shut down today’s landline “telecommunications” service in favor of IP-based Voice over IP, which would effectively reclassify your phone line as an “information service.” That means by changing just one word — “telecommunications” to “information” — AT&T can walk away from a century of basic consumer protection rules and regulations. AT&T also gets a divorce from its telecommunications service obligations as a “common carrier,” which requires AT&T to deliver service to any customer who requests it, at a fair and reasonable price, without changing its form or content.

If AT&T’s broadband networks were reclassified as a “telecommunications service,” Net Neutrality would be easy to enforce under the “without changing its form or content” provision of common carrier rules. Back in the 1996 Telecommunications Act, AT&T’s lobbyists had already made their mark, creating new “distinctions” of telecommunications services, some more regulated than others. Now AT&T is back to kill off the last regulatory obligations it still has to endure, taking Net Neutrality to the grave once and for all.

4. Reform Interconnection – after the official date for the TDM sunset, no carrier or other provider of TDM based services should be entitled to require others to interconnect in TDM. The Commission should take action to maintain the market-based, regulation-free interconnection regime that has applied to IP-based interconnection for decades.

[…] Reform wholesale obligations under section 251/271 to eliminate unbundling, resale, collocation and other requirements that could require ILECs to maintain TDM networks and services.

These particularly opaque sections give AT&T’s competitors real nightmares because they would wipe out requirements that phone companies open certain facilities to competitors who deliver services over AT&T’s network. If AT&T’s recommendation is adopted, no competitor would be safe if AT&T eventually padlocks access to its network.

But AT&T does not want its intentions to be that obvious. It throws a transparent bone to regulators to offer a facade of competition in both this and the preceding recommendation.

AT&T instructs the FCC it can mimic the time-honored patina of an open, competitive industry by allowing AT&T’s competitors to sell DSL or other broadband services over AT&T facilities, but only if AT&T feels like it (at comfortable prices that don’t undercut AT&T).

5. Eliminate regulatory underbrush/superstructure that accompanies TDM-based services. For example, phase out equal access, residual ONA/CEI, record-keeping, accounting, guidebook, dialing parity, payphone, and data collection (which should be limited to that which is collected on the Commission’s Form 477) requirements.

AT&T leaving town.

What AT&T calls “underbrush,” consumers and regulators call oversight and consumer protection.

“Sayonara any telco rules, regulations and oh yes, your rights,” says Bruce Kushnick. “Your service breaks… tough. Prices go up and there’s no direct competition — too bad. Networks weren’t upgraded — so what.”

Kushnick notes this provision would allow AT&T to avoid maintaining a public record of its performance (and its potential abusive practices, bad service, and high prices), including any requirement on the state or federal level to tell the public anything about how well we are being served by the wired monopoly.

Other things on AT&T’s hit list: “Equal Access,” which opened the door to competitive long distance calling and lower rates, “Dialing Parity” which lets you avoid dialing ten (or more) digits for every call (or being forced to learn more complicated numbers for things like directory assistance or other shortened dialing numbers), and public payphones. AT&T’s desire to kill off “residual ONA” refers to the costs to establish Open Network Architecture — the framework for opening up the nation’s phone monopoly for competition. Re-establish the monopoly and there is no reason to fret about the costs to maintain access for competitors AT&T will eventually eliminate.

6. Further reform USF to provide support for broadband regardless of the regulatory classification of broadband services, eliminate any obligation to offer such services on a common carriage basis to be eligible for such support, and provide incentives for service providers to invest and offer services necessary to ensure that no one is left behind by the transition to an all-IP, broadband ecosystem.

The reform of the Universal Service Fund has already opened up opportunities for rural telecommunications companies to apply for broadband infrastructure grants to expand broadband in rural America. Only AT&T has refused to participate in the current round of broadband grants because they do not like the rules. AT&T wants a free hand to receive broadband funding, so long as it faces no questions about where the money gets spent. Under AT&T’s recommendation, the company would receive money with no obligation to ensure everyone who wants broadband in rural America can get it. It also wants the government to hand out money to providers to implement their goal of regulatory nirvana — the conversion of basic landline service to Voice over IP, idolized as the golden calf of ultimate deregulation.

But although providers won’t be left behind, consumers might be:

7. Establish/reform rules to facilitate migration of customers from legacy to IP-based services and to prevent customers that procrastinate or fail to migrate from holding up the transition. For example, establish a process for identifying a default service provider if a customer fails to migrate, and/or permit service providers to notify customers that they will be dropped from service as of a date certain if they have not migrated to an alternative service/service provider.

This particularly arrogant provision would put a stop to Aunt Maude holding up AT&T’s grand plan to live a regulation-free lifestyle. How dare she drag her feet with AT&T’s agenda at stake? If your elderly parents or extended family don’t understand why AT&T is meddling with their landline service and don’t want to change, AT&T has an unsympathetic solution. Under their recommendation, your parents would find themselves with a “default service provider” they might not want to do business with or, even worse, simply leave them with a dead phone line AT&T has no interest in repairing. But AT&T would likely still get their way. In rural areas they already cover, AT&T would be the “default service provider” because it is the only service provider. If Maude wants her phone line back, the only way she will get it is choosing the migration to Voice over IP AT&T intended all along.

This particularly arrogant provision would put a stop to Aunt Maude holding up AT&T’s grand plan to live a regulation-free lifestyle. How dare she drag her feet with AT&T’s agenda at stake? If your elderly parents or extended family don’t understand why AT&T is meddling with their landline service and don’t want to change, AT&T has an unsympathetic solution. Under their recommendation, your parents would find themselves with a “default service provider” they might not want to do business with or, even worse, simply leave them with a dead phone line AT&T has no interest in repairing. But AT&T would likely still get their way. In rural areas they already cover, AT&T would be the “default service provider” because it is the only service provider. If Maude wants her phone line back, the only way she will get it is choosing the migration to Voice over IP AT&T intended all along.

AT&T’s language is remarkably frank, but was never intended to be viewed and explained to the public at large. It was the product of a phone company lobbyist talking to a politician, staffer, or regulator that one day could become an employee of that phone company. The only way to stop this cozy relationship is to tell regulators you are watching (and understanding) the game being played here.

Subscribe

Subscribe