One of the “benefits” AT&T’s lobbying team claims will come with a merger between AT&T and T-Mobile is improved wireless service for rural America.

One of the “benefits” AT&T’s lobbying team claims will come with a merger between AT&T and T-Mobile is improved wireless service for rural America.

But an investigation into T-Mobile’s urban-focused coverage, and AT&T’s own recent rural past prove those claimed benefits simply don’t make any sense.

Although rural and small town America is increasingly aware of AT&T, that comes mostly from the company’s recent acquisitions, not from mass expansion projects to blanket rural America with AT&T iPhones. AT&T has been on a shopping spree for smaller regional wireless carriers for the last five years, picking up resources through acquisition, not from independent investment. But a buyout of T-Mobile will bring no new assets for AT&T’s presence in rural America. It will simply reduce competition in larger communities the same way AT&T cut out competitors in rural markets.

Just ask customers of Dobson Cellular. In 2007, AT&T bought the rural provider, doing business as Cellular One, for $2.8 billion dollars and converted customers to AT&T. Dobson was the largest cell phone company around in Alaska and rural Michigan. In fact, the company provided roaming capability to customers of AT&T and T-Mobile who ventured into the rural areas Dobson specialized in serving.

After the conversion, did service improve for the newly acquired AT&T customers?

“No way,” says ex-Cellular One customer Jim Duncan who lives in a former Dobson service area in Michigan. “AT&T ruined cell phone service when they got here with dropped calls and phantom busy signals, turning a friendly local-focused company into one where you are just an account number reaching some national call center.”

Duncan says AT&T never cared one bit about rural Michigan before buying Dobson, and in his view, still doesn’t.

“Smaller markets are an afterthought for AT&T and T-Mobile has zero impact (and customers) in my area, so I have no idea what great improvements a merger will bring to our part of Michigan that neither company paid much attention to,” Duncan says.

That same year, AT&T also grabbed spectrum worth $2.5 billion with its acquisition of Aloha Partners, which spent time at FCC auctions buying up 700Mhz spectrum and then eventually reselling it at a profit to wireless carriers. AT&T didn’t just buy some of Aloha’s spectrum, it acquired the whole partnership.

In April 2008, Edge Wireless customers in southern Oregon, northern California, southeastern Idaho and Jackson, Wyoming discovered they were well on their way to becoming AT&T customers, too. AT&T acquired Edge and rebranded it AT&T. That hardly represents investment and dedicated expansion into rural Rocky Mountain states — AT&T simply bought up another company that did.

Also in 2008, AT&T snapped up Centennial Communications, a considerable-sized regional player in the central United States. Centennial delivered service in less urban areas in Indiana, Ohio, and Michigan in the north, and Louisiana, Texas, and Mississippi in the south. One million customers, Centennial’s spectrum and name all became part of AT&T. Did service improve for Centennial customers with that merger?

“Overall, it stayed the same when it was Centennial and switched to AT&T,” says our reader Kevin, who now lives in Ft. Wayne, Ind. “We did get access to the iPhone, but along with it came AT&T’s infamous dropped calls and lousy customer service.”

Kevin switched to Verizon Wireless earlier this year.

“If I was the FCC, I wouldn’t approve this merger because it promises nothing for rural America or anyone else,” says Kevin. “AT&T had a presence in Indiana before they bought Centennial, so all the deal did was reduce competition in this state.”

Centennial’s service areas were not exactly among T-Mobile’s priority coverage areas, either.

“T-Who?,” Kevin asks. “We’re aware of them now, but I don’t know anyone who has service with them.”

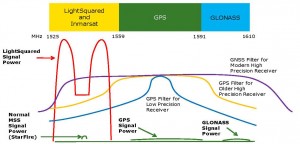

The real unanswered question is what AT&T is doing with all of the rural spectrum it already owns, controls, or has acquired. How will an acquisition of an urban-focused carrier help deliver improved service in the rural markets both companies have traditionally ignored?

Answer: It won’t.

[flv width=”480″ height=”380″]http://www.phillipdampier.com/video/WANE Ft Wayne Centennial Joins ATT 10-09 and 02-10.flv[/flv]

WANE-TV in Ft. Wayne, Ind., covered the merger of Centennial and AT&T back in 2009 and early 2010. Fort Wayne was the home of a major regional office for Centennial. (4 minutes)

Subscribe

Subscribe