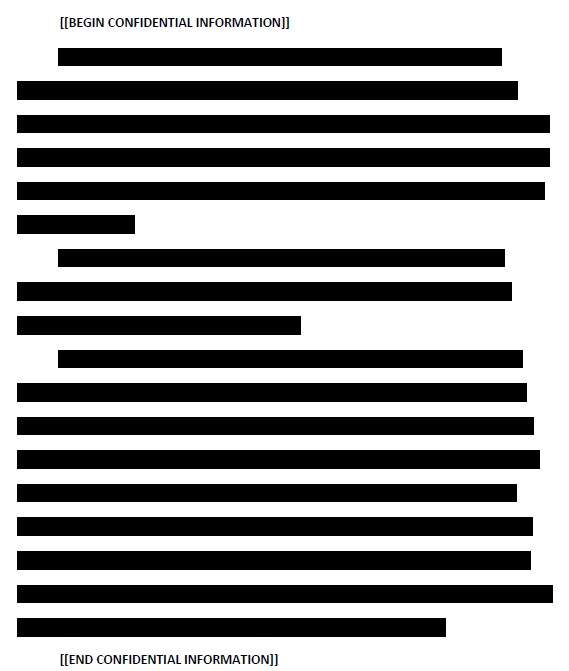

Verizon gets out the black marker to redact information it considers “confidential.”

The New York Public Service Commission Monday rejected most of Verizon’s request to keep secret the state of its landline network and details about the company’s plans to distribute Voice Link as an optional wireless landline replacement in the state.

Nearly two months after Verizon announced it was abandoning its original plan to replace defective landlines on Fire Island with Voice Link, Verizon is bristling over a Freedom Of Information Law (FOIL) request from consumer advocates and a union for disclosure of reports filed with the PSC regarding Verizon’s network and its upkeep — information the company considers confidential trade secrets. To underline that belief, Verizon provided the PSC with edited versions of documents it filed with the state considered suitable for public disclosure, one consisting of 330 pages of blanket redactions except for the page headings and page numbers.

“[These discovery requests] are designed solely to advance the Communications Workers of America’s self-serving efforts to prevent Verizon from offering its Voice Link product, even on an optional basis, and to investigate the relationship between Verizon and Verizon Wireless — matters that are beyond the scope of this or any other pending Commission proceeding,” wrote Verizon deputy general counsel Joseph A. Post. “On September 11, 2013, Verizon announced that it had decided to build out a fiber-to-the-premises (“FTTP”) network on western Fire Island, and targeted Memorial Day 2014 for the completion of construction and the general availability of services over the new network.”

The PSC disagreed with Post, ruling the majority of documents labeled “confidential” by Verizon were, in fact, not.

“[…] The information claimed by Verizon to be trade secrets or confidential commercial information does not warrant an exception from disclosure and its request for continued protection from disclosure is denied,” ruled Donna M. Giliberto, assistant counsel & records access officer at the Department of Public Service.

Verizon has until Nov. 14 to file an appeal.

Common Cause New York, the Communications Workers of America-Region 1, Consumers Union, the Fire Island Association, and Richard Brodsky used New York’s public disclosure laws to collectively request documents shedding light on their suspicion Verizon has systematically allowed its landline facilities to deteriorate to the point a wireless landline substitute becomes a rational substitute. They also suspect Verizon diverted funds intended for its landline network to more profitable Verizon Wireless.

“In spite of its obligations under New York law, in spite of the investment by ratepayers in the FIOS wireline system, in spite of the needs and expectations of the people, businesses and economy of the state, Verizon is intending to and has begun to shut down its wireline system,” declared the groups.

Many involved took note of Stop the Cap!’s report in July 2012 that warned then-CEO Lowell McAdam had plans to decommission a substantial part of Verizon’s copper landline network, especially in rural areas, where it intended to replace it with wireless service:

“In […] areas that are more rural and more sparsely populated, we have got [a wireless 4G] LTE built that will handle all of those services and so we are going to cut the copper off there,” McAdam said. “We are going to do it over wireless. So I am going to be really shrinking the amount of copper we have out there and then I can focus the investment on that to improve the performance of it. The vision that I have is we are going into the copper plant areas and every place we have FiOS, we are going to kill the copper. We are going to just take it out of service and we are going to move those services onto FiOS. We have got parallel networks in way too many places now, so that is a pot of gold in my view.”

“In […] areas that are more rural and more sparsely populated, we have got [a wireless 4G] LTE built that will handle all of those services and so we are going to cut the copper off there,” McAdam said. “We are going to do it over wireless. So I am going to be really shrinking the amount of copper we have out there and then I can focus the investment on that to improve the performance of it. The vision that I have is we are going into the copper plant areas and every place we have FiOS, we are going to kill the copper. We are going to just take it out of service and we are going to move those services onto FiOS. We have got parallel networks in way too many places now, so that is a pot of gold in my view.”

Some consumer groups suspect Fire Island represented an opportunity to test regulators’ tolerance for a transition away from copper landlines in high cost service areas. As Stop the Cap! reported this summer, New Yorkers soundly rejected Verizon Voice Link, with more than 1,700 letters opposing the wireless service and none in favor on record at the PSC.

In early September, a well-placed source in Albany told Stop the Cap! Verizon’s request to substitute Voice Link where it was no longer economically feasible to maintain landline infrastructure was headed for rejection after a constant stream of complaints arrived from affected customers. Verizon suddenly withdrew its proposal on Sept. 11 and announced it would bring FiOS fiber optics to Fire Island instead.

Although Verizon now insists it will only offer Voice Link as an optional service for New York residents going forward, public interest groups still believe Verizon has allowed its landline network to deteriorate to unacceptable levels.

Verizon originally claimed 40% of its facilities on Fire Island were damaged beyond repair when they were assessed after Hurricane Sandy. But residents claim some of that damage existed before the storm struck last October. Some fear Verizon is engaged in a self-fulfilling prophecy, allowing its unprofitable copper wire facilities to fall apart and then point to the sorry state of the network as their principle argument in favor of a switch to wireless service.

Herding money, resources, and customers away from landlines to Verizon Wireless

“In fact, the vast majority of defective lines are a consequence of the failure and refusal of Verizon to maintain and repair the system over time,” the groups assert. “The Commission must make a factual determination of the cause of the 40% defect allegation as part of this proceeding. If, as asserted herein and elsewhere, the evidence shows a pattern of inadequate repair, maintenance and capital investment, the Commission can not and should not approve any loss of wireline service to any customer, as matters of law and sound policy.”

“We assert that Verizon has systematically misallocated costs thereby distorting the extent to which the wireline system has suffered losses, if any. […] It is fair to say that substantial losses in the landline system are repeatedly used by the Commission and the Company as a justification for rate increases and regulatory decisions affecting the scope, cost, adequacy and nature of telephone service provided to customers of Verizon NY.”

Verizon would seem to confirm as much.

In 2012, Verizon’s chief financial officer Fran Shammo told investors the company was diverting some of the costs of Verizon Wireless’ upgrades by booking them on Verizon’s landline construction budget.

“The fact of the matter is wireline capital — and I won’t get the number but it’s pretty substantial — is being spent on the wireline side of the house to support the wireless growth,” said Shammo. “So the IP backbone, the data transmission, fiber to the cell, that is all on the wireline books but it’s all being built for [Verizon Wireless].”

Funds diverted for Verizon Wireless’ highly profitable business were unavailable to spend on Verizon’s copper wire network or expansion of FiOS. In 2011, Verizon diverted money to deploying fiber optics to 1,848 Verizon Wireless cell towers in the state. In 2012, Verizon deployed fiber to an extra 867 cell tower sites in New York and Connecticut. Public interest groups assert the costs for these fiber to the cell tower builds were effectively paid by Verizon’s landline and FiOS customers, not Verizon Wireless customers.

Since 2003, Verizon has been subject to special attention from the New York Public Service Commission because of an excessive number of subscriber complaints about poor service. As early as a decade ago, the PSC found Verizon’s workforce reductions and declining investment in its landline network were largely responsible for deteriorating service. Each month since, Verizon must file reports on service failures and its plans to fix them.

Since 2003, Verizon has been subject to special attention from the New York Public Service Commission because of an excessive number of subscriber complaints about poor service. As early as a decade ago, the PSC found Verizon’s workforce reductions and declining investment in its landline network were largely responsible for deteriorating service. Each month since, Verizon must file reports on service failures and its plans to fix them.

In September alone, Verizon reported significant failures in service in rural areas upstate, almost entirely due to the weather:

- Heuvelton: A summer filled with significant thunderstorms resulted in downed poles and service disruptions. Verizon reported the central office serving the community was in jeopardy in June. By mid-July, 7% of customers reported major problems with their landline service.

- Amber: Nearly 11% of customers were without acceptable service in May because a 100-pair cable serving many of the community’s 274 customers was failing.

- Chittenango: Nearly 9% of the community’s 1,059 landline customers had significant problems with service because Verizon’s central office switching system in the exchange was failing.

- Sharon Springs: Almost 11% of Verizon’s customers in this small rural office of 417 lines were knocked out of service in July.

- Elenburg Dept.: More than 8% of Verizon’s 324 lines in this rural Adirondack community were out of service, usually as a result of a thunderstorm passing through.

- Hartford: When it rains hard in this Adirondack community, landline service fails for a substantial number of customers. In September, 2.43 inches of rain left 12.4% of customers with dysfunctional landline service.

- Valley Falls: Nearly one-third of Valley Falls’ 722 landlines were out of service in September after lightning hit several Verizon telephone cables. Problems only worsened towards the end of the month.

- Kendall: Almost 9% of Verizon customers in the Rochester suburb of Kendall were without service after a rain and wind storm. When a cold front moves through the community, landlines service is threatened.

- Bolivar: More than 20% of customers lost service July 19th after heavy rain, winds, and power outages hit.

- Cherry Valley: Verizon blamed seasonal service outages in Cherry Valley on farmers that dig up or damage buried telephone cables. More than 7% of customers were knocked out by harvested phone lines in July.

- Edmeston: More rain, more service outages for the 801 landlines in this small community in area code 607. More than 13.5% of customers called in with complaints in July. Verizon blamed heavy rain.

- Clinton Corners: Service failures come after nearly every heavy rainfall due to multiple pair cable failures in the aging infrastructure. More than 9% of customers reported problems in June, 13.2% in July, 8.2% in August, and 12.5% in September.

Verizon’s landline trouble reports disproportionately come from rural communities, exactly those Verizon’s former CEO proposed to serve by wireless. Weather-related failures are often the result of deteriorating infrastructure that results in outages, especially when moisture penetrates aging cables. Rural communities are also the least-likely to be provided fiber service, exposing customers to a larger percentage of the same copper wiring critics charge Verizon is allowing to deteriorate.

Subscribe

Subscribe

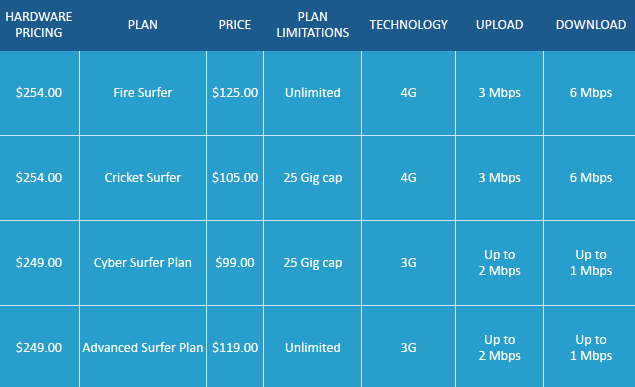

Millenicom customers have had their ups and downs over the last two weeks coping with e-mail notifications they would lose, keep, and once again lose their unlimited wireless data plan.

Millenicom customers have had their ups and downs over the last two weeks coping with e-mail notifications they would lose, keep, and once again lose their unlimited wireless data plan. We will be shipping out Hotspot devices to those clients who had opted for that solution and BMI.net is ready to fulfill orders for those choosing to go with them.

We will be shipping out Hotspot devices to those clients who had opted for that solution and BMI.net is ready to fulfill orders for those choosing to go with them. Blue Mountain Internet (BMI) offers an “unlimited plan” that isn’t along with several usage allowance plans. BMI strongly recommends the use of their Mobile Broadband Optimizer software that compresses web traffic, dramatically improving speeds and reducing consumption:

Blue Mountain Internet (BMI) offers an “unlimited plan” that isn’t along with several usage allowance plans. BMI strongly recommends the use of their Mobile Broadband Optimizer software that compresses web traffic, dramatically improving speeds and reducing consumption: There is a $100 maximum on overlimit fees, but BMI reserves the right to suspend accounts after running 3-5GB over a plan’s allowance to limit exposure to the penalty rate. The compression software is for Windows only and does not work with MIFI devices or with video/audio streaming. BMI warns its wireless service is not intended for video streaming. Customers are not allowed to host computer applications including continuous streaming video and webcam posts that broadcast more than 24 hours; automatic data feeds; automated continuous streaming machine-to-machine connections; or peer-to-peer (P2P) file-sharing.

There is a $100 maximum on overlimit fees, but BMI reserves the right to suspend accounts after running 3-5GB over a plan’s allowance to limit exposure to the penalty rate. The compression software is for Windows only and does not work with MIFI devices or with video/audio streaming. BMI warns its wireless service is not intended for video streaming. Customers are not allowed to host computer applications including continuous streaming video and webcam posts that broadcast more than 24 hours; automatic data feeds; automated continuous streaming machine-to-machine connections; or peer-to-peer (P2P) file-sharing.

Wireless ‘n Wifi

Wireless ‘n Wifi