Gov. Andrew Cuomo discusses his rural broadband initiative in New York.

Despite repeated assurances that 98% of New Yorkers now have access to high-speed internet, rural New Yorkers from the state’s border with Massachusetts to farm country outside of Niagara Falls don’t believe it. Now New York’s Comptroller, Thomas P. DiNapoli, is auditing the half-billion dollar program to determine where the money went and where broadband service is now available.

A source told WGRZ-TV in Buffalo that an audit of Gov. Andrew Cuomo’s “Broadband for All” program was initiated by the Comptroller’s office back in March 2020 after rural residents and the lawmakers that represent them began complaining the program never delivered on its commitments. WGRZ Reporter Nate Benson notes that what may have started as a routine audit may now be under additional scrutiny because of the impact of the COVID-19 pandemic, which forced many New Yorkers online for work and learning from home.

The broadband program, introduced with great fanfare by the governor in 2015, promised that every New Yorker that wanted high speed internet (at least 25 Mbps in rural areas, 100 Mbps in urban communities) would have access by the end of 2018. The governor claimed the state earmarked $500 million — mostly proceeds from legal settlements with large New York City banks accused of criminal activity surrounding the Great Recession — towards the program, with dollar for dollar matching from companies awarded grants to expand internet access in specific areas.

Benson noted that publicly available data on the N.Y. Broadband Program Office website found a significant shortfall in private investment dollars, with only four out of 53 internet service providers awarded grants matching or exceeding the amounts they received from the state broadband fund. In short, they accepted generous subsidies without being equally generous with their own money.

DiNapoli

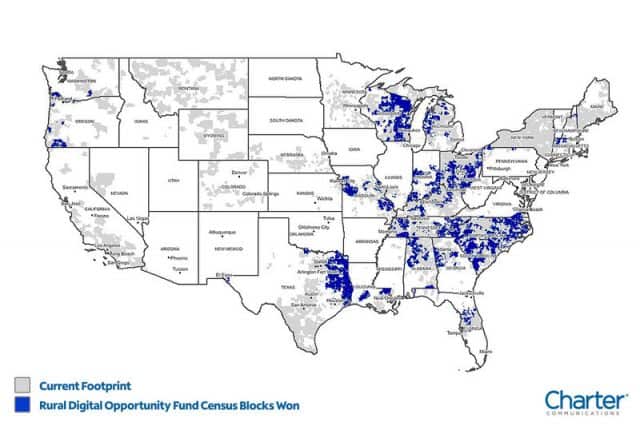

The program used a reverse auction approach to award state broadband funding. Phone, cable, and wireless providers bid to serve one or more of the 256,000 “census blocks” the state identified as lacking access to high-speed internet. Most companies chose the most densely populated census blocks next to their existing service areas, assuring higher profits while the state paid a significant amount of the construction costs. In the end, 76,000 census blocks in very rural, sparsely populated areas least likely to get broadband service attracted no bids at all. To achieve the state’s vaunted “98% served,” officials signed a contract with a satellite internet provider to service the remaining 30% of rural New Yorkers left behind, despite the fact satellite internet providers had a reputation for not meeting subscriber expectations and rarely guaranteed consistent minimum broadband speeds of 25 Mbps. Hughes Satellite provides the service, but our readers using the service warn it comes with a stingy data cap inadequate for today’s average household usage. Speeds are wildly inconsistent as well, often way below 25 Mbps.

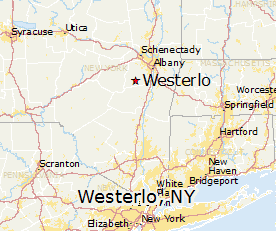

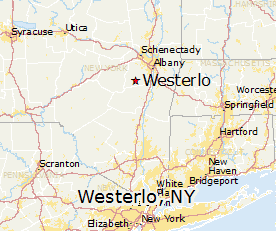

Even with satellite internet as an option, New Yorkers continue to tell Stop the Cap! they are still without access, including satellite, even in communities just a few miles outside of major cities like Albany, the state capital. The true scope of the problem became apparent last spring as the coronavirus pandemic emerged, forcing employers to send workers home and schools switched to online learning.

Westerlo, N.Y.

The Berne Knox Westerlo School District, located in the hill towns of Albany County, quickly realized there was a wide gap between the state’s “98% covered” claim and reality.

“We had about 28-30% of our student population without internet access or with very poor internet access.” Superintendent Dr. Timothy Mundell told WRGB News. The district tried stop-gap measures like parking Wi-Fi enabled school buses around the district and handing out Wi-Fi hotspot devices, which proved to work unevenly. Mundell says the only real solution to this problem is ubiquitous fiber to the home internet access, and that is a long way off.

“It concerns me because every day we’re without, my students have the potential of falling behind their peers down in the suburbs and the urban areas,” Mundell said. “So this is a real equity issue for us and we want to make sure rural areas get served.”

Two Republican lawmakers from Western New York also introduced a bill this year to repeal a 2019 state tax on optical fiber cable projects. Senators George Borrello and Pam Helming believe the tax will discourage fiber optic buildouts, especially in higher cost rural areas.

“The reality is that broadband is no longer a luxury this is a basic infrastructure need just like water sewer electric and roads, and without it we’re not going to be able to expand.” Sen. Borrello said.

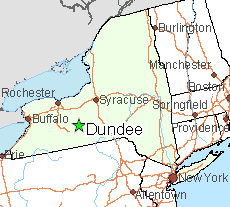

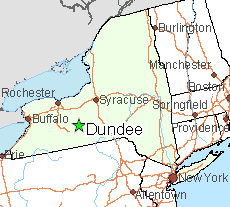

Dundee, N.Y.

But the biggest proponent of the law’s repeal, Verizon Communications, is also one of the telecommunications companies showing the least interest in expanding its fiber internet service in rural New York. Verizon is fighting the tax so it can save money on expanding its mobile 4G and 5G wireless networks, which are connected with fiber optic cables, not because it wants to expand FiOS fiber to the home service.

Meanwhile, New Yorkers without broadband remain stuck.

“It’s all a lot of empty promises with no sign of service,” Katy tells Stop the Cap! from her home near Dundee, in the Finger Lakes region of the state. “I’ve lived here since the days when the only phone line you could get was a party line shared with four other homes and I still have my rotary dial phone New York Telephone installed in 1965. These companies don’t want me to forget I am living in the past.”

Katy lives about 500 feet from the nearest address able to subscribe to Charter Spectrum and was quoted $9,000 to extend cable to her home, set far back from the main road. Verizon has never offered DSL in her neighborhood, because she is located too far away from the central office. Her property is set in a small forest, so satellite internet is not a possibility either.

“I can watch two channels over the air from Syracuse with my outdoor antenna, but that is all. I guess I prefer reading anyway,” she tells us.

WGRZ in Buffalo reports the New York State’s Comptroller’s Office is auditing Gov. Andrew Cuomo’s Broadband for All program, which guaranteed 98% of New Yorkers high-speed internet. (3:06)

Subscribe

Subscribe

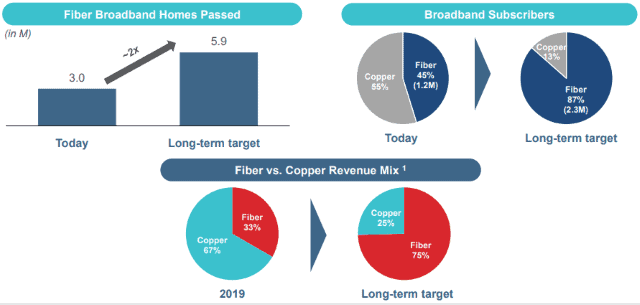

In 2021, the company announced it had “planning and engineering” underway for unspecified fiber to the home service upgrades in copper service areas “in select regions.” But most of Frontier’s fiber upgrades will take place over the next decade. Specifically, Frontier plans to wire up to 2.9 million homes with fiber using a combination of its own money and subsidy funds provided by the FCC. Frontier’s new owners have signaled they will not go out on a limb to finance rapid fiber upgrades, and you better live in a state where fiber upgrades are being given priority.

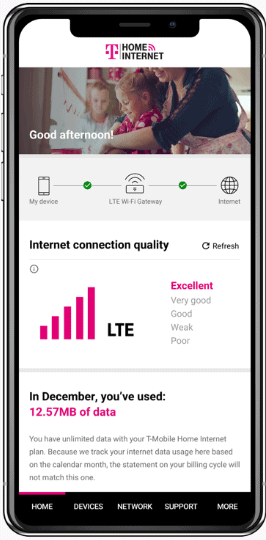

In 2021, the company announced it had “planning and engineering” underway for unspecified fiber to the home service upgrades in copper service areas “in select regions.” But most of Frontier’s fiber upgrades will take place over the next decade. Specifically, Frontier plans to wire up to 2.9 million homes with fiber using a combination of its own money and subsidy funds provided by the FCC. Frontier’s new owners have signaled they will not go out on a limb to finance rapid fiber upgrades, and you better live in a state where fiber upgrades are being given priority. T-Mobile is widening its wireless home broadband pilot program to cover more than 20 million additional underserved and unserved households in 130 communities in parts of nine states.

T-Mobile is widening its wireless home broadband pilot program to cover more than 20 million additional underserved and unserved households in 130 communities in parts of nine states.

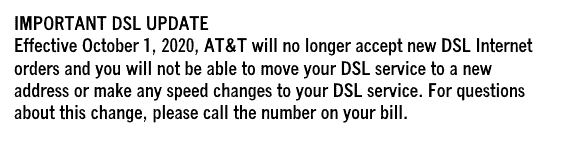

AT&T stopped accepting orders for traditional DSL service from customers across its landline service area on Oct. 1, and will no longer allow existing customers to change speeds or transfer DSL service if they move to a new address.

AT&T stopped accepting orders for traditional DSL service from customers across its landline service area on Oct. 1, and will no longer allow existing customers to change speeds or transfer DSL service if they move to a new address. Only AT&T’s DSL service has been discontinued. The company claims about a half million customers still get DSL service from AT&T as of the second quarter of 2020. Most don’t choose DSL by choice. It is often the only option, because the customer lives in a rural area where no other options for internet service exist. That may leave some new customers with no options for wired internet service at all.

Only AT&T’s DSL service has been discontinued. The company claims about a half million customers still get DSL service from AT&T as of the second quarter of 2020. Most don’t choose DSL by choice. It is often the only option, because the customer lives in a rural area where no other options for internet service exist. That may leave some new customers with no options for wired internet service at all.