America has a new second largest cable conglomerate with 17 million customers and a new name.

America has a new second largest cable conglomerate with 17 million customers and a new name.

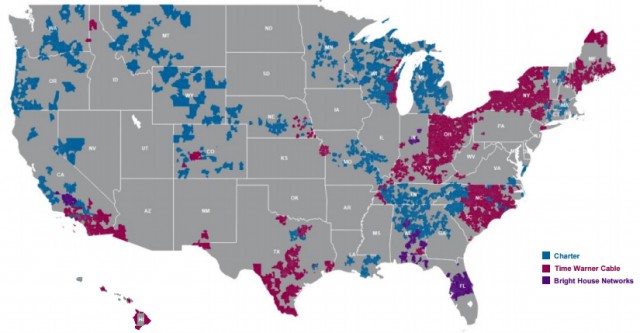

Charter Communications formally completed their $55 billion acquisition of Time Warner Cable and Bright House Networks today, creating a new cable giant that more closely rivals number one Comcast in size and scope.

The approval came despite warnings from a team at the FCC assigned to review the impact of the merger.

The Deal is Likely to Trigger an Abusive Money Party at the Expense of Customers… Merger Approved

“We conclude that the transaction will materially alter [Charter’s] incentives and abilities in ways that are potentially harmful to the public interest,” an FCC report about the impact of the merger states.

The FCC concluded the deal could become an enormous money-maker for Charter and its investors through the eventual metering of online usage. There are strong incentives, according to the FCC, for Charter “to impose data caps and usage-based prices in order to make watching online video more expensive, and in particular more expensive than subscribing to a traditional pay-TV bundle” after its voluntary commitment not to impose data caps expires.

Existing Charter customers warn this isn’t the cable company you are looking for.

The FCC is also certain Charter will enjoy considerable pricing power with its near broadband monopoly at speeds of 25Mbps or higher. That means one thing: substantial rate increases unchecked by competition.

Despite the gloomy prospects, FCC commissioners found a “compromise” that will impose consumer-friendly conditions on the merger, but will expire between 5-7 years from today. After that, in the absence of robust competition from a player like Google Fiber, it will be open season on broadband customers.

Consumer advocates were less than pleased.

“There’s nothing about this massive merger that serves the public interest. There’s nothing about it that helps make the market for cable TV and Internet services more affordable and competitive for Americans,” said Free Press president and CEO Craig Aaron. “Customers of the newly merged entity will be socked with higher prices as Charter attempts to pay off the nearly $27 billion debt load it took on to finance this deal. The wasted expense of this merger is staggering. For the money Charter spent to make this happen it could have built new competitive broadband options for tens of millions of people. Now these billions of dollars will do little more than line the pockets of Time Warner Cable’s shareholders and executives. CEO Rob Marcus will walk away with a $100 million golden parachute.”

![[Image: WSJ.com]](https://stopthecap.com/wp-content/uploads/2016/05/golden-parachute-640x426.jpg)

In fact, the golden parachutes will extend far beyond retiring Time Warner Cable CEO Rob Marcus. According to a regulatory filing, Marcus’ contract was written to allow him to sell the company and effectively be “terminated without cause,” which activates the equivalent of a Powerball Powerplay. Marcus will automatically qualify to receive several years’ worth of his original salary, expected bonuses, and compensation in stock for showing himself to the exit. That alone is expected to exceed $100 million. Marcus’ ancillary benefits also add up, and will be eventually disclosed in future filings with the Securities & Exchange Commission.

Marcus’ colleagues won’t leave empty-handed either. The chief operating officer and chief financial officer of Time Warner Cable could each get $32 million in compensation. The general counsel of Time Warner will retire with around $22 million and some mid-level executives could leave with around $18 million each.

Familar names on Wall Street will also enjoy proceeds worthy of Donald Trump Lotto. Everyone’s favorite financial casino Goldman Sachs is sitting pretty with millions in fees advising Charter on both its acquisitions of Bright House and Time Warner Cable. UBS helped lead the financing of the whopping $55 billion deal on behalf of Charter and is the sole financial adviser to Advance/Newhouse, which owns Bright House. That means big bucks for the Swiss bank.

The Small Swallow the Big

The Small Swallow the Big

Charter was a much smaller, and not well-regarded cable company before it financed the acquisition of two of its non-competing rivals. In fact, Time Warner Cable was already the country’s second largest cable operator before the acquisition, and Charter will have to contend with managing a cable operator much larger than itself. Charter executives have hinted it will take many months to manage that transition, with the eventual retirement of both the Time Warner Cable and Bright House brands, in favor of Charter and its Spectrum product suite.

Those not already Charter customers will be subjected to a publicity campaign to manage the introduction of Charter in the best possible light, despite the fact current Charter customers rate the cable operator as mediocre in consumer surveys. Its reputation is well-known, especially in the middle of the country where many Charter systems operate.

Charter will continue to be led by CEO Thomas Rutledge, who will also hold the titles of president and chairman of the board. But the man behind-the-scenes expected to have a substantial amount of influence in how Charter is run in the future is ex-Tele-Communications, Inc. (TCI) CEO Dr. John Malone through his entity Liberty Broadband, which will control three seats on Charter’s board of directors, including one for Malone himself. Malone advocated for Rutledge to become CEO of Charter after the cable company emerged from bankruptcy reorganization in 2009.

How to Remake Your Image: Change the Name

How to Remake Your Image: Change the Name

Renaming Time Warner Cable isn’t likely to fix the scandalously low regard its customers hold the company. But it couldn’t hurt either.

“It’s not surprising Charter wants to rebrand Time Warner Cable,” said David VanAmburg, managing director of the American Customer Satisfaction Index, which regularly rates Time Warner Cable (and often Comcast trading places) the worst companies in the country. “Charter has scored better than Time Warner Cable in recent years, so it could bode well for Time Warner Cable customers. But the data suggests leaps-and-bounds improvement could be difficult.”

ACSI graded Charter 57 in 2015. Time Warner Cable managed a 58 — both effectively failing grades on a scale of 0-100.

What kinds of services Charter is now compelled to offer is dependent on the state of the cable system serving each area and if regulators extracted concessions on the state level to guarantee better service. The state that worked the hardest to compel upgrades and insist on a more customer-friendly transition is New York, where the Public Service Commission forced concessions to upgrade all of the state and allow customers to keep their current Time Warner Cable plans if they wished.

“On Day One, customers of (Time Warner) won’t really see any changes,” Charter spokesman Justin Venech told the Albany Times Union. “Time Warner Cable and Charter Spectrum will continue offering their current suite of advanced products and services to customers in their markets.”

“As we go all digital market by market, we will launch the Spectrum brand product, pricing and packaging, and Charter will also launch Spectrum in those markets in which (Time Warner has) already gone all digital,” Venech said. “We will be communicating directly with customers, letting them know when they will start seeing the Spectrum brand. In addition, when our Spectrum packages launch, if a customer likes the package they are currently in, they will be able to stay in that package.”

Subscribe

Subscribe If you were wondering what motivated Time Warner Cable CEO Robert Marcus to move so quickly from a failed merger with Comcast to a new deal with Charter Communications, follow the money.

If you were wondering what motivated Time Warner Cable CEO Robert Marcus to move so quickly from a failed merger with Comcast to a new deal with Charter Communications, follow the money.

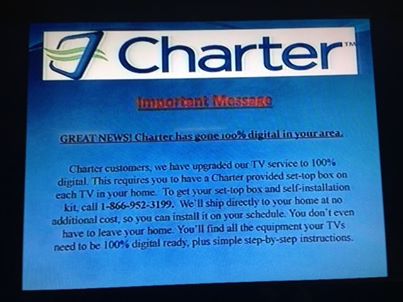

Charter told investors at today’s merger announcement it will accelerate the removal of all analog television signals on TWC and Bright House cable TV lineups to free capacity for faster Internet products, more HD channels, and “other advanced products.”

Charter told investors at today’s merger announcement it will accelerate the removal of all analog television signals on TWC and Bright House cable TV lineups to free capacity for faster Internet products, more HD channels, and “other advanced products.” This is likely to be a red flag for regulators concerned about broadband affordability. Although it is likely Charter may offer concessions by grandfathering existing Time Warner Cable and Bright House customers under their current plans, Charter has nothing comparable to Time Warner’s “Everyday Low Price Internet” for $14.99 a month or a 6Mbps Basic broadband alternative far less expensive than Charter’s entry-level Internet tier. Bright House customers are not likely to experience something similar. The entry-level 15Mbps broadband-only plan is $65 a month without a promotion, according to Bright House.

This is likely to be a red flag for regulators concerned about broadband affordability. Although it is likely Charter may offer concessions by grandfathering existing Time Warner Cable and Bright House customers under their current plans, Charter has nothing comparable to Time Warner’s “Everyday Low Price Internet” for $14.99 a month or a 6Mbps Basic broadband alternative far less expensive than Charter’s entry-level Internet tier. Bright House customers are not likely to experience something similar. The entry-level 15Mbps broadband-only plan is $65 a month without a promotion, according to Bright House. Charter enjoys a higher rate of revenue per customer than either Time Warner or Bright House, which is a sign customers are paying more. It is likely Charter’s reduced menu of choices is responsible for this. Although customers do get a better advertised level of service, they are paying a higher price for it, with no downgrade options. Ancillary equipment rental fees for television set-top boxes are also a likely culprit.

Charter enjoys a higher rate of revenue per customer than either Time Warner or Bright House, which is a sign customers are paying more. It is likely Charter’s reduced menu of choices is responsible for this. Although customers do get a better advertised level of service, they are paying a higher price for it, with no downgrade options. Ancillary equipment rental fees for television set-top boxes are also a likely culprit. Time Warner Cable plans to reach 75 percent of its customers with Maxx service upgrades offering broadband speed boosts up to 300/20Mbps for the same price it charges for 50Mbps by the end of 2016, assuming a merger with Comcast does not result in the plans being shelved.

Time Warner Cable plans to reach 75 percent of its customers with Maxx service upgrades offering broadband speed boosts up to 300/20Mbps for the same price it charges for 50Mbps by the end of 2016, assuming a merger with Comcast does not result in the plans being shelved.