The next generation of retransmission consent wars is here, as programmers and cable operators do battle with set-top box companies that increasingly seek compensation to allow content on their hardware platforms.

The next generation of retransmission consent wars is here, as programmers and cable operators do battle with set-top box companies that increasingly seek compensation to allow content on their hardware platforms.

Once again, Roku has triggered a dispute after Charter Communications turned down a contract renewal offer permitting Charter’s Spectrum TV app in Roku’s Channel Store. The app allows customers to stream Spectrum’s cable TV lineup over Roku. Existing users tell Stop the Cap! that the app disappeared from the Channel Store, but previously installed versions still work over Roku. The problem, readers tell us, is there is no way to install or reinstall it on new Roku devices.

Charter noted the issue in a new support article explaining why the app disappeared:

Despite our best efforts to reach an agreement, Roku has not accepted Spectrum’s offer to continue our contract, which allowed customers to access the Spectrum TV app from Roku devices.

This change may prevent new downloads of the Spectrum TV app to your Roku device, but you can still access your full video library by downloading the Spectrum TV app to your Apple TV, Samsung Smart TV, Xbox, smartphone or tablet.

If you already use the Spectrum TV app on Roku, your service shouldn’t be affected.

Be sure not to uninstall the app, but you can still add devices by signing in to your current account.

If you’re new to Roku, or if you have not yet downloaded the app, you can still access Spectrum programming on another device, or use your smartphone or laptop to screen mirror Spectrum content to your Roku TV.

Find out more about using the Spectrum TV app, or get help to troubleshoot common concerns.

Roku defended its decision but also admitted it now expects compensation from certain providers in return for allowing their apps on Roku’s Channel Store.

Roku defended its decision but also admitted it now expects compensation from certain providers in return for allowing their apps on Roku’s Channel Store.

“As America’s #1 streaming platform we are committed to providing access to amazing streaming content at an exceptional value for our users,” Roku said in a statement. “Our contract with Charter for the distribution of the Spectrum TV [app] on the Roku platform expired and we are working together to reach a positive and mutually beneficial distribution agreement. All existing customers can continue to use the Charter app while we work together on a renewal.”

Roku’s willingness to battle with programmers became apparent this year as the company continued to keep HBO Max off of its platform. Other programmers that saw their apps temporarily blocked or unsupported include AT&T TV, FOX, and Comcast’s Peacock.

Subscribe

Subscribe NBCUniversal’s Peacock streaming service app is now finally available on Roku devices and Roku-enabled televisions, almost 10 weeks after the new streaming service launched.

NBCUniversal’s Peacock streaming service app is now finally available on Roku devices and Roku-enabled televisions, almost 10 weeks after the new streaming service launched.

DirecTV Now customers will

DirecTV Now customers will

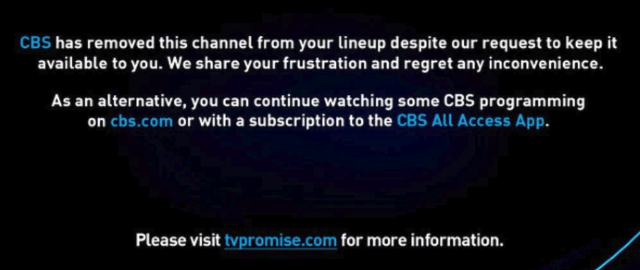

AT&T is facing a last hour showdown with CBS owned and operated local TV stations in 17 major U.S. cities over a new retransmission consent contract that could mean the third major station blackout for customers of DirecTV, DirecTV Now, and AT&T U-verse. Streaming customers would also lose access to on-demand content. In addition, CBS-owned CW television stations would be dropped from all three AT&T-owned services.

AT&T is facing a last hour showdown with CBS owned and operated local TV stations in 17 major U.S. cities over a new retransmission consent contract that could mean the third major station blackout for customers of DirecTV, DirecTV Now, and AT&T U-verse. Streaming customers would also lose access to on-demand content. In addition, CBS-owned CW television stations would be dropped from all three AT&T-owned services. AT&T has already left customers blacked out from nearly 150 local stations owned by Nexstar and several smaller owners — some effectively front groups for Sinclair Broadcasting — with no end in sight. Both sides are taking heat from public officials and members of Congress upset with the loss of one or more local stations, and the latest blackout of CBS stations could result in even greater scrutiny of AT&T and station owners.

AT&T has already left customers blacked out from nearly 150 local stations owned by Nexstar and several smaller owners — some effectively front groups for Sinclair Broadcasting — with no end in sight. Both sides are taking heat from public officials and members of Congress upset with the loss of one or more local stations, and the latest blackout of CBS stations could result in even greater scrutiny of AT&T and station owners.