In a major victory for net roots groups, President Barack Obama today announced his support for the strongest possible Net Neutrality protections, asking the Federal Communications Commission to quickly reclassify broadband as a “telecommunications service” subject to oversight and consumer protection regulatory policies that would prohibit paid fast lanes, the blocking or degrading of websites for financial reasons, and more transparency in how Internet Service Providers handle traffic.

In a major victory for net roots groups, President Barack Obama today announced his support for the strongest possible Net Neutrality protections, asking the Federal Communications Commission to quickly reclassify broadband as a “telecommunications service” subject to oversight and consumer protection regulatory policies that would prohibit paid fast lanes, the blocking or degrading of websites for financial reasons, and more transparency in how Internet Service Providers handle traffic.

“For almost a century, our law has recognized that companies who connect you to the world have special obligations not to exploit the monopoly they enjoy over access in and out of your home or business,” said the president. “That is why a phone call from a customer of one phone company can reliably reach a customer of a different one, and why you will not be penalized solely for calling someone who is using another provider. It is common sense that the same philosophy should guide any service that is based on the transmission of information — whether a phone call, or a packet of data.”

“’Net neutrality’ has been built into the fabric of the Internet since its creation — but it is also a principle that we cannot take for granted,” President Obama added. “We cannot allow Internet Service Providers (ISPs) to restrict the best access or to pick winners and losers in the online marketplace for services and ideas. That is why today, I am asking the Federal Communications Commission (FCC) to answer the call of almost four million public comments, and implement the strongest possible rules to protect Net Neutrality.”

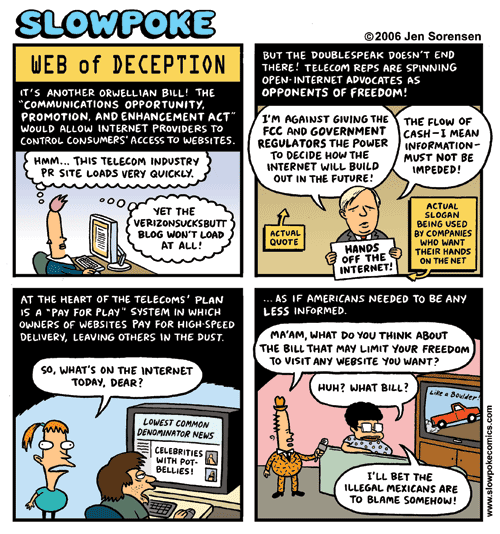

The president’s call will likely force FCC chairman Thomas Wheeler to abandon efforts to reclassify only certain types of Internet traffic under Title 2 regulations while leaving consumers vulnerable to paid fast lanes and other traffic monetizing schemes. Wheeler was rumored to be working on a limited Net Neutrality plan that would protect large online video content distributors like Netflix and Amazon from unfair compensation deals with ISPs. The plan would have given the FCC authority to review agreements between your Internet provider and some of the net’s biggest traffic generators.

President Obama’s statement goes beyond Wheeler’s tolerance for “individualized, differentiated arrangements” that could let cable and phone companies offer compensated “preferred partnership” deals with websites and applications, granting them special treatment or exemptions from speed throttles or usage caps not available to others.

The president’s four principles for a free and open Internet represent “common-sense steps that reflect the Internet you and I use every day, and that some ISPs already observe:”

No blocking. If a consumer requests access to a website or service, and the content is legal, your ISP should not be permitted to block it. That way, every player — not just those commercially affiliated with an ISP — gets a fair shot at your business;

No blocking. If a consumer requests access to a website or service, and the content is legal, your ISP should not be permitted to block it. That way, every player — not just those commercially affiliated with an ISP — gets a fair shot at your business;- No throttling. Nor should ISPs be able to intentionally slow down some content or speed up others — through a process often called “throttling” — based on the type of service or your ISP’s preferences;

- Increased transparency. The connection between consumers and ISPs — the so-called “last mile” — is not the only place some sites might get special treatment. So, I am also asking the FCC to make full use of the transparency authorities the court recently upheld, and if necessary to apply net neutrality rules to points of interconnection between the ISP and the rest of the Internet;

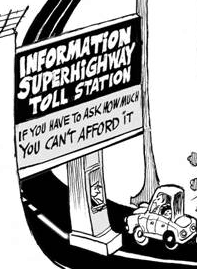

- No paid prioritization. Simply put: No service should be stuck in a “slow lane” because it does not pay a fee. That kind of gatekeeping would undermine the level playing field essential to the Internet’s growth. So, as I have before, I am asking for an explicit ban on paid prioritization and any other restriction that has a similar effect.

The president also expressed a desire to see the same rules applied to mobile networks. That is a significant departure from the policies of the FCC under Wheeler’s predecessor Julius Genachowski, who served as chairman during the Obama Administration’s first term in office. His Net Neutrality policies exempted wireless carriers.

“The rules also have to reflect the way people use the Internet today, which increasingly means on a mobile device,” said the president. “I believe the FCC should make these rules fully applicable to mobile broadband as well, while recognizing the special challenges that come with managing wireless networks.”

[flv]http://www.phillipdampier.com/video/111014_NetNeutrality_Final.mp4[/flv]

President Barack Obama recorded this message supporting strong Net Neutrality protections for the Internet. (1:56)

Republicans in Congress and large telecommunications companies both immediately pounced on the president’s Net Neutrality plans.

Cruz

“Net Neutrality is Obamacare for the Internet,” tweeted Sen. Ted Cruz (R-Tex.) “The Internet should not operate at the speed of government.”

Cruz’s spokeswoman, Amanda Carpenter, added that Net Neutrality would place the government “in charge of determining pricing, terms of service, and what products can be delivered. Sound like Obamacare much?”

The National Cable and Telecommunications Association expressed surprise over the president’s strong public support for Net Neutrality action.

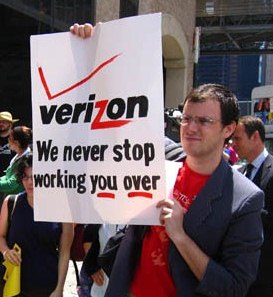

“We are stunned the President would abandon the longstanding, bipartisan policy of lightly regulating the Internet and call for extreme Title II regulation,” the NCTA wrote. “The cable industry strongly supports an open Internet, is building an open internet, and strongly believes that over-regulating the fastest growing technology in our history will not advance the cause of Internet freedom. There is no dispute about the propriety of transparency rules and bans on discrimination and blocking. But this tectonic shift in national policy, should it be adopted, would create devastating results.”

“Heavily regulating the Internet will lead to slower Internet growth, higher prices for consumers, and the threat of excessive intervention by the government in the working of the Internet,” stated the NCTA release. “This will also have severe and profound implications internationally, as the United States loses the high ground in arguing against greater control of the Internet by foreign governments. There is no substantive justification for this overreach, and no acknowledgment that it is unlawful to prohibit paid prioritization under Title II. We will fight vigorously against efforts to impose this backwards policy.”

Subscribe

Subscribe

“Those who advocated the Telecommunications Act of 1996 promised more competition and diversity, but the opposite happened,” said Common Cause president Chellie Pingree back in 1995. “Citizens, excluded from the process when the Act was negotiated in Congress, must have a seat at the table as Congress proposes to revisit this law.”

“Those who advocated the Telecommunications Act of 1996 promised more competition and diversity, but the opposite happened,” said Common Cause president Chellie Pingree back in 1995. “Citizens, excluded from the process when the Act was negotiated in Congress, must have a seat at the table as Congress proposes to revisit this law.” Big Telecom companies like Verizon and AT&T use phony numbers and perpetuate myths about broadband traffic and network investments that have conned investors

Big Telecom companies like Verizon and AT&T use phony numbers and perpetuate myths about broadband traffic and network investments that have conned investors  “We just have to try harder to match those growth rates and catch up with WorldCom,” AT&T executives told Odlyzko and his colleagues, believing the problem was simply ineffective sales, not real broadband demand. When sales couldn’t generate those traffic numbers and Wall Street analysts began asking why, companies like Global Crossing and Qwest resorted to “hollow swaps” and other dubious tricks to fool analysts, prop up the stock price and executive bonuses, and invent sales.

“We just have to try harder to match those growth rates and catch up with WorldCom,” AT&T executives told Odlyzko and his colleagues, believing the problem was simply ineffective sales, not real broadband demand. When sales couldn’t generate those traffic numbers and Wall Street analysts began asking why, companies like Global Crossing and Qwest resorted to “hollow swaps” and other dubious tricks to fool analysts, prop up the stock price and executive bonuses, and invent sales. That isn’t a problem for wireless carriers because texting is where the real money is made. Odlyzko notes that wireless carriers profit an average of $1,000 per megabyte for text messages, usually charged per-message or through subscription plan add ons or as part of a bundle. Cellular voice calling is much less profitable, earning about $1 per megabyte of digitized traffic.

That isn’t a problem for wireless carriers because texting is where the real money is made. Odlyzko notes that wireless carriers profit an average of $1,000 per megabyte for text messages, usually charged per-message or through subscription plan add ons or as part of a bundle. Cellular voice calling is much less profitable, earning about $1 per megabyte of digitized traffic. In the Netherlands, having access to two broadband competitors isn’t enough to guarantee broadband competition, and Dutch telecom regulators are not about to deregulate Internet service in the country until consumers have more choices for broadband access.

In the Netherlands, having access to two broadband competitors isn’t enough to guarantee broadband competition, and Dutch telecom regulators are not about to deregulate Internet service in the country until consumers have more choices for broadband access.

Not everyone can afford to move their assets overseas or set up complicated charitable trusts to shelter income, but the enormously wealthy Malone can. He recently passed Ted Turner as America’s biggest private landowner, owning 2.2 million acres of property in the United States, including more than 5% of the state of Maine.

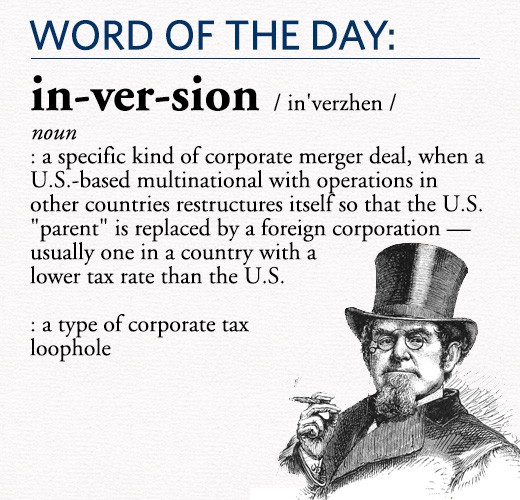

Not everyone can afford to move their assets overseas or set up complicated charitable trusts to shelter income, but the enormously wealthy Malone can. He recently passed Ted Turner as America’s biggest private landowner, owning 2.2 million acres of property in the United States, including more than 5% of the state of Maine. Although the corporation escapes a tax bill, shareholders usually do not, subject to tax for shares converted from the old U.S.-based company to the new overseas entity. Faced with owing capital gains taxes at a rate of 23.8 percent, the day before the inversion was announced, Malone transferred almost $600 million of his shares to the Malone-controlled, tax exempt LG 2013 Charitable Remainder Unitrust, avoiding much of the tax. Not satisfied with the fact he still would owe tax on the remaining $260 million of his personal stake in Liberty, the company hired Shearman & Sterling LLP to devise a strategy to get Malone (and shareholders) off the hook for any tax liability.

Although the corporation escapes a tax bill, shareholders usually do not, subject to tax for shares converted from the old U.S.-based company to the new overseas entity. Faced with owing capital gains taxes at a rate of 23.8 percent, the day before the inversion was announced, Malone transferred almost $600 million of his shares to the Malone-controlled, tax exempt LG 2013 Charitable Remainder Unitrust, avoiding much of the tax. Not satisfied with the fact he still would owe tax on the remaining $260 million of his personal stake in Liberty, the company hired Shearman & Sterling LLP to devise a strategy to get Malone (and shareholders) off the hook for any tax liability.