Comcast sends a repair crew to the Justice Department to salvage its merger with Time Warner Cable.

Comcast has won a private meeting with officials at the U.S. Department of Justice to discuss potential remedies to salvage their $45.2 billion acquisition of Time Warner Cable, even as those officials seem ready to decisively reject the merger on the grounds it is anticompetitive.

Both the Wall Street Journal and Bloomberg News report the meeting would be the first between executives of Comcast and lawyers at the Justice Department that have spent more than 14 months reviewing the proposed deal. But Comcast disputes those reports. A source told Multichannel News there was a meeting this week, but said it was one in a series of meetings.

Comcast is likely to offer more concessions, including the possibility of divesting itself of more than the current 3.9 million Comcast and Time Warner Cable customers it plans to sell to GreatLand Connections, the thinly veneered de facto division of Charter Communications. The current merger proposal would allow Comcast to control just under 30 million cable subscribers.

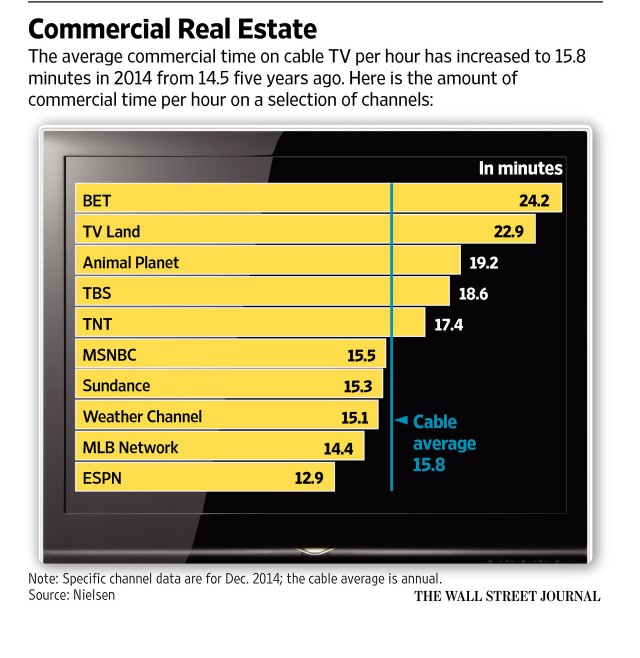

Newspaper reports indicate staffers at both the Justice Department and the Federal Communications Commission are firmly opposed to the deal, concerned it would allow Comcast to control not less than 57% of the American broadband marketplace. No other ISP has a market share that would come close to Comcast. The market power of the combined company could give Comcast unfair leverage in negotiations with content owners ranging from broadcast stations and over the air networks to cable networks that would be harmed significantly if Comcast refused to carry their programming.

Comcast’s broadband supremacy could be lethal to emerging online cable television providers like Sling TV and PlayStation Vue, particularly if Comcast manipulates broadband packages with usage caps that could limit online viewing or force customers to pay penalty rates if they seek to avoid Comcast’s own cable television package.

[flv]http://www.phillipdampier.com/video/WSJ Comcast Strives to Save Merger With Time Warner Cable 4-20-15.flv[/flv]

Comcast and Time Warner Cable are working to keep the $45.2 billion deal alive despite serious reservations from the FCC and the Department of Justice. The Wall Street Journal reports deal critics have made a strong case against the merger over its impact on the emerging competition offered by online video. (4:04)

Although details are still murky, one incident in 2013 may have been responsible for putting the merger deal in a bad light with regulators and antitrust lawyers.

Comcast’s fulfillment of its concessions to regulators to win approval of its buyout of NBC-Universal has been under scrutiny. If it can be proved that Comcast managed an end run around its own concessions, or flagrantly violated them, regulators will doubt whether Comcast can be trusted to fulfill any new concessions made to win approval of the Time Warner Cable deal.

Comcast’s fulfillment of its concessions to regulators to win approval of its buyout of NBC-Universal has been under scrutiny. If it can be proved that Comcast managed an end run around its own concessions, or flagrantly violated them, regulators will doubt whether Comcast can be trusted to fulfill any new concessions made to win approval of the Time Warner Cable deal.

Two years ago, Walt Disney and 21st Century Fox were in the advanced stages of selling the online service Hulu, in which Comcast also owns a stake. As a condition for approving Comcast’s deal with NBC, the cable company was to become a silent partner in Hulu and have no managerial control over the venture.

Among the bidders seeking ownership of Hulu were two of Comcast’s biggest competitors — DirecTV and AT&T.

One of the topics under review is whether Comcast CEO Brian Roberts influenced Disney and Fox not to sell the venture. Hulu suddenly was taken off the market.

If Roberts or another Comcast official is proved to have intervened in the aborted Hulu sale, that would likely violate the agreement with the Justice Department and the FCC.

The Justice Department considered the possibility serious enough to order depositions in February from Comcast executives regarding the attempted sale of Hulu, according to Bloomberg News. Comcast says it wasn’t involved and Disney was responsible for the sale being terminated.

[flv]http://www.phillipdampier.com/video/Bloomberg Comcast Time Warner Said to Talk Deal at DOJ Wednesday 4-20-15.flv[/flv]

Bloomberg’s Alex Sherman reports that the Comcast-Time Warner Cable merger deal is in serious peril as it faces potential opposition from the Justice Department. (4:14)

The deal continues to face growing hurdles that Wall Street analyst BTIG Research believes Comcast is unlikely to successfully jump (registration req.).

“The political winds have shifted dramatically over the past 14 months since Comcast announced its acquisition of Time Warner Cable,” said BTIG’s Richard Greenfield. “Since we lowered the odds of the transaction being approved or Comcast walking away due to harsh proposed conditions to only 30% in early February, we have grown increasingly confident that the government will outright block the transaction.”

The key regulatory tests that the Comcast/Time Warner Cable merger must pass:

The key regulatory tests that the Comcast/Time Warner Cable merger must pass:

DoJ: Section 7 of the Clayton Act prohibits mergers if “in any line of commerce or in any activity affecting commerce in any section of the country, the effect of such acquisition may be substantially to lessen competition, or to tend to create a monopoly;”

FCC: “Under section 310(d) of the Communications Act, we determine whether a proposed transaction will serve the public interest, convenience and necessity…We balance the potential public interest harms against the potential benefits. The Applicants bear the burden of proving, by a preponderance of the evidence, that the proposed transaction, on balance, will serve the public interest.”

Greenfield believes Comcast’s “bad behavior” after the NBC consent decree makes it unlikely the Justice Department will trust Comcast enough to allow voluntary concessions in return for the merger with Time Warner to pass.

Online video competition may be the key to derailing the merger of Comcast and Time Warner Cable.

Among the concessions Greenfield believes might be on the table include deal killers like selling off Time Warner Cable’s systems in New York City and Los Angeles, allowing third-party ISPs to buy access to Comcast’s broadband network at wholesale prices for resale to consumers, price regulations, or voluntary compliance with Net Neutrality rules whether they survive a court challenge or not. Comcast is unlikely to agree to any of those types of concessions and would likely walk away from Time Warner Cable, according to Greenfield.

The case against the merger is reportedly a strong one and comes from various unaligned players affected by it. Online video competitors (over-the-top streamers like Netflix, Amazon, HBONow, WWE, Sling, Vue, and others) have gained a foothold and more than 50 percent of broadband subscribers now use one or more of these services. Dish Network’s filing reminds regulators Comcast will control 13 of the top-13 markets in the U.S. with ownership of both their own online video platform and the broadband service customers depend on to reach its competitors. That would pose a direct threat to competition, according to Dish.

Comcast has not denied the staffers at the Department of Justice are opposed to the deal, but have told Wall Street the senior leadership at the Justice Department is fine with the merger and its political influence at the “top” is so strong, senior officials will come to their rescue.

If true, Greenfield notes, that would require Renata B. Hesse, deputy assistant Attorney General to overrule a staff recommendation opposing the deal at a time when the transaction has few fans outside of the executive suites at Comcast and Time Warner Cable. The only other obvious option would be if Obama Administration officials in The White House or the president himself intervened to save the deal. Greenfield added he was “somewhat amazed” Comcast would openly imply its powers of political influence would trump the recommendations of regulator staff members.

President Barack Obama plays golf with Comcast CEO Brian Roberts.

Greenfield seriously doubts The White House will get involved in a politically dicey merger involving two despised cable companies:

- [Online video] is becoming critically important to all Americans. In turn, ensuring robust online video competition is critical;

- There is no major constituency we can find that is in favor of the transaction – Silicon Valley hates it, traditional media companies hate it and you would be hard pressed to find an individual consumer/consumer group that thinks a bigger Comcast is in their best interests;

- The same grassroots organizations that helped push the White House’s agenda to drive the Net Neutrality/Title II outcome they desired are actively advocating against the Comcast Time Warner Cable transaction;

- The White House is already the subject of two Congressional investigations (Senate and House) into improper influence of the supposedly independent FCC tied to the 2015 Net Neutrality order;

- Stepping into the Comcast situation would also raise even further questions as to whether The White House had traded Comcast’s Net Neutrality/Title II support in return for helping the Time Warner Cable acquisition gain approval.

Greenfield believes The White House will not come to Comcast’s rescue. He also finds it difficult to believe senior officials at the Justice Department, including Hesse, will overrule their staff after a laborious 14-plus month investigation, particularly given how important online video issues are.

But Bernstein Research analyst Paul De Sa thinks the reports in the Wall Street Journal and Bloomberg News should be “taken with a grain of salt.”

The Wall Street analyst firm is still advising their clients the merger will be successful:

“We strongly believe that this decision will be made based on the vast, transaction-specific fact base that regulators have assembled during the past year (not on politics, or the FCC’s 25 Mbps broadband definition, or Title II classification of broadband, or the amount of noise generated by deal opponents). As almost all of this fact base consists of highly-confidential information, unknowable from the outside, it is in principle impossible to have a high conviction about the outcome at this stage, although we still think that it more likely than not that the deal will be approved with conditions.”

[flv]http://www.phillipdampier.com/video/Bloomberg Comcast-TWC Obamas Net Neutrality Hunger Games 4-20-15.flv[/flv]

John Chachas, managing partner at Methuselah Capital Advisors, thinks Comcast is running into political opposition because of efforts to secure Net Neutrality, but Bloomberg’s Alex Sherman reports the future of online video competing with the traditional cable television package may be at the heart of any opposition to a Comcast-Time Warner Cable deal. (7:06)

Subscribe

Subscribe

According to the National Institute of Money in Politics, telecommunications industry interests wrote at least $643,000 in campaign contribution checks to Tennessee politicians during the two-year 2014 election cycle. AT&T alone put $211,000 into the pockets of legislators. The Tennessee Registry of Election Finance reports AT&T contributed $20,000 during the last election cycle to Republican Lt. Gov. Ron Ramsey’s leadership political action committee, RAAMPAC. AT&T President Joelle Phillips personally gave another $2,000.

According to the National Institute of Money in Politics, telecommunications industry interests wrote at least $643,000 in campaign contribution checks to Tennessee politicians during the two-year 2014 election cycle. AT&T alone put $211,000 into the pockets of legislators. The Tennessee Registry of Election Finance reports AT&T contributed $20,000 during the last election cycle to Republican Lt. Gov. Ron Ramsey’s leadership political action committee, RAAMPAC. AT&T President Joelle Phillips personally gave another $2,000.

Verizon believes it has a premium product and expects to be paid for it. Like a Neiman Marcus of the wireless industry, customers can expect a superior level of service, if they can afford to pay for it.

Verizon believes it has a premium product and expects to be paid for it. Like a Neiman Marcus of the wireless industry, customers can expect a superior level of service, if they can afford to pay for it.

Comcast’s fulfillment of its concessions to regulators to win approval of its buyout of NBC-Universal has been under scrutiny. If it can be proved that Comcast managed an end run around its own concessions, or flagrantly violated them, regulators will doubt whether Comcast can be trusted to fulfill any new concessions made to win approval of the Time Warner Cable deal.

Comcast’s fulfillment of its concessions to regulators to win approval of its buyout of NBC-Universal has been under scrutiny. If it can be proved that Comcast managed an end run around its own concessions, or flagrantly violated them, regulators will doubt whether Comcast can be trusted to fulfill any new concessions made to win approval of the Time Warner Cable deal. The key regulatory tests that the Comcast/Time Warner Cable merger must pass:

The key regulatory tests that the Comcast/Time Warner Cable merger must pass: