Residents in greater Philadelphia overpaid Comcast more than $875 million dollars, thanks to the cable company’s alleged anti-competitive practice of building regional cable clusters that scare would-be competitors away.

Residents in greater Philadelphia overpaid Comcast more than $875 million dollars, thanks to the cable company’s alleged anti-competitive practice of building regional cable clusters that scare would-be competitors away.

Those are the primary allegations in a 2003 class action case brought against the country’s largest cable operator — a lawsuit Comcast has appealed, so far unsuccessfully. A three-judge panel of the 3rd Circuit on Tuesday delivered the latest blow to the cable company, denying Comcast’s efforts to get the case thrown out.

At issue is the cable industry’s practice of acquiring and trading cable systems with each another to create regional “clusters,” — large geographic areas all served by the same cable provider — and what that practice does to cable pricing. All the rage in the late 1990s and early 2000s, cable clustering largely put an end to multiple cable systems serving individual cities. In the 1980s and 90s, it was not uncommon to find up to four different cable systems serving different sections of a community. Philadelphia was no different, served by more than a half-dozen cable operators in the greater metropolitan region and surrounding counties.

In the late 1990s, the Court noted Comcast launched a major shopping spree to consolidate the entire area around one cable provider: Comcast. The lawsuit claims subscribers have paid the price ever since.

Comcast’s Cable Swaps and Acquisitions

- April 1998: Comcast acquires 27,000 Marcus Cable customers in Harrington, Delaware, which is part of the Philadelphia Designated Market Area (DMA);

- June 1999: Comcast acquires 79,000 Greater Philadelphia Cablevision customers in the city of Philadelphia;

- January 2000: Comcast acquires 1.1 million Lenfest Communications customers in Berks, Bucks, Chester, Delaware, and Montgomery counties in Pennsylvania, and New Castle County in Delaware;

- January 2000: Comcast acquires 212,000 Garden State Cablevision customers in Atlantic, Burlington, Camden, Cape May, Cumberland, Gloucester, Mercer, and Salem counties in New Jersey, which is part of the Philadelphia DMA;

- December 2000: Comcast acquires 770,000 AT&T Cable customers in Eastern Pennsylvania (Berks and Bucks counties) and New Jersey, in return for trading 700,000 Comcast customers in Chicago with AT&T (Comcast would later win them back by acquiring AT&T Cable itself);

- January 2001: Comcast acquires 464,000 subscribers in Philadelphia and nearby communities in New Jersey in a subscriber trade with Adelphia Communications Corp., wherein Comcast obtained cable systems and approximately 464,000 subscribers located primarily in the Philadelphia area and adjacent New Jersey areas. In return, Comcast turns over its subscribers in Palm Beach, Florida and Los Angeles, California to Adelphia.

- April 2001: Comcast wins another 595,000 subscribers in the region in a trade with AT&T Cable;

- August 2006: Adelphia implodes and cable companies including Time Warner Cable and Comcast pick over what’s left. Comcast manages to pick up another 41,000 former Adelphia customers that were originally headed to Time Warner in yet another subscriber swap;

- August 2007: Comcast acquires Patriot Media and its 81,000 New Jersey customers located within the Philadelphia DMA.

When the acquisitions and transfers were complete, Comcast managed to build a major empire in southeastern Pennsylvania. In 1998, the company had just a 23.9 percent market share in the Philadelphia DMA. Comcast managed to control 77.8 percent of the market by 2002. Despite competition from satellite television and one struggling cable competitor — RCN, Comcast still controlled nearly 70 percent of the market as late as 2007.

When the acquisitions and transfers were complete, Comcast managed to build a major empire in southeastern Pennsylvania. In 1998, the company had just a 23.9 percent market share in the Philadelphia DMA. Comcast managed to control 77.8 percent of the market by 2002. Despite competition from satellite television and one struggling cable competitor — RCN, Comcast still controlled nearly 70 percent of the market as late as 2007.

Who Pays for the Shopping Spree? Comcast Customers, Say Plaintiffs

Six Comcast customers upset with the relentless rate increases that came with Comcast’s acquisitions joined forces and filed suit against Comcast in 2003. The plaintiffs charged Comcast with anti-competitive business practices and violations of the Sherman Act for building a monopoly presence in the market that also helped keep competitors at bay.

One plaintiff’s expert was able to calculate what he called “a conservative estimate” of how much Comcast has effectively overcharged customers in Philadelphia by preventing effective competition: $875,576,662.

That figure was hotly disputed in Comcast’s court appeal, but last Tuesday the Court rejected Comcast’s arguments. In fact, the Court found merit in the formula used to arrive at the amount of overcharging Comcast has allegedly engaged in — in Philadelphia alone. Comcast’s argument that customers enjoy lower pricing through promotions and other special pricing arrangements fell apart when the Court learned at least 80 percent of Comcast subscribers pay regular “list prices” for service, and the expert who created the ‘wallet damage‘ formula had taken that special pricing into account.

The plaintiffs suggest that had Comcast not engaged in system clustering, one or more of the area’s cable systems might have decided to compete against the other cable systems. In that scenario, customers might have been able to choose from Comcast, Lenfest Communications, Marcus Cable, and/or Patriot Cable for cable service, resulting in increased price competition. While there have been instances of traditional cable operators overbuilding into each other’s territories, those instances have been rare — a point Comcast made in an effort to have the case tossed out. Comcast’s case is that the majority of Americans are served by a single cable provider, but that’s not a problem because the industry faces increasing competition from satellite TV providers and, as of late, large phone companies.

The plaintiffs suggest that had Comcast not engaged in system clustering, one or more of the area’s cable systems might have decided to compete against the other cable systems. In that scenario, customers might have been able to choose from Comcast, Lenfest Communications, Marcus Cable, and/or Patriot Cable for cable service, resulting in increased price competition. While there have been instances of traditional cable operators overbuilding into each other’s territories, those instances have been rare — a point Comcast made in an effort to have the case tossed out. Comcast’s case is that the majority of Americans are served by a single cable provider, but that’s not a problem because the industry faces increasing competition from satellite TV providers and, as of late, large phone companies.

But the Court found the reason for this lack of competition could be, as plaintiffs argue, the successful outcome of the alleged anti-competitive, cable system-clustering strategy.

As an example, a railway monopoly from 100 years ago could claim it isn’t economical for more than one railroad to serve a particular community, but that isn’t a problem because other forms of transportation exist to move goods and people. That argument would be based on a market reality created by the railway industry, which routinely bought out the competition through withering price wars, cross-subsidized by higher prices in other monopoly markets. The end effect was a shrinking number of competitive markets, increasing profits (and prices), and a strong deterrent for would-be competitors to enter the business.

A similar case has been brought by the plaintiffs struggling with high cable bills. In their eyes, cable customers paid for the Monopoly game board on which cable properties were traded or sold. When the shopping spree was complete, higher rates were the result, indefinitely.

The Case of RCN — Programming Denied

Most traditional cable companies do not compete in areas already served by another cable company. It’s a tradition some liken to a cartel, where companies carve up territories and enjoy the market benefits afforded by a lack of competition. But this model is also considered standard operating procedure by Wall Street and other private investors, who fear all-0ut price wars cutting revenues and destroying value and profits. But there are some companies whose entire mission is to challenge this economic model: the cable overbuilders. The business plan of the cable overbuilder is to challenge the status quo and deliver service where cable TV already exists and do so profitably.

Most traditional cable companies do not compete in areas already served by another cable company. It’s a tradition some liken to a cartel, where companies carve up territories and enjoy the market benefits afforded by a lack of competition. But this model is also considered standard operating procedure by Wall Street and other private investors, who fear all-0ut price wars cutting revenues and destroying value and profits. But there are some companies whose entire mission is to challenge this economic model: the cable overbuilders. The business plan of the cable overbuilder is to challenge the status quo and deliver service where cable TV already exists and do so profitably.

One such overbuilder is RCN Corporation, which delivers competitive cable service in Boston, Washington, D.C., New York City, Chicago, and parts of the Lehigh Valley. RCN began operations in 1996 in Boston, just before the cable industry’s quest for clusters went into hyper-drive. Their plans to compete have been challenged by the ever-increasing concentration in the cable-TV marketplace ever since, and the company has had a particularly tough time attracting subscribers in the Philadelphia area. Much of RCN’s service area these days is limited to multi-dwelling units like high-rise condos and apartments, where wiring costs are lower.

One of the most effective ways to keep customers from switching to a competitor is to develop or maintain exclusive programming rights. If a Comcast customer discovered his favorite sporting events could only be seen with a Comcast subscription, that could be a deal-breaker for signing up with RCN. Before the 1992 Cable Act, the cable industry which owned and controlled a number of popular cable networks refused to sell those channels to would-be competitors (or charged unreasonable prices for access).

When this lawsuit was filed in 2003, RCN found itself locked out of Comcast’s SportsNet, just one of several regional sports networks that cable operators withheld from satellite and cable competitors. That’s because the 1992 Cable Act included a loophole: it applied only to networks distributed on satellite. Several regional sports channels were not on satellite, so they could, and were, legally withheld from competitors like RCN. That loophole was finally closed by the FCC last summer. But for more than a decade, RCN had to convince sports fans to sign up for a competing service that didn’t have one of the most popular sports channels on the lineup.

Satellite competitors DirecTV and DISH Network were in the same boat, and the legal case recognizes the impact: satellite TV competition in Philadelphia has a below-average percentage of the market, when compared to other cities.

Plaintiffs argued RCN never had fair access to programming, leaving them to compete with one hand tied behind their back. Even worse, they allege Comcast compelled local contractors into non-compete contracts agreeing not to work for any Comcast competitor, and signing customers up to unusually long contract terms with hefty cancellation penalties in RCN service areas.

All of these accusations were deemed credible by the Court, much to the objection of Comcast, which argued RCN was in serious financial distress and would never be a strongly viable competitor in Philadelphia. Last week’s Court decision found that ironic, accepting that RCN’s present condition could be, as plaintiffs allege, the result of the anti-competitive, unfair business practices Comcast is charged with.

The evidence on the record “demonstrates that Comcast’s alleged clustering conduct indeed could have reduced competition, raised barriers to market entry [by other competitors] … and resulted in higher cable prices to all of its subscribers in the Philadelphia Designated Market Area,” the court ruled.

The evidence on the record “demonstrates that Comcast’s alleged clustering conduct indeed could have reduced competition, raised barriers to market entry [by other competitors] … and resulted in higher cable prices to all of its subscribers in the Philadelphia Designated Market Area,” the court ruled.

Comcast: A Competitive Marketplace Begins And Ends Only at Home

One of the most-disputed elements in the case is determining how much, if any, damage was done to consumers in the greater Philadelphia area. Much of the plaintiffs’ case rests on pricing anomalies found in the Philadelphia region, where customers are alleged to be paying significantly higher prices for cable service and not enjoying a significant amount of competition. To build that case, lawyers measured cable rates and available competitors in the various counties in and around the city of Philadelphia.

This is also critical for determining the size of the “class” in the class action lawsuit. The larger the class, the greater risk of significant damages if the court rules against the cable company (or if the case reaches a settlement.) Plaintiffs claim their case should include all cable television customers who subscribe or subscribed at any time since December 1, 1999, to the present to video programming services (other than solely to basic cable services) from Comcast, or any of its subsidiaries or affiliates in Comcast‘s Philadelphia cluster.

They specifically defined the cluster as “areas covered by Comcast‘s cable franchises, or any of its subsidiaries or affiliates, located in the following counties: Berks, Bucks, Chester, Delaware, Montgomery and Philadelphia, Pennsylvania; Kent and New Castle, Delaware; and Atlantic, Burlington, Camden, Cape May, Cumberland, Gloucester, Mercer and Salem, New Jersey.”

Comcast counters the geographic market is exactly the size of one, single household. They argue that subscribers can only choose among video providers serving that customer’s specific home, so what cable competition exists in other counties or communities isn’t relevant.

The side effect of such an argument would be the end of a class action case, since the class size would be reduced from a number in the millions to just one, requiring every impacted consumer to file their own case.

The three judge panel was wholly unimpressed with Comcast’s argument, throwing it out and allowing the case to proceed.

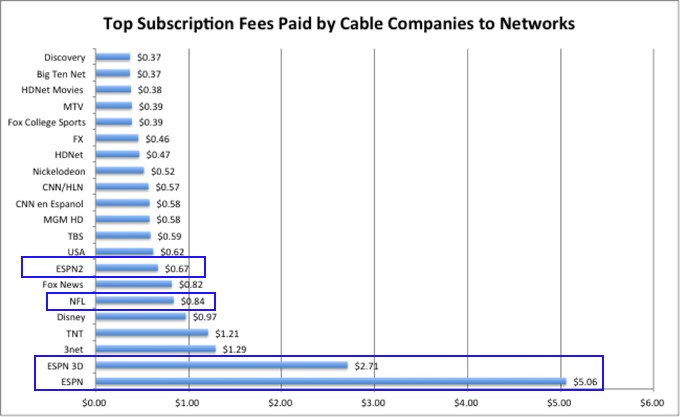

In the last 20 months, some of the biggest names in sports programming including Comcast/NBC, Fox, ESPN, CBS, and Turner have agreed to collectively pay $72 billion in TV rights to air pro, college, and Olympic events over the next decade. Costs are anticipated to soar to $100 billion or more once those contracts come up for renewal.

In the last 20 months, some of the biggest names in sports programming including Comcast/NBC, Fox, ESPN, CBS, and Turner have agreed to collectively pay $72 billion in TV rights to air pro, college, and Olympic events over the next decade. Costs are anticipated to soar to $100 billion or more once those contracts come up for renewal. If you don’t believe him, consider estimates from NPD Group, which predicts the national average for cable TV bills could reach $200 a month as soon as 2020. That is up from the already-high $86 a month customers pay today, after all costs and surcharges are added up.

If you don’t believe him, consider estimates from NPD Group, which predicts the national average for cable TV bills could reach $200 a month as soon as 2020. That is up from the already-high $86 a month customers pay today, after all costs and surcharges are added up. In a defensive move, many cable and satellite companies assume the more live sports a provider offers, the lower the chance a sports enthusiast will consider canceling service.

In a defensive move, many cable and satellite companies assume the more live sports a provider offers, the lower the chance a sports enthusiast will consider canceling service.

Subscribe

Subscribe