Once again, the telecommunications industry is threatening to run to the courts if it faces Net Neutrality regulation, claiming their corporate freedom of speech would be violated by protecting the rights of consumers to access the content of their choice on their terms.

Kyle McSlarrow, President & CEO of the National Cable & Telecommunications Association, the nation’s big cable operator trade association, delivered the warning at yesterday’s appearance at the Media Institute in Washington, DC.

In a speech clearly designed to put regulators on notice, McSlarrow dismissed Net Neutrality as a solution in search of a problem and a concept big cable would likely challenge in the courts.

“When all the dire warnings of the net neutrality proponents are stripped away, there really are no signs of actual harm. Yes, there have been a couple of isolated incidents that keep being held up as examples of what needs to be prevented, but nothing that suggests any threat to the openness of the Internet,” McSlarrow said. “Internet Service Providers do not threaten free speech; their business is to enable speech and they are part of an ecosystem that represents perhaps the greatest engine for promotion of democracy and free expression in history.”

McSlarrow told the audience that the cable industry would be among the victims of Net Neutrality, claiming their rights to transact business on their networks could be trampled by an overzealous Federal Communications Commission.

Almost every net neutrality proposal would seek to control how an ISP affects the delivery of Internet content or applications as it reaches its customers. This is particularly odd for two reasons: First, there is plenty of case law about instances of speech compelled by the government – “forced speech” — that suggests such rules should be scrutinized closely. Second, and perhaps more importantly, it is an almost completely unnecessary risk. All ISPs have stated repeatedly that they will not block their customers from accessing any lawful content or application on the Internet. Competitive pressures alone ensure this result: we are in the business of maximizing our customers’ choices and experiences on the Internet. The counter examples used to debate this point are so few and so distinguishable as to make the point for me.

Beyond the forced speech First Amendment implications, however, net neutrality rules also could infringe First Amendment rights because they could prevent providers from delivering their traditional multichannel video programming services or new services that are separate and distinct from their Internet access service. While the FCC’s NPRM acknowledges the need to carve out “managed” or “specialized” services from the scope of any new rules, it also expresses concerns that “the growth of managed or specialized services might supplant or otherwise negatively affect the open Internet.” Meaning what? Well, the strong implication is some kind of guaranteed amount of bandwidth capacity for services the government deems important.

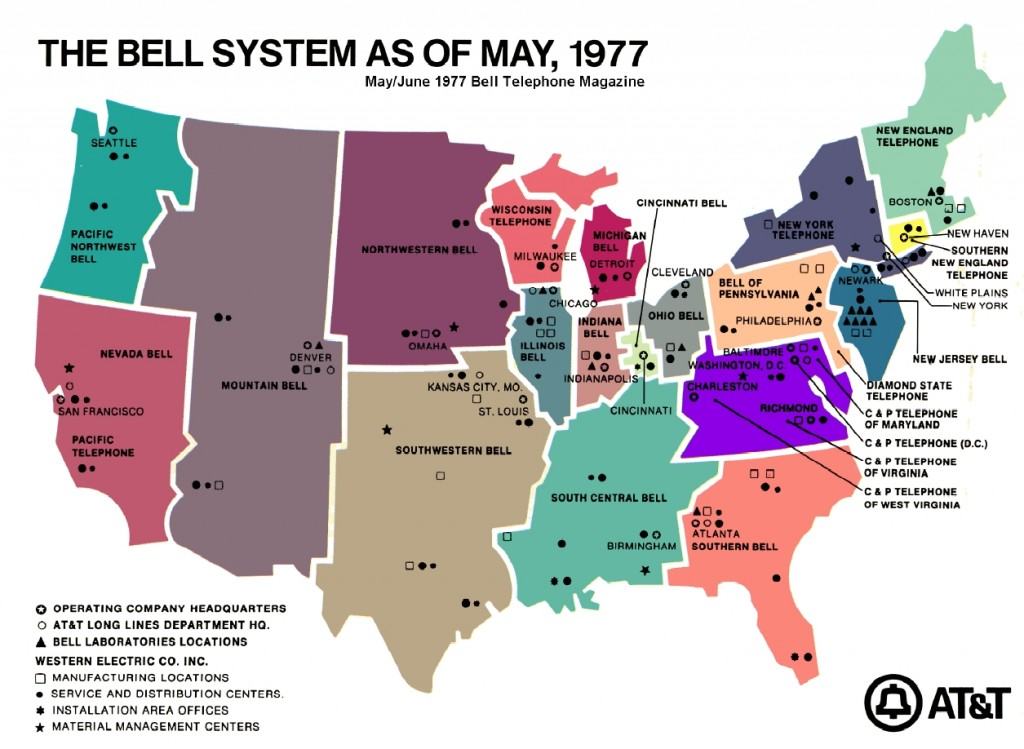

McSlarrow is focused front and center on the rights of providers, not consumers, when he speaks about the First Amendment. His constituents are Time Warner Cable, Cox, Comcast, Charter, and the other NCTA members, namely big cable companies. In his view, any regulation or interference in how providers decide to deliver service is a potential violation of their constitutionally protected rights. That’s a side effect of the nation’s courts recognizing that corporations have rights, too.

McSlarrow predicts a laundry list of ‘doom and gloom’ scenarios that would befall providers if Net Neutrality was enacted:

- Net Neutrality could prevent providers from delivering their traditional multichannel video programming services or new services that are separate and distinct from their Internet access service;

- Net Neutrality would prohibit ISPs and applications providers from contracting for any enhanced or prioritized delivery of that application or content to the ISPs’ customers. Under the proposal, ISPs wouldn’t even be permitted to offer such prioritization or quality-of-service enhancements at nondiscriminatory prices, terms and conditions to anyone who wanted it.

- Net Neutrality may mean that they [content providers] can’t provide material in the enhanced form that they want.

- Net Neutrality could tell a new entrant or an existing content provider that it cannot enter into arrangements with an ISP for unique prioritization or quality of service enhancements that might enable it to enter the marketplace and have its voice heard along with those of established competitors.

McSlarrow doesn’t offer a shred of evidence to prove his more alarmist predictions, even as he demands it from those who support Net Neutrality. The kind of unregulated, non-neutral net McSlarrow advocates already exists in places like Canada. What you see there is what you’ll get here — threats of usage caps unless speed throttles are permitted, arbitrary “network management” that reduces speeds for some services while “enhancing” or “exempting” certain other services (usually those partnered with the provider), and in the end usage caps -and- throttles -and- price increases. In Canada, the story extends beyond the retail broadband market. Wholesale broadband sold to independent ISPs comes nicely throttled and overpriced as well.

McSlarrow maintains a see no evil, hear no evil approach to his provider friends who pay his salary. Comcast’s quiet throttling of peer to peer applicati0ns that blew up into a major scandal when the truth came out was evidently one of the “isolated incidents” he speaks about. That’s only the nation’s largest cable operator — no reason to get bent out of shape about that.

Let’s break down McSlarrow’s concerns and read between the lines:

- Nothing about Net Neutrality impacts on a cable system’s ability to deliver its multichannel video programming. What McSlarrow is hinting at is that cable may end up using some of the same technology that moves online video to your computer to transport television programming to your TV set. AT&T does that today with its U-verse system. It’s basically a fat broadband pipe over which television, telephone, and broadband service travels together over a single pair of wires. There is no demand that broadband must usurp your cable television package.

- McSlarrow is trying to be clever when he describes “new services” that he defines as separate and distinct from Internet access service. That usually includes “digital phone” products which providers already exempt from usage limits imposed on competitors like Vonage. If “network management” throttles Vonage while exempting the cable system’s own phone product, is that fair? What about the forthcoming TV Everywhere? Could a provider throttle the speed of Hulu while exempting its own online television service? What happens if a provider’s own service is exempted from these throttles and can deliver a higher quality picture because of that exemption?

- “Bandwidth is not infinite.” That’s something I’ve heard providers argue for more than a year complaining about their congested networks and why they need to impose controls to “manage them.” McSlarrow wants providers to be able to “manage” those networks by selling enhanced speeds for applications that partner with the provider. Unfortunately, because cable broadband is a shared resource, those premium enhanced speeds will consume a larger share of that resource, naturally slowing down everyone else who didn’t agree to pay. Providers will say they are not ‘intentionally’ slowing down the free lane, but that’s a distinction without a difference to the consumer who will find many of their websites slower to access.

- Today’s model asks consumers to make the ultimate choice. If they want a faster online experience, they can purchase a faster tier of service. Now providers want to change that by establishing a nice protection racket — pay us for “enhanced speeds” or your content may not reach your customers at a tolerable rate of speed.

- It’s ironic McSlarrow is suddenly crying about how unfair it is content providers can’t purchase these “enhanced services.” That’s a change of tune from an industry that used to accuse the large number of content providers who support Net Neutrality as freeloaders trying to use “their pipes for free.”

Customer demand for higher speeds and more reliable service should be all the impetus the cable industry needs to deliver quality service, particularly considering consumers pay a lot of money for the service and remain loyal to it.

McSlarrow’s final argument is a testament to the arrogance of the cable industry on the issues that concern subscribers. A-la-carte channel choice, equipment options and expenses, usage limits, rate increases, and service standards are all issues this industry has fought with regulators about. What customers want is secondary, and can remain that way as long as consumer choice is kept limited. McSlarrow’s valiant defense of the rights and freedoms of the cable industry to offer extra freedom of speech through enhanced speed-privileges to content partners is more important to him and his provider friends than the rights of customers to not have their service artificially degraded to make room for even bigger cable profits.

Subscribe

Subscribe