The ex-CEO of Shaw Communications is a charter member of the 1% Club, raking in more than $25 million from a golden parachute retirement package cable customers are paying as part of their ever-increasing monthly cable bills.

Jim Shaw earned $1.2 million in 2011 from his duties as chief executive. But when the 53-year old decided early retirement was right for him, the company that shares his name provided a generous $25.5 million parting gift. That’s a golden parachute package equivalent to what more than 2,000 lower-middle class Canadians earn each year.

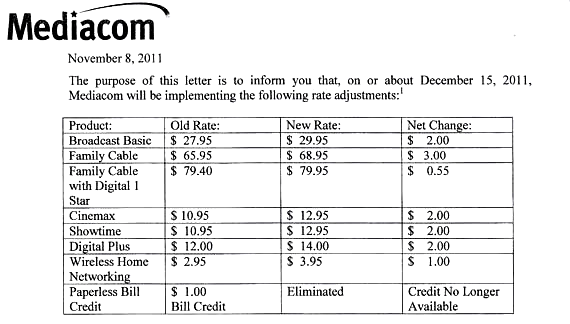

What makes Jim Shaw worth that much? Company officials claim the departing CEO helped the company earn new revenue. But Shaw subscribers know the recipe for higher revenue is easy to make — annual rate increases and overpriced products and services.

Shaw didn’t have much of a fight justifying his departing pay package. Not with his father J.R. Shaw holding 79 percent of the cable company’s Class A voting stock. The Shaw family has been especially generous with themselves in 2011. Brother Brad pocketed $15.8 million this year for himself.

The Shaw Executive Money Party has grown so large, the company’s top six paid officers collectively walked away with compensation of $82.2 million in 2011, $1.5 million more than Shaw Communications earned in the entire fourth quarter of 2010. Imagine one-quarter of your company’s earnings headed straight into the pockets of a half-dozen employees, often immediate family members of the CEO or company founder.

Even those sums are dwarfed by the $330 million the company has now set aside to guarantee executive pensions, even as Shaw’s lower level employees (and most of their customers) see their incomes continue to stagnate, if not outright decline.

That three Shaw family members collectively grabbed $58.6 million from the company accounts is not welcome news for shareholders. Jim Shaw’s exit package in particular proved galling for some, particularly because he effectively sabotaged his own standing with image-damaging public comments and an abrasive management style.

That three Shaw family members collectively grabbed $58.6 million from the company accounts is not welcome news for shareholders. Jim Shaw’s exit package in particular proved galling for some, particularly because he effectively sabotaged his own standing with image-damaging public comments and an abrasive management style.

“There was a lot of institutional backlash over the pension given to Jim on his departure because it was rather monstrous,” one pension fund adviser was reported as saying in the Edmonton Journal. “This is just another piece that will get everybody upset.”

Shareholders are also unimpressed with the value of their Class B Shaw stock, which has remained lackluster since 2006.

While top management earned big, Shaw has alienated customers with legendary call holding times that can extend for hours, annual rate increases for cable service, and less-than-impressive customer satisfaction scores.

Shaw is western Canada’s dominant cable operator.

Subscribe

Subscribe