“Hey look, is that the Verizon FiOS truck?”

New York City comptroller Scott Stringer is lukewarm at best about the idea of Comcast taking over for Time Warner Cable. In a letter to the New York Public Service Commission released today, Stringer says the deal needs major changes before it comes close to serving the public interest.

“As New York City residents know all too well, our city is stuck in an Internet stone age, at least when compared to other municipalities across the country and around the world,” Stringer wrote. “According to a study by the Open Technology Institute at the New America Foundation, New Yorkers not only endure slower Internet service than similar cities in other parts of the world, but they also pay higher prices for that substandard service. Tokyo residents enjoy speeds that are eight times faster than New York City’s, for a lower price. And Hong Kong residents enjoy speeds that are 20 times faster, for the equivalent price.”

Stringer should visit upstate New York some time. While the Big Apple is moving to a Verizon FiOS and Time Warner Cable Maxx or Cablevision/Optimum future, upstate New York is, in comparison, Raquel Welch-prehistoric, especially if your only choice is Verizon “No, We Won’t Expand DSL to Your House,” or Frontier “3.1Mbps is Plenty” Communications. If New York City’s speeds are slow, upstate New York speeds are glacial.

“The latest data from the FCC shows that, as of June 30, 2013, over 40 percent of connections in New York State are below 3Mbps,” Springer added.

Come for the Finger Lakes, but don’t stay for the broadband.

Should the merger be approved, Comcast would be obligated to comply with the existing franchise agreement between Time Warner Cable and the City of New York. However, in order for the proposed merger to truly be in the public interest, Comcast must have a more detailed plan to address these ongoing challenges and to further close the digital divide that leaves so many low-income New Yorkers cut off from the information superhighway. To date, Comcast’s efforts to close the digital divide have focused on its “Internet Essentials” program, which was launched in 2012.iii The program offers a 5 megabit/second connection for $9.95/month (plus tax) to families matching all of the following criteria:

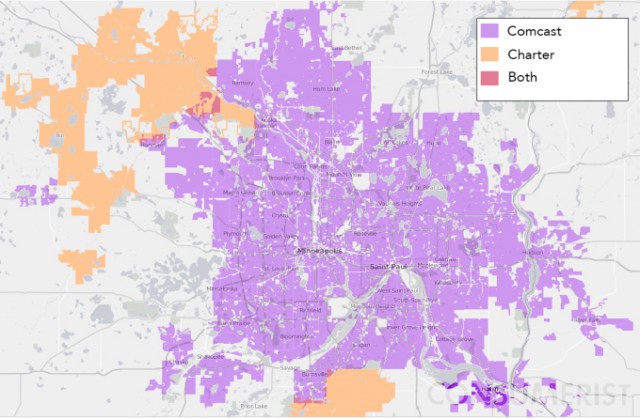

• Located within an area where Comcast offers Internet service

• Have at least one child eligible to participate in the National School Lunch Program

• Have not subscribed to Comcast Internet service within the last 90 days

• Does not have an overdue Comcast bill or unreturned equipmentWhile the aim of the program is laudatory, its slow speed, limited eligibility, and inadequate outreach have kept high-quality connectivity beyond the reach of millions of low-income Americans. Not only are the eligibility rules for Internet Essentials far too narrow, but the company has done a poor job of signing up those who do meet the criteria. In fact, only 300,000 (12 percent) of eligible households nationwide have actually signed up since the program was launched in 2011.

It is critical that the PSC not only press Comcast to significantly expand the reach of Internet Essentials, but also that it engage in appropriate oversight to ensure that the company is meeting its commitments to low-income residents of the Empire State.

Phillip “Comcast isn’t the answer, it’s the problem” Dampier

In fact, the best way New York can protect its low-income residents is to keep Comcast out of the state. Time Warner Cable offers everyday $14.99 Internet access to anyone who wants it as long as they want it. No complicated pre-qualification conditions, annoying forms, or gotcha terms and conditions.

When a representative from the PSC asked a Comcast representative if the company would keep Time Warner’s discount Internet offer, a non-answer answer was the response. That usually means the answer is no.

“We have seen how telecommunications companies will promise to expand access as a condition of a merger, only to shirk their commitments once the merger has been approved,” Springer complained. “For instance, as part of its 2006 purchase of BellSouth, AT&T told Congress that it would work to provide customers ‘greater access and more choices for broadband, no matter where they live or work.’ However, later reports found that the FCC relied on the companies themselves to report their own merger compliance and did not conduct independent audits to verify their claims.”

Big Telecom promises are like getting commitments from a cheating spouse. Never trust… do verify or throw them out. Comcast still has not met all the conditions it promised to meet after its recent merger with NBCUniversal, according to Sen. Al Franken (D-Minn.).

Stringer also blasted Comcast for its Net Neutrality roughhousing:

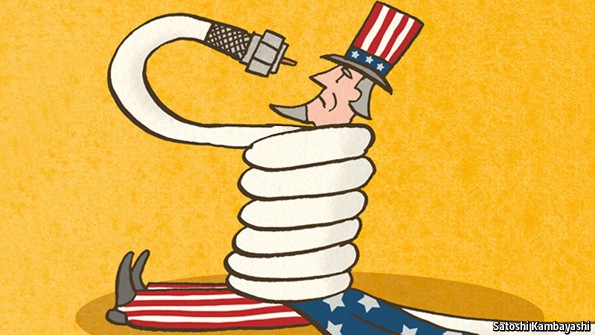

While the FCC has not declared internet providers to be “common carriers”, state law has effectively done so within the Empire State. Under 16 NYCRR Part 605, a common carrier is defined as “a corporation that holds itself out to provide service to the public for hire to provide conduit services including voice, data, or video by electrical, electronic, electromagnetic or photonic means.”

Importantly, the law requires these carriers to “provide publicly offered conduit services on demand to any similarly situated user on substantially similar terms, subject to the availability of facilities and capacity.”

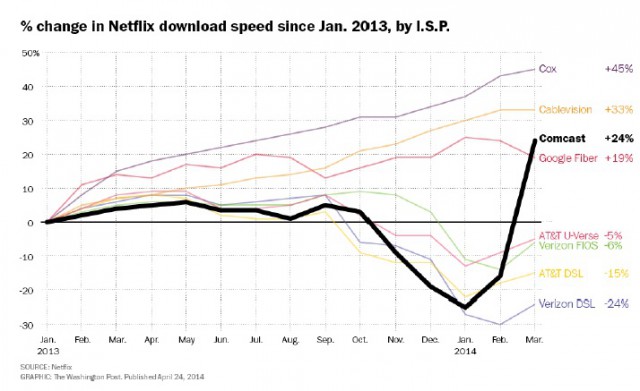

In recent months, Comcast has shown that it is willing to sacrifice net neutrality in order to squeeze additional payment out of content providers, such as Netflix. As shown in the chart below, Netflix download speeds on the Comcast network deteriorated rapidly prior to an agreement whereby Netflix now pays Comcast for preferential access.

Consumers have a legitimate fear that if access to fiber-optic networks is eventually for sale to the highest bidder, then not only will it stifle the entrepreneurial energy unleashed by the democratizing forces of the Internet, but will also potentially lead to higher prices for consumers in accessing content. Under that scenario, consumers are hit twice—first by paying for Internet access to their home and second by paying for certain content providers’ preferred access.

Internet neutrality has been a core principle of the web since its founding and the PSC must examine whether Comcast’s recent deal with Netflix is a sign that the company is eroding this principle in a manner that conflicts with the public interest.

Stringer may not realize Comcast also has an end run around Net Neutrality in the form of usage caps that will deter customers from accessing competitors’ content if it could put them over their monthly usage allowance and subject to penalty rates. Comcast could voluntarily agree to Net Neutrality and still win by slapping usage limits on all of their broadband customers. Either causes great harm for competitors like Netflix.

“I urge the Commission to hold Comcast to that burden and to ensure that the merger is in the best interest of the approximately 2.6 million Time Warner Cable subscribers in New York State and many more for whom quality, affordable Internet access remains unavailable,” Stringer writes. “And I urge Comcast to view this as an opportunity to do the right thing by introducing itself to the New York market as a company that values equitable access and understands that its product—the fourth utility of the modern age—must be available to all New Yorkers.”

If Comcast’s existing enormous customer base has already voted them the Worst Company in America, it is unlikely Comcast will turn on a dime for the benefit of New York.

The best way to ensure quality, affordable Internet access in New York is to keep Comcast out of New York.

No cable company has ever resolved the rural broadband problem. Their for-profit business model depends on a Return on Investment formula that prohibits expanding service into unprofitable service areas.

These rural service problems remain pervasive in Comcast areas as well, and always have since the company took over for AT&T Cable in the early 2000s. Little has changed over the last dozen years and little will change in the next dozen if we depend entirely on companies like Comcast to handle the rural broadband problem.

A more thoughtful solution is encouraging the development of community co-ops and similar broadband enterprises that need not answer to shareholders and strict ROI formulas.

In the meantime, for the good of all New York, let’s keep Comcast south (and north) of the border, thank you very much.

Subscribe

Subscribe

Powell and others made certain that Internet Service Providers would not be classified as “common carriers,” which would require them to rent their broadband pipes at a reasonable wholesale rate to competitors. The industry and their well-compensated friends in the House and Senate argued such a status would destroy investment in broadband expansion and innovation. Instead it destroyed the family budget as prices for mediocre service in uncompetitive markets soared. Today, consumers in common carrier countries including France and Britain pay a fraction of what Americans do for Internet access, and get faster speeds as well.

Powell and others made certain that Internet Service Providers would not be classified as “common carriers,” which would require them to rent their broadband pipes at a reasonable wholesale rate to competitors. The industry and their well-compensated friends in the House and Senate argued such a status would destroy investment in broadband expansion and innovation. Instead it destroyed the family budget as prices for mediocre service in uncompetitive markets soared. Today, consumers in common carrier countries including France and Britain pay a fraction of what Americans do for Internet access, and get faster speeds as well. While regulators sort through the thicket of fine print that keeps hundreds of thousands of families from qualifying for Comcast’s $9.95 Internet Essentials affordable Internet program, a much simpler offer has emerged that doesn’t work overtime to protect Comcast’s broadband revenue from being cannibalized. In short, regulators don’t need to cut deals to expand programs like Internet Essentials in return for saddling residents with America’s “worst cable company.” There are alternatives.

While regulators sort through the thicket of fine print that keeps hundreds of thousands of families from qualifying for Comcast’s $9.95 Internet Essentials affordable Internet program, a much simpler offer has emerged that doesn’t work overtime to protect Comcast’s broadband revenue from being cannibalized. In short, regulators don’t need to cut deals to expand programs like Internet Essentials in return for saddling residents with America’s “worst cable company.” There are alternatives.