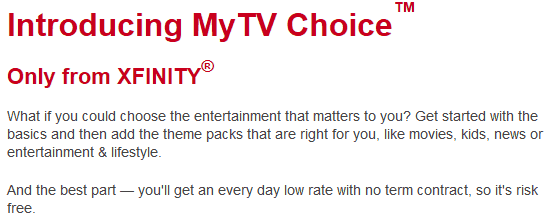

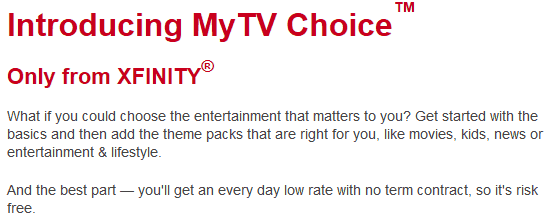

Cable subscribers paying ever-increasing television bills for hundreds of channels they never watch may find some relief if Comcast decides its experiment in “a-la-carte” cable-TV is a success.

Cable subscribers paying ever-increasing television bills for hundreds of channels they never watch may find some relief if Comcast decides its experiment in “a-la-carte” cable-TV is a success.

The company is testing a new way of selling service that delivers a basic package of channels for a lower price and then offers customers bouquets of add-on channels sold in “theme packs” for $10 apiece.

Comcast is testing what it calls MyTV Choice in parts of Connecticut, Massachusetts, Vermont and Charleston, South Carolina, and plans to expand it to the Seattle area soon.

Here’s how MyTV Choice works:

Customers start with a basic package of channels that Comcast calls “Get Started” ($24.95) or “Get Started Plus,” which sells for $44.95 a month.

What differentiates the two options are the networks they contain. Inexpensive cable networks turn up in Get Started — A&E, Discovery, C-SPAN, Animal Planet, Daystar, Food Network, home shopping, and The Weather Channel are among the 32 channels that accompanies a basic package of local channels.

Get Started Plus includes all of those networks plus sports — the budget-busting networks that help keep cable bills growing. ESPN and other regional sports channels are included in the more expensive package.

Get Started Plus includes all of those networks plus sports — the budget-busting networks that help keep cable bills growing. ESPN and other regional sports channels are included in the more expensive package.

Missing from the basic package of channels are kids shows, news, movies, and niche networks. That’s where Comcast’s “Choice” packs come into play. Customers can add a 19-channel News & Info pack, 31-channel Entertainment & Lifestyle pack, 16-channel Movie pack, and/or an 11-channel Kids pack for $10 each.

That’s where the “choice” ends. Customers cannot skip the basic channel package to select only one of the theme packages, individual channels are not for sale, and anywhere outside of Charleston, customers also have to buy phone and Internet service from Comcast. HD also costs extra.

So much for a lower bill.

In fact, Comcast sells a digital cable package incorporating a full lineup of basic cable channels for just under $60. If your family loves sports, has kids, and needs news channels, sticking with the digital cable package is actually cheaper than MyTV Choice. That’s because the latter will require a $44.95 base package, plus three theme packs for an additional $30 a month.

Comcast denies their experimental a-la-carte package has anything to do with cord-cutting Internet viewers.

Comcast denies their experimental a-la-carte package has anything to do with cord-cutting Internet viewers.

“It’s more or less responding to feedback from customers that they want more choice,” Comcast spokesman Bill Ferry told the Post & Courier.

While Ferry and others argue the pay-per-channel is not economically feasible, Christopher C. King, a telecom analyst for Stifel Nicolaus in Baltimore told the newspaper that is the trend.

“Certainly the industry’s moving more toward an a la carte model,” King said.

Theme-packs are not a new concept for some pay television viewers. In the 1980s and 1990s, consumers owning large 6-to-12 foot satellite dishes routinely encountered the channel bouquet concept. Customers would purchase a basic package and then select from a dozen or more mini-tiers, usually made up of networks owned by one company. Want TBS and TNT? Turner Broadcasting sold an add-on with those two channels. Wanted a superstation package? Channels uplinked by cable companies like TCI from Denver could be purchased as a small package. So could stations like WSBK in Boston, WWOR and WPIX in New York, KTVT in Dallas and KTLA in Los Angeles.

Comcast has “simplified” things with a much smaller set of choices. But that also dramatically limits any potential savings.

The concept of a-la-carte cable horrifies cable companies and their Wall Street shareholders, because a true “pay-per-channel” offer would dramatically cut the average revenue earned per subscriber if customers took a hatchet to the bloated channel packages most customers receive today.

Cable operators have resisted the concept because every channel would have to be encrypted to sell individually, billing would become more complicated, and the business model of niche-oriented networks supported by more popular fare would end. That’s why programmers hate the idea as well. While A&E, TNT, and CNN would have no trouble surviving, networks like Current TV, TV One, Hallmark, Cloo, and LOGO probably would not.

More importantly, many subscribers might find savings elusive from a-la-carte, because the most expensive cable programming networks also happen to be among the most popular. ESPN and Fox News Channel, for example, have dramatically increased their rates to cable companies, who helpfully pass them along to you. But if cable operators suddenly stripped those networks out of basic packages, while leaving the much cheaper networks together in broad-based theme packages like “lifestyle and entertainment,” subscribers may howl in protest or accuse the cable operator of playing politics.

It gets even harder when the cable companies selling the big packages of channels customers never watch also happen to own some of the networks found within those packages. Comcast shareholders may not like the cable side of the business kicking lucrative NBC-owned and operated cable networks like The Weather Channel, USA, E!, Cloo, and other owned networks to a-la-carte Siberia. Every cable subscriber pays for Cloo and E! today. How many will choose to pay for those networks under an “a-la-carte” model is an open question.

Only two cable operators have expressed an interest in switching to a true, a-la-carte model to date — Suddenlink and Mediacom — both small, regional players that have no programming interests and lack sufficient buying power to score the kinds of discounts available to companies like Comcast and Time Warner Cable — discounts they can have if they agree to keep as many channels bundled in one digital cable package as possible.

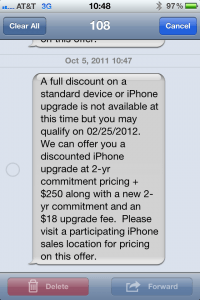

Stop the Cap! reader Wayne A. dropped us a line to let us know Comcast has been getting very aggressive in the Denver area, poaching CenturyLink customers with enormous discounts:

Stop the Cap! reader Wayne A. dropped us a line to let us know Comcast has been getting very aggressive in the Denver area, poaching CenturyLink customers with enormous discounts: If you are paying Comcast more, it may be time to pick up the phone and threaten to walk unless you can have the same deal. We’ve found dealing with customer retentions to be a real “your results may vary”-experience. Don’t be willing to take the first offer. Don’t be afraid to dismiss weak deals with a non-committal “I’ll think about it” if the price is not right for you. Then call back.

If you are paying Comcast more, it may be time to pick up the phone and threaten to walk unless you can have the same deal. We’ve found dealing with customer retentions to be a real “your results may vary”-experience. Don’t be willing to take the first offer. Don’t be afraid to dismiss weak deals with a non-committal “I’ll think about it” if the price is not right for you. Then call back. week or two out, and wait by the phone. You can keep your service running while company representatives try to convince you to stick with them. Just make sure you answer those unfamiliar Caller ID-calls — it’s probably the cable company. Most will ask why you disconnected. If you answer “price,” the deals start coming.

week or two out, and wait by the phone. You can keep your service running while company representatives try to convince you to stick with them. Just make sure you answer those unfamiliar Caller ID-calls — it’s probably the cable company. Most will ask why you disconnected. If you answer “price,” the deals start coming.

Subscribe

Subscribe