Some of AT&T’s prepaid GoPhone customers are howling over the company’s “new and improved” data packages that now require customers to purchase a qualified voice package if they also want affordable wireless data.

Some of AT&T’s prepaid GoPhone customers are howling over the company’s “new and improved” data packages that now require customers to purchase a qualified voice package if they also want affordable wireless data.

AT&T’s press release:

AT&T today announced the following new data packages with double the data or more for the same price for GoPhone customers, available April 22.

- 1GB for $25

- 200MB for $15

- 50MB for $5

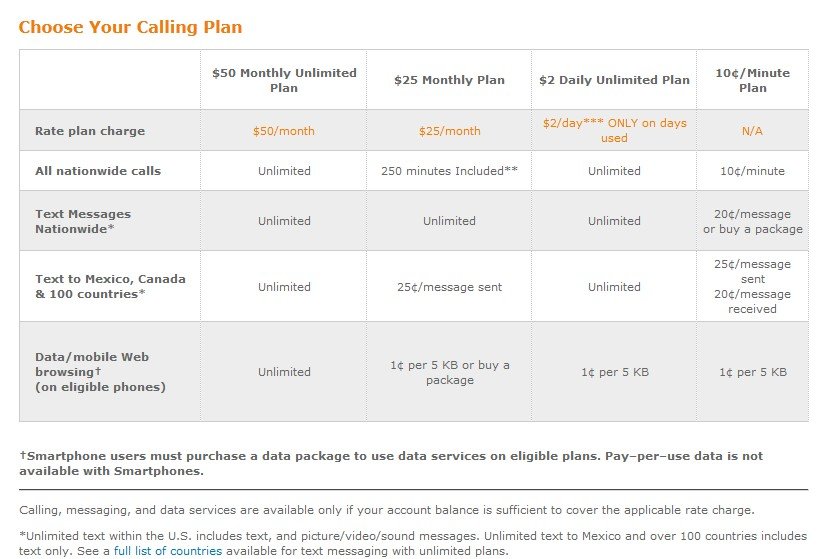

All data packages are available on the $50 Unlimited Talk & Text nationwide plan for GoPhone smartphones and the $25 Unlimited Text with 250 minutes nationwide GoPhone plan.

At first glance the new data plans seem to offer double the data allowance of AT&T’s older plans, which were available to any prepaid customer who wanted to avoid AT&T’s default data rate: 1 cent per 5KB. While that amount seems tiny, in fact it’s not. A gigabyte of usage without a data plan costs over $2,000. That is quite an incentive to enroll in one of AT&T’s data packages.

Only now AT&T’s most value-conscious customers can’t.

AT&T’s “new and improved” prepaid plans now require customers to first enroll in a $25 or $50 voice plan before they are allowed to purchase a data package. That leaves AT&T’s “pay as you go” customers out in the cold.

A customer used to spending $15 a month on a data package with a 10c per voice minute plan with no daily access fee will now pay at least $50. The required 250 minute voice plan with unlimited text runs $25 a month. The data package costs an additional $25.

Rory Smith called that “rubbish.”

“Effectively this makes the service completely useless as I only need a small amount of data and rarely use my phone for voice calls or SMS messages,” Smith wrote.

“By doing this they are requiring you to enter a talk plan and pay for minutes you will never use, all just to force consumers into paying more,” another customer remarked. “It really seems like AT&T is trying to squeeze every penny they can out of their prepaid plans.”

Some analysts worry AT&T’s quest for data profits are pricing them out of the prepaid data-only market.

Current Analysis analyst Deepa Karthikeyan wrote in a report that AT&T will likely prompt customers to start shopping around and they are likely to encounter daily plan options that deliver somewhat better pricing at rival carriers. Daily plan customers typically want the cheapest plan possible so they can pay a-la-carte for the specific features that interest them. AT&T’s move forces customers to pay a $25 entry fee just to qualify for a data plan, which in some cases is the only reason the customer has the phone.

Some of AT&T’s competitors with comparable plans:

- T-Mobile: $3/day Pay As You Go – First 200MB at 3G speed -or- $30 up to 5GB at 4G speed plus 100 minutes, unlimited texting

- Virgin Mobile: $35 up to 2.5GB data, 300 minutes, unlimited texting

- Verizon: $50 unlimited talk, texting, minutes

- Straight Talk: $45 unlimited talk, texting, 2GB data with roaming on small GSM carriers

- Red Pocket: $60 unlimited talk, texting, 2GB data and 200 international minutes

- H20 Wireless: $60 unlimited talk, texting, 1GB data and $10 international calling

Subscribe

Subscribe