Frontier Communications has confirmed a Stop the Cap! exclusive report that the company has shown an interest in a licensing arrangement with AT&T to deliver U-verse to Frontier customers in larger markets.

Frontier Communications has confirmed a Stop the Cap! exclusive report that the company has shown an interest in a licensing arrangement with AT&T to deliver U-verse to Frontier customers in larger markets.

Maggie Wilderotter, CEO of Frontier Communications today told investors on a morning conference call that the company likes the U-verse product and is considering deploying it.

“We’ve been evaluating a lot of other alternatives of which U-verse is one of the alternatives,” Wilderotter said. “We think it’s a product that can work, not just on fiber, but it also works on copper as well. So it’s a lot more forgiving in the market.”

Wilderotter claimed the company has no immediate plans to introduce the technology, but Stop the Cap! has obtained documentation that shows the company now refers specifically to “U-verse” in internal communications, is hiring new leadership to oversee the company’s IPTV plans, and has plans to dramatically expand VDSL technology, a prerequisite for deploying AT&T’s fiber to the neighborhood platform.

Frontier Communications has had a difficult time supporting its Verizon-inherited FiOS fiber-to-the-home networks in the Pacific Northwest and Indiana. The company has found itself unable to compete effectively in the video business because it negotiates programming contracts independently, which locks Frontier out of the volume discounts that other independent providers routinely receive from participating in programming purchasing co-ops. Frontier lost 4,800 FiOS video customers in the last quarter alone.

Wilderotter said as a result of programming costs, Frontier has no plans to pursue any additional fiber expansion to deliver video programming.

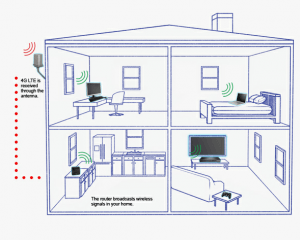

However, a licensing arrangement with AT&T U-verse could open the door to Frontier receiving the same volume discount prices for programming that AT&T already receives as part of its own operations. Because Frontier would have to significantly upgrade its existing, primarily middle-mile fiber network to reduce the amount of copper wiring in its network, the company faces significant capital investment costs wherever it chooses to deploy the more advanced broadband network.

Wilderotter hinted Frontier’s plans for the enhanced technology would be limited to a handful of cities.

“It doesn’t make sense in all of our markets,” she said. “It’s only a handful of markets other than where we have FiOS today. So there’s more to come on that over time. Video is very important. We think over the top video is probably more important than anything else.”

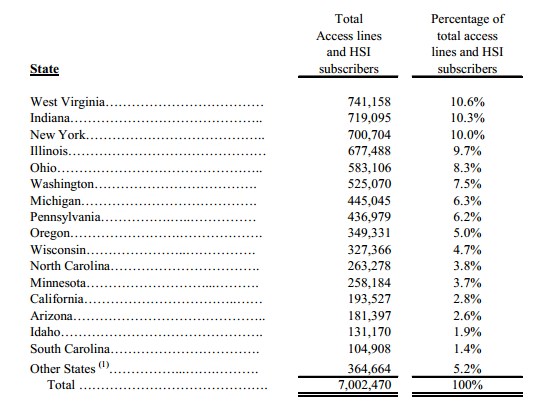

The most likely target for any IPTV expansion would be Frontier’s western New York operation in and around Rochester, where the company currently competes against Time Warner Cable with a mediocre DSL product that can no longer compete with the cable operator’s superior speeds and pricing promotions. Frontier is steadily losing market share in most of its more-populated service areas.

Other likely targets for expanded broadband include larger cities in Pennsylvania, Illinois, West Virginia, and California.

Chief Operating Officer Daniel McCarthy added Frontier also has plans to improve broadband speeds in most of its service areas.

“We’ve been working pretty steadily to improve the core network around the country,” McCarthy said. “You’ll see us aggressively move forward with sort of VDSL and bonded ADSL2 copper.”

Currently, Frontier only informally offers bonded service to residential customers in very limited areas, notably in parts of the Genesee Valley in western New York. The company has been marketing an extra line of traditional ADSL service to customers elsewhere who want more broadband capacity, but that requires a second broadband modem and delivers no speed improvements.

Frontier’s time frame to deploy enhanced speeds in within 12-24 months, according the company officials.

In other developments, Frontier Communications customers formerly served by Verizon will likely find themselves choosing new service plans as Frontier prepares to migrate customers away from legacy Verizon service packages.

Wilderotter telegraphed that affected Frontier customers will see some rate increases when the new plans become effective.

“We do think that there is a pretty substantial revenue upside,” Wilderotter said. “We think the net-net is we’ll get customers on the right portfolio of products that will also be revenue enhancing for the company and we’re going to surround the products with the right kind of service experience, both online and off-line. We’re redesigning all of our online product sets for a better customer experience so they can manage their own broadband usage and actually upgrading or changing what they do with broadband themselves, if in fact, they want to do that.”

Subscribe

Subscribe