Think your wireless service contract ties you down?

Think your wireless service contract ties you down?

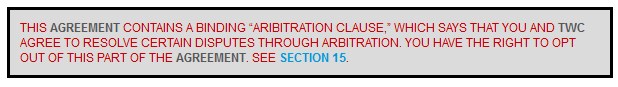

More than 500 Canadians filed comments about their wireless service with the Canadian Radio-television and Telecommunications Commission as the telecom regulator wrestles with a proposed code of conduct for Canada’s wireless industry and the contracts they hand customers. Why? Because of language like this from a typical contract with Rogers Communications:

Device Savings Recovery Fee (applicable to term commitment customers only for any new term entered into on or after January 22, 2012): A Device Savings Recovery Fee (DSRF) applies if you have been granted an Economic Inducement (as defined below) upon entering your new term, and if, for any reason, your wireless service or your new term is terminated prior to the end of the term of your Service Agreement (Service Agreement Term). The DSRF is the amount of the economic inducement (which may take the form of a discount, rebate or other benefit granted on the price of your Equipment), as stated in your Service Agreement (Economic Inducement), less the amount obtained by multiplying such Economic Inducement by a fraction representing the number of months elapsed in your Service Agreement Term as compared to the total number of months of your Service Agreement Term (plus applicable taxes). In other words, DSRF = Economic Inducement [Economic Inducement × (# months elapsed in your Service Agreement Term ÷ Total # months in your Service Agreement Term)] + applicable taxes. An Additional Device Savings Recovery Fee (ADSRF) also applies if, for any reason, your wireless data service, or your data plans commitment term (Data Term), is terminated prior to the end of your Data Term. An Additional Device Savings Recovery Fee (ADSRF) also applies if, for any reason, your wireless data service, or your data plans commitment term (Data Term), is terminated prior to the end of your Data Term. The ADSRF is the additional Economic Inducement you received for subscribing to your wireless data service, less the amount obtained by multiplying such Economic Inducement by a fraction representing the number of months elapsed in your Data Term as compared to the total number of months of your Data Term (plus applicable taxes), and applies in addition to the DSRF for termination of your Service Agreement. If you subscribe to a plan combining both voice and data services, both the DSRF and the ADSRF apply, up to the total Economic Inducement.

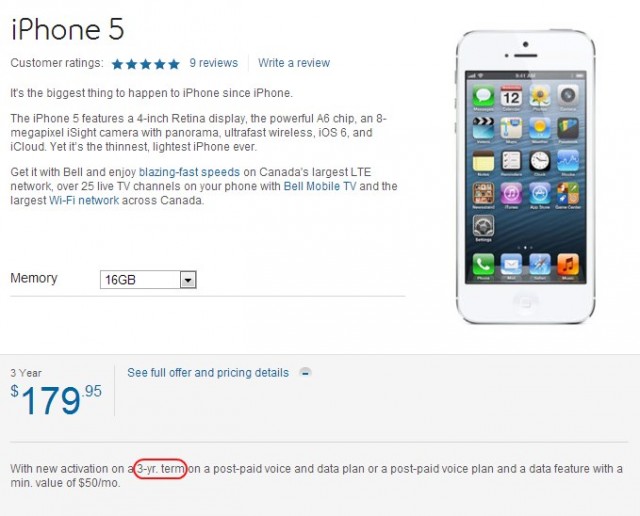

Despite contract confusion being an issue in the eyes of the CRTC, the overwhelming majority of comments focused on something else that irks Canadians above all else: being held hostage by the industry’s traditional 36-month wireless contract, one year longer than consumers in the United States find common.

“Get rid of the 36 months contract,” wrote one Canadian, noting contract creep is all the rage. “It first started with 12 months, then 24 months, now the standard is 36 months, which is ridiculous!”

Most of the comments came from customers of the chief three providers: Bell, Rogers, and Telus. All three received scorn from customers for uncompetitive, expensive service.

The state of competition in Canada:

Roger offers new plans:

– $55 1000min local, unlimited text, 200MB

– $65 unlimited local/text, 1GB

– $75 unlimited local/text, 2GB

– $95 unlimited canada/text, 5GBThen Bell offers their new competitive plans:

– $55 1000 min local, unlimited text, 200MB

– $65 unlimited local/text, 1GB

– $75 unlimited local/text, 2GB

– $95 unlimited canada/text, 5GBThen Telus offers their competitive plans:

– $70 unlimited local/text, 1GB

– $80 unlimited local/text, 3GB

– $100 unlimited canada/text, 5GBWhere is the competition? These plans are all the same.

Also unfamiliar to Americans, the automatically-renewing contract that snags Canadians that forget to cancel with a brand new service commitment complete with a cancellation penalty. Perhaps the most consumer-friendly provinces in Canada are Quebec and Manitoba, which ban certain kinds of termination fees and auto-renewing contracts. Canadians want these bans extended nationwide. The European Union already bans 36 month contracts and made 24 months the maximum. One former resident of the United Kingdom noted the EU also compels providers to offer 12 month contracts for those who want them.

Also unfamiliar to Americans, the automatically-renewing contract that snags Canadians that forget to cancel with a brand new service commitment complete with a cancellation penalty. Perhaps the most consumer-friendly provinces in Canada are Quebec and Manitoba, which ban certain kinds of termination fees and auto-renewing contracts. Canadians want these bans extended nationwide. The European Union already bans 36 month contracts and made 24 months the maximum. One former resident of the United Kingdom noted the EU also compels providers to offer 12 month contracts for those who want them.

The CRTC may not provide much relief if it remains convinced the marketplace remains competitive.

The agency points out under the Telecommunications Act, the CRTC will only intervene in a market if there is insufficient competition to protect the interests of users. In the 1990s the CRTC decided to allow market forces to guide the growth of the mobile wireless industry.

The CRTC seems to have already made up its mind on this issue when it announced its proceeding:

In the decision issued on 11 October 2012, the CRTC found that there was competition sufficient to protect the interests of consumers and it did not need to regulate rates. Although many consumers indicated concerns about wireless rates and the competitiveness of the wireless market, a number of market indicators demonstrate that consumers have a choice of competitive service providers and a range of rates and payment options for mobile wireless services. According to the CRTC’s 2012 Communications Monitoring Report, new entrants in the mobile wireless market continue to increase their market share and coverage. Companies continue to invest in new infrastructure to bring new innovative services to more Canadians. Moreover, the average cost per month for mobile wireless services has remained relatively stable.

The CRTC concluded that competition in the mobile wireless market continues to be sufficient to protect the interests of users with respect to rates and choice of competitive service provider.

That makes it more likely than not the agency will limit itself to ordering wireless carriers to better explain their wireless policies, not force them to change them.

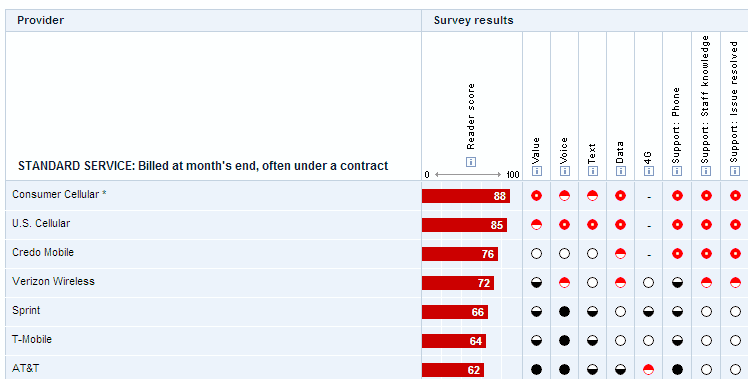

The only relief potentially available outside of canceling service is considering one of several new competitors which offer relaxed terms and better prices to attract customers. So far, only 4% of Canadians have switched to WIND, Mobilicity, Vidéotron, or Public Mobile. Some may be trapped in current contracts with larger companies or are discouraged having to buy new equipment to switch providers. Most providers in Canada, like in the United States, lock phones so they cannot be easily used on another company’s network.

[flv width=”640″ height=”380″]http://www.phillipdampier.com/video/CRTC Cell Phone Contracts 12-12.flv[/flv]

The CRTC used this video to invite consumers to share comments about confusing wireless service contracts. Instead, criticism of tricky term contracts that auto-renew and last three years arrived in buckets. (2 minutes)

Subscribe

Subscribe