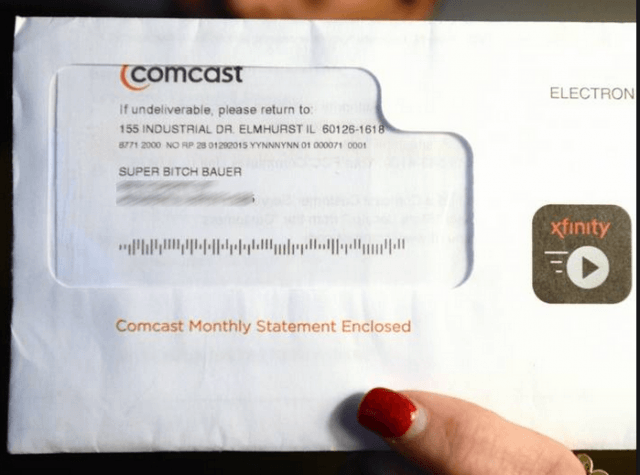

Comcast changed the name of this customer to “Super Bitch Bauer” in their billing records after she complained about poor service.

Getting a firm deal from Comcast on a promotion or retention package has become increasingly difficult as the company points to terms and conditions in its contract that allow it to adjust pricing of equipment, service fees and surcharges at will.

One Broadband Reports reader signed up for a Comcast Double Play promotion that appeared to be a great deal until it turned into a major headache.

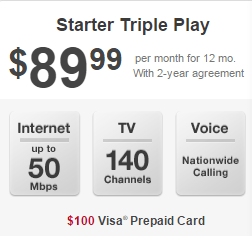

What Comcast promised:

- 105Mbps Extreme Internet plus Preferred 220 digital-channel TV package with free HBO price-locked for 24 months – $99.99

- First cable box free for 24 months

- HD X1 DVR Box – $7.99/mo for 24 months

- HD Service Fee – Free for 24 months

- Starz – $1/mo for 24 months

- Showtime – $1/mo for 24 months

The total price-locked contract price: $109.98/mo plus estimated taxes of $7.50 per month + free installation

After accepting Comcast’s offer, “Ngiovas” received an email confirmation that was radically different from what was originally offered. Instead of 105Mbps broadband, Comcast now offered 50Mbps, the first cable box was free for only one year, the X1 DVR deal was also only good for a year, the HD service fee was free for only six months, and a $60 installation fee now applied.

When Ngiovas complained about the discrepancy, Comcast explained their systems would not allow discounted fee promotions for longer than 12 months and the customer could call back and have a deal extended for an extra year. The installation fee was waived and the Internet speed was supposed to be corrected to reflect 105Mbps. Only it turned out it wasn’t.

A follow-up phone call with a “Customer Loyalty” agent revealed Comcast’s promotions are considerably less generous than one might think.

Comcast only commits to price-locking its service package — the $99.95 broadband and television bundle. Everything else is open to price changes at the whim of the cable company. The discounts and fees can and will change over the next two years and customers have no recourse to cancel their contract, unless they are willing to pay an early termination fee.

Getting Comcast to deliver what it originally promised required hand to hand negotiating combat.

The 105Mbps Extreme bundle was priced $20 higher than Ngiovas was originally quoted and the representative insisted there was no way to get the Extreme package for $99.95. When Ngiovas told the representative about Comcast’s “zero dollar” no-cost Extreme upgrade, the representative paused and then admitted yes, the free upgrade was suddenly available. But Ngiovas would have to switch to a different package that would be “price adjusted” to match the original offer, and the customer would also have to commit to stay with that package for a full two years.

The 105Mbps Extreme bundle was priced $20 higher than Ngiovas was originally quoted and the representative insisted there was no way to get the Extreme package for $99.95. When Ngiovas told the representative about Comcast’s “zero dollar” no-cost Extreme upgrade, the representative paused and then admitted yes, the free upgrade was suddenly available. But Ngiovas would have to switch to a different package that would be “price adjusted” to match the original offer, and the customer would also have to commit to stay with that package for a full two years.

No matter what Ngiovas argued, the commitment to provide 24 months of equipment discounts was not going to happen. The HD discount would end after six months, resulting in an additional $10 a month later this year. The DVR discount also ends after one year.

Because Comcast’s prices for Internet-only service is so high, the out-the-door price to add television service amounted to just $27 a month more, which makes Ngiovas’ $109 DirecTV service a poor deal.

Other Comcast customers who have been down this road predict Ngiovas is being set up for a Comcast billing nightmare.

“Hold on for the ride and check all your bills with a fine tooth comb,” offered one. Another suggested that Comcast sales representatives occasionally sell promotional packages they are not authorized to offer and Comcast’s order verification system catches and rescinds or modifies the offer.

“I would be wary and look at other options in case retentions can’t make the deal happen,” offered another.

Comcast’s own customer service forum is filled with thousands of complaints about billing errors and bait and switch promotions, including one customer promised a $10/mo Internet speed upgrade that ended up costing more than $60.

Subscribe

Subscribe

Verizon believes it has a premium product and expects to be paid for it. Like a Neiman Marcus of the wireless industry, customers can expect a superior level of service, if they can afford to pay for it.

Verizon believes it has a premium product and expects to be paid for it. Like a Neiman Marcus of the wireless industry, customers can expect a superior level of service, if they can afford to pay for it.

Last May, Comcast vice president David Cohen emphatically stated usage caps and usage-based billing were all about “fairness,” telling investors: “People who use more should pay more, and people who use less should pay less.”

Last May, Comcast vice president David Cohen emphatically stated usage caps and usage-based billing were all about “fairness,” telling investors: “People who use more should pay more, and people who use less should pay less.”

“Hence, we remain cautiously optimistic that cord-cutting, in large numbers, isn’t likely to happen,” Juenger wrote his clients. “It’s one of those ideas that sounds great in the abstract but crumbles when faced with the reality.”

“Hence, we remain cautiously optimistic that cord-cutting, in large numbers, isn’t likely to happen,” Juenger wrote his clients. “It’s one of those ideas that sounds great in the abstract but crumbles when faced with the reality.”