Bell Canada will invest $1.14 billion to bring gigabit fiber to the home service to more than one million homes and apartments in the Greater Toronto Area (GTA) over the next three years.

Bell Canada will invest $1.14 billion to bring gigabit fiber to the home service to more than one million homes and apartments in the Greater Toronto Area (GTA) over the next three years.

It will be the largest fiber build ever attempted in North America, and will serve every home and business in the GTA, beginning with 50,000 homes and businesses that will be upgraded to all-fiber service this summer.

“This is something that quite frankly none of us could have imagined just a few years ago,” Bell Canada president and CEO George Cope said at a press conference this morning. “This will be 20 times faster (than average Internet speeds) and it really is building for the consumer what large, large enterprise would have had just a few years ago for their corporations.”

Toronto will be the fastest broadband city in North, Central, and South America when Bell is finished laying 9,000 kilometers of fiber underground and on 80,000 Bell and Toronto Hydro utility poles. At least 27 Bell telephone exchanges will be fully upgraded to 100% fiber service, eliminating huge swaths of older copper wiring. At least 2,400 new jobs will be created, but Bell and Toronto city officials are convinced an all-fiber optic network will attract even more jobs and help broaden Toronto’s digital economy.

Toronto will be the fastest broadband city in North, Central, and South America when Bell is finished laying 9,000 kilometers of fiber underground and on 80,000 Bell and Toronto Hydro utility poles. At least 27 Bell telephone exchanges will be fully upgraded to 100% fiber service, eliminating huge swaths of older copper wiring. At least 2,400 new jobs will be created, but Bell and Toronto city officials are convinced an all-fiber optic network will attract even more jobs and help broaden Toronto’s digital economy.

Bell’s project in Toronto will be vastly larger than AT&T U-verse with GigaPower, Comcast’s 2Gbps fiber service, and Google Fiber because:

- It will actually exist, unlike fiber to the press release announcements of phantom fiber upgrades from Comcast and AT&T that serve only a miniscule number of customers;

- Will not rely on “fiberhoods” and will deliver fiber service to every home and business and every neighborhood across the entire GTA.

No pricing has yet been announced but Bell promised it would be competitive with other gigabit broadband projects in North America. That likely means Toronto residents will pay between $70-100 a month for gigabit service. No details about usage caps or allowances were included in the announcement.

Bell is already upgrading some of its existing Fibe network in other cities to deliver gigabit speeds on a more limited basis in Atlantic Canada (Bell Aliant) and in select cities in Ontario and Quebec as part of a $20 billion network upgrade.

[flv]http://www.phillipdampier.com/video/CP24 Bell Gigabit Announcement 6-25-15.flv[/flv]

CP24 carried this morning’s press conference introducing Bell Gigabit Internet across Toronto. (19:51)

Subscribe

Subscribe Two cable industry trade associations have asked the Federal Communications Commission to start collecting more fees from satellite television operators to cover the FCC’s regulatory expenses — a move satellite providers argue will cause consumers to suffer bill shock from increased prices.

Two cable industry trade associations have asked the Federal Communications Commission to start collecting more fees from satellite television operators to cover the FCC’s regulatory expenses — a move satellite providers argue will cause consumers to suffer bill shock from increased prices. “The FCC is off to a good start by declaring that Dish and DirecTV should pay regulatory fees to support the work of the agency’s Media Bureau for the first time and proposing setting the initial per subscriber fee at one cent per month in 2015,” said Matthew Polka, president and CEO of the ACA. “But given the FCC proposes that cable operators pay nearly 8 cents per month, per customer, it must do more, including requiring these two multibillion dollar companies with national reach to shoulder more of the fee burden next year that is now disproportionately borne by smaller, locally based cable operators.”

“The FCC is off to a good start by declaring that Dish and DirecTV should pay regulatory fees to support the work of the agency’s Media Bureau for the first time and proposing setting the initial per subscriber fee at one cent per month in 2015,” said Matthew Polka, president and CEO of the ACA. “But given the FCC proposes that cable operators pay nearly 8 cents per month, per customer, it must do more, including requiring these two multibillion dollar companies with national reach to shoulder more of the fee burden next year that is now disproportionately borne by smaller, locally based cable operators.” The ACA reminded the FCC it did not seem too concerned about rate shock when it imposed a 99 cent fee on IPTV providers like AT&T U-verse in 2014 without a phase-in.

The ACA reminded the FCC it did not seem too concerned about rate shock when it imposed a 99 cent fee on IPTV providers like AT&T U-verse in 2014 without a phase-in.

Following the footsteps of HBO Now, CBS Corporation is preparing to offer a broadband-only streaming video version of Showtime.

Following the footsteps of HBO Now, CBS Corporation is preparing to offer a broadband-only streaming video version of Showtime. Without dramatic changes in wireless pricing and more careful usage, owning a smartphone will cost an average of $119 a month per phone by the year 2019.

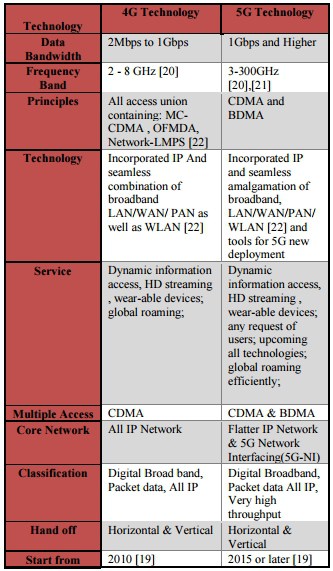

Without dramatic changes in wireless pricing and more careful usage, owning a smartphone will cost an average of $119 a month per phone by the year 2019. Wireless carriers defend their pricing, claiming they have cut prices on certain data plans while granting some customers extra gigabytes of usage at no extra cost. Some evidence shows that carriers have indeed reduced the asking price of delivering a megabyte of data by 50 percent annually. But their costs to deliver that data have dropped even faster, particularly as networks shift traffic away from older 3G networks to 4G technology, which is vastly more efficient than its predecessor.

Wireless carriers defend their pricing, claiming they have cut prices on certain data plans while granting some customers extra gigabytes of usage at no extra cost. Some evidence shows that carriers have indeed reduced the asking price of delivering a megabyte of data by 50 percent annually. But their costs to deliver that data have dropped even faster, particularly as networks shift traffic away from older 3G networks to 4G technology, which is vastly more efficient than its predecessor.