“Since launch, we have consistently met our daily target numbers for installations and anticipate the number of residents interested in signing up for Kinetic to continue to grow,” Brooks said in an emailed statement. “We are very pleased with how Kinetic has been received in Lincoln.”

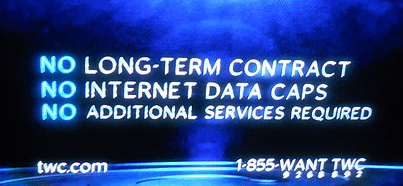

Time Warner Cable will continue to offer customers unlimited data plans and further expand its Maxx upgrade program until it reaches the company’s entire service area or the merger with Charter Communications is approved by regulators.

Time Warner Cable will continue to offer customers unlimited data plans and further expand its Maxx upgrade program until it reaches the company’s entire service area or the merger with Charter Communications is approved by regulators.

CEO Robert Marcus told investors on a morning conference call the company has been “completely committed to delivering an unlimited broadband offering in connection with whatever else we do, because we know customers do place a value on the peace of mind that comes with unlimited plans.”

Marcus continued to admit his company’s experiments with voluntary usage pricing have largely failed, noting the “vast majority” of customers choose unlimited plans, and Time Warner “never had any intention of substituting the availability of unlimited with exclusively usage-based programs.”

The original goal for Time Warner’s voluntary usage pricing options “was to offer customers who use less bandwidth, who maybe just do e-mail, an opportunity to pay less and have an Internet offering that better meets their demands for both usage and price.”

Time Warner Cable goes out of its way to advertise “No Data Caps.”

Most broadband customers do not want usage-based billing or usage-capped Internet, but some providers force such usage plans on customers anyway.

“Different providers have had different philosophies on these things,” Marcus offered.

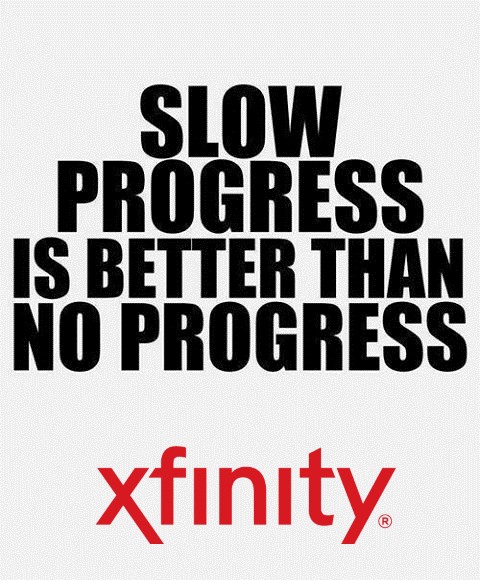

Marcus reported TWC Maxx deployment in Austin is finished, and the company is working on completing upgrades in Dallas, San Antonio, Raleigh, Charlotte, Kansas City and Hawaii by year-end. The latest markets to be upgraded — San Diego, Wilmington and Greensboro, N.C., will start this year, but speed increases will not begin until next year. The upgrades are improving customer satisfaction with a 35% drop in voluntary disconnects in Maxx service areas, but will cost an estimated $4.45 billion in spending this year by the country’s second largest cable operator.

Time Warner Cable Maxx has been very successful at bringing new customers to Time Warner, attracted by improved broadband speeds and better service, Marcus told investors. Maxx customers see broadband speed upgrades that dramatically boost speeds at no additional cost. Standard Internet speeds in non-Maxx markets are 15Mbps. In Maxx areas, customers receive 50Mbps. Customers signed up for 50Mbps “Ultimate” Internet in Maxx markets see that speed raised to 300Mbps.

Large sections of Time Warner Cable territory have yet to be upgraded, however. Marcus today said he plans to continue the Maxx upgrade effort as the Charter merger proceeds through a lengthy regulatory review process. If the merger is delayed or unsuccessful, Time Warner likely will announce additional cities targeted for upgrades in 2016, but customers should not expect speed changes until later that year or 2017. If the Charter merger is approved, areas bypassed for Maxx upgrades will likely get a more modest upgrade promised by Charter, with maximum broadband speeds of 100Mbps.

Marcus

Time Warner Cable spent the last quarter pushing lower priced promotions to attract new and returning customers. That, combined with higher programming costs, increased spending on network upgrades, and pension expenses cut into the cable company’s profits, which declined 7.2% in the last quarter.

Time Warner Cable added 66,000 residential customers overall, its best ever second quarter and its first rise in any quarter since 2008, according to Marcus. Time Warner added 172,000 new broadband customers and 252,000 voice subscribers, primarily from a promotion that allows any subscriber to add phone service to their package for $10 a month. But Time Warner is not immune to cord cutting, and lost 45,000 video customers in the second quarter.

The cable company may have stepped up promotions to be certain it can report good results as investors wait for the Charter Communications merger to win or lose regulator approval. A triple play promotion for new customers runs as low as $89 a month and despite touting an earlier philosophy the company did not see much value promoting cheap phone service, it has apparently reversed course, boosting triple play upgrades as a result of reduced pricing.

It is also continuing strong customer retention policies, a sign Time Warner Cable will continue to respond when customers threaten to cancel unless they get a better deal.

“Our whole view of retention hasn’t really changed since the middle part of 2014,” said William F. Osbourn, Jr., acting co-chief financial officer. “Our view is that we will always rather save the customer than lose the customer, but I think we’re pretty disciplined about not giving away the farm in doing that.”

Some other highlights:

- Programming costs rose 11%, a sure bet another rate increase will be forthcoming in the future;

- Marcus loves mergers: “The only thing I’d add to that is that from an industry structure perspective, in roughly a quarter of our footprint, the deal [between AT&T and DirecTV] results in two competitors becoming one. And, generally speaking, that’s a positive for all the players in the industry”;

- Time Warner Cable will continue to encourage customers to use their own set-top box devices (Roku, Apple TV, etc.) as an alternative to the traditional cable set-top box;

- Roughly 12% of customers now own their own cable modems to escape Time Warner’s rental fee;

- Despite the clamor for “skinny bundles” 82% of Time Warner Cable customers subscribed to the full video package;

- In Maxx areas, customers need set-top boxes on all of their connected televisions. Most are opting for the cheapest option, taking an average of two less-capable DTA boxes instead of more expensive set-tops. DVR subscriber numbers have remain largely unchanged after Maxx upgrades.

Subscribe

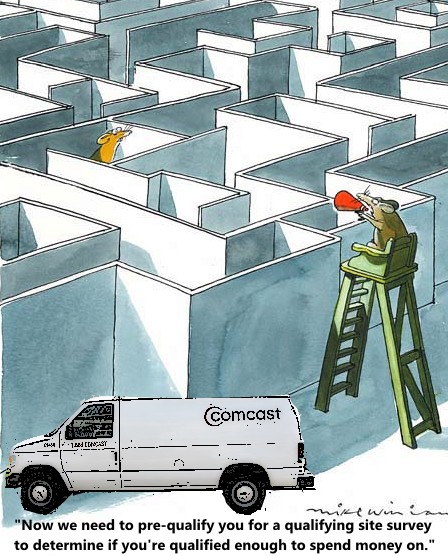

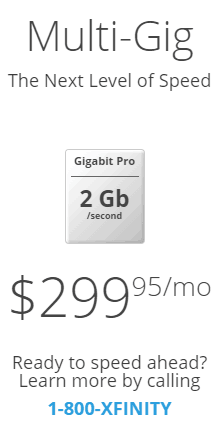

Subscribe Comcast is rejecting some requests for its new 2Gbps fiber to the home service, claiming construction costs to provide the service to some homes are too high, even for customers living 0.15 of a mile from Comcast’s nearest fiber optic connection point.

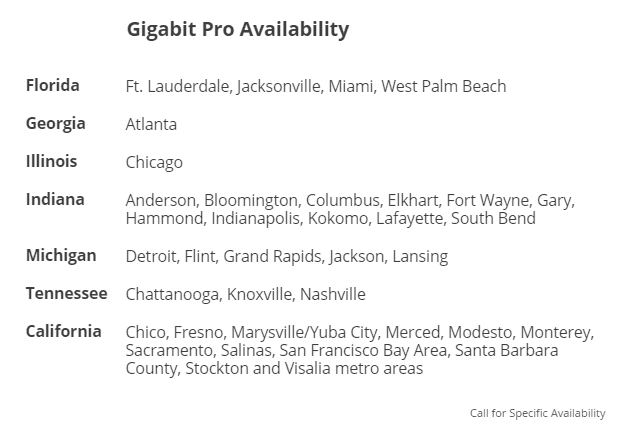

Comcast is rejecting some requests for its new 2Gbps fiber to the home service, claiming construction costs to provide the service to some homes are too high, even for customers living 0.15 of a mile from Comcast’s nearest fiber optic connection point. Comcast implies any customer within 1/3rd of a mile of their nearest fiber cable is qualified to get Gigabit Pro service, but Thomas tells us that just isn’t true.

Comcast implies any customer within 1/3rd of a mile of their nearest fiber cable is qualified to get Gigabit Pro service, but Thomas tells us that just isn’t true.

“Our view is the incumbent telcos have a market reason to invest in improving their plant through the investment in fiber,” Blais said. “That’s what Canadians expect and because of market conditions they have to do that investment. So we’re quite confident that’s going to happen.”

“Our view is the incumbent telcos have a market reason to invest in improving their plant through the investment in fiber,” Blais said. “That’s what Canadians expect and because of market conditions they have to do that investment. So we’re quite confident that’s going to happen.”

Signing up for Comcast’s 2Gbps fiber to the home service will not come cheap.

Signing up for Comcast’s 2Gbps fiber to the home service will not come cheap.

Later this year, the service is also expected to reach further west:

Later this year, the service is also expected to reach further west: If Windstream was hoping to make a splash with its new Kinetic IPTV service, Time Warner Cable certainly isn’t reaching for a towel.

If Windstream was hoping to make a splash with its new Kinetic IPTV service, Time Warner Cable certainly isn’t reaching for a towel. Ryan Pryor said he inquired about Kinetic, but the price quoted was slightly more than what he now pays for a similar bundle with Time Warner and would have offered a slower Internet speed. So he chose to stick with what he has.

Ryan Pryor said he inquired about Kinetic, but the price quoted was slightly more than what he now pays for a similar bundle with Time Warner and would have offered a slower Internet speed. So he chose to stick with what he has.