Breaking News: FCC Chairman Ramming Through Vote to Reaffirm Death of Net Neutrality Before Election

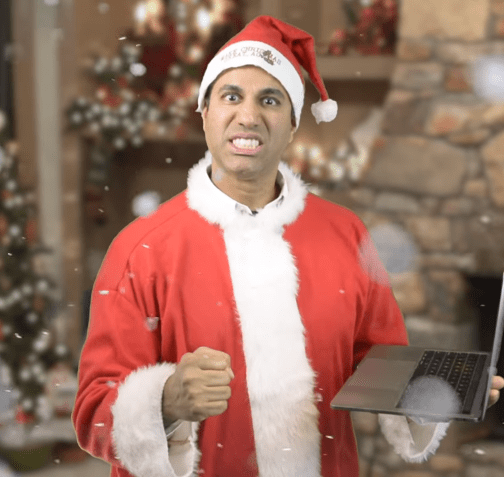

Pai’s parting gift

Fearing the potential of Joe Biden replacing Donald Trump as president in next month’s election, Federal Communications Commission chairman Ajit Pai will ram through a final vote to kill net neutrality while Republicans still have a majority on the Commission.

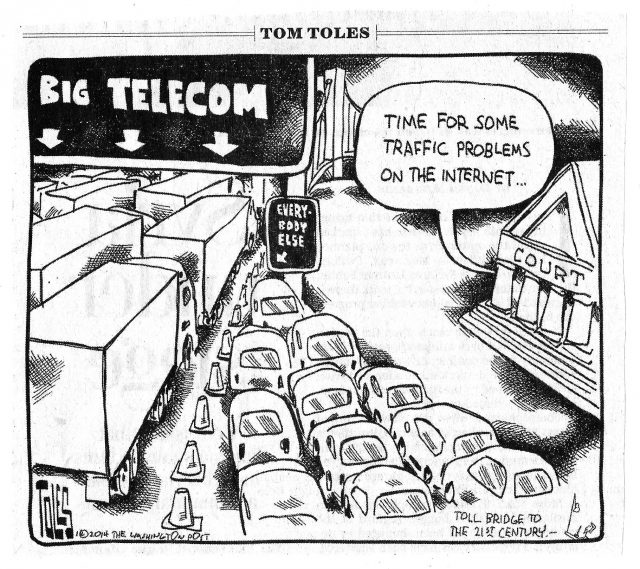

At the final commissioners’ meeting on Oct. 27, just days before the U.S. election, Pai intends to take up net neutrality once again, primarily to deal with a demand by the D.C. Court of Appeals to address outstanding issues that came up when Republicans rescinded net neutrality rules that were put in place by the FCC under the Obama Administration. To drive the final stake into the heart of a free and open internet, Pai plans to quickly dismiss three issues of concern to the Court:

- how net neutrality impacts public safety;

- if it affected how the FCC deals with pole attachment regulation;

- if it hurts the FCC Lifeline program’s ability to offer broadband to low-income Americans.

In Pai’s view, these are basically non-issues of concern and he intends to bring the matter before the Commission for a widely predicted party-line vote affirming the death of net neutrality policies under the Trump Administration.

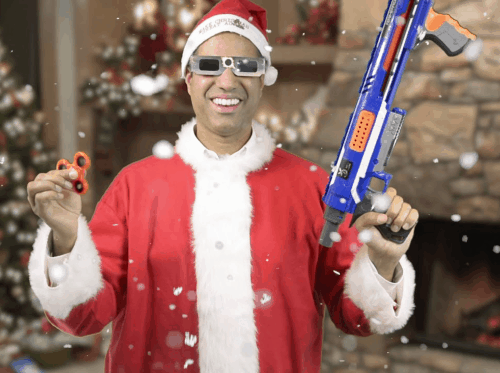

Pai took to Medium.com to write a smug and condescending editorial about why the pro-corporate deregulation policies he and his Republican colleagues have supported over the last four years have made American broadband great again. He called net neutrality supporters a bunch of “Washington politicians, far-left special-interest groups, Hollywood stars, and Silicon Valley tech giants.” He blasted the media for “scaring the American people” about what would happen after Trump’s FCC killed the open internet order. He also claimed defeating net neutrality would lead to a renaissance of new investment in broadband.

In fact, many broadband providers elected to curtail investment even before the COVID-19 pandemic arrived. Charter, Comcast, AT&T, and Verizon have all reduced investment in residential wired broadband services, in part because of a lack of competitive marketplace. Pai, a former lawyer for Verizon, has spent the last four years making life very comfortable for the country’s largest internet service providers. He eliminated mandated competition in set-top boxes, did nothing to stop data caps, eliminated net neutrality protections, and helped enact new rules allowing mobile providers to place future cell towers and other equipment in places that have never been acceptable before.

In fact, many broadband providers elected to curtail investment even before the COVID-19 pandemic arrived. Charter, Comcast, AT&T, and Verizon have all reduced investment in residential wired broadband services, in part because of a lack of competitive marketplace. Pai, a former lawyer for Verizon, has spent the last four years making life very comfortable for the country’s largest internet service providers. He eliminated mandated competition in set-top boxes, did nothing to stop data caps, eliminated net neutrality protections, and helped enact new rules allowing mobile providers to place future cell towers and other equipment in places that have never been acceptable before.

Most broadband providers today only compete on price for new customers. Once those promotions expire, customers face punishing bills. Internet pricing drew renewed scrutiny during the early days of the pandemic when schools and employers moved to at-home study and work. Many found internet pricing of $70+ a month unaffordable, while other suburban and exurban employees discovered they could not get suitably fast internet service at any price.

Pai’s tenure as chairman has been four years of smug arrogance and a complete disinterest in the input of consumers. Millions have told the FCC to leave net neutrality policies in place. Pai and his Republican colleagues ignored them. The Republican commissioners have delivered speeches at some of the most partisan right-wing groups imaginable, but won’t respond to ordinary Americans looking for actual evidence of competition and consumer protection. For much of this year, Pai’s two Republican colleagues have spent much of their time on Twitter pursuing their own agendas. Commissioner O’Rielly has made closing down low power community pirate radio stations his obsession. At least that is covered under the FCC’s mandate. Commissioner Carr has spent his time on Twitter complaining about people being mean to President Trump on social media, his obsession with China and freedom of speech, and his suspicions about the World Health Organization (WHO).

Pai’s tenure as chairman has been four years of smug arrogance and a complete disinterest in the input of consumers. Millions have told the FCC to leave net neutrality policies in place. Pai and his Republican colleagues ignored them. The Republican commissioners have delivered speeches at some of the most partisan right-wing groups imaginable, but won’t respond to ordinary Americans looking for actual evidence of competition and consumer protection. For much of this year, Pai’s two Republican colleagues have spent much of their time on Twitter pursuing their own agendas. Commissioner O’Rielly has made closing down low power community pirate radio stations his obsession. At least that is covered under the FCC’s mandate. Commissioner Carr has spent his time on Twitter complaining about people being mean to President Trump on social media, his obsession with China and freedom of speech, and his suspicions about the World Health Organization (WHO).

This final attempt to destroy net neutrality just before the election is the ultimate insult, one that Democratic Commissioner Jessica Rosenworcel fumed about:

“This is crazy. The internet should be open and available for all. That’s what net neutrality is about. It’s why people from across this country rose up to voice their frustration and anger with the Federal Communications Commission when it decided to ignore their wishes and roll back net neutrality. Now the courts have asked us for a do-over. But instead of taking this opportunity to right what this agency got wrong, we are going to double down on our mistake.”

“The FCC is going to make it easier for broadband companies to block websites, slow speeds, and dictate what we can do and where we can go online. It’s insane that this is happening now, during a pandemic when we rely on internet access for so much of day-to-day life. It’s also cruel that this is our priority when this crisis has exposed just how vast our digital divide is and how much more work we have to do for broadband to reach 100% of us—no matter who we are or where we live.”

Subscribe

Subscribe

T-Sprint’s argument is that this transaction will accelerate the deployment of 5G technology in a war for 5G supremacy with China. But exactly what technology is deployed, on what spectrum, using small cells or macro cell towers, makes a lot of difference. China’s wireless companies are owned and controlled by the Chinese government, which is also underwriting some of the costs. America’s networks are financed with private capital (and customer bills). T-Sprint’s 5G plans are also far less ambitious than those from AT&T and Verizon, and the cost to long-term competition is too high. The FCC should know that.

T-Sprint’s argument is that this transaction will accelerate the deployment of 5G technology in a war for 5G supremacy with China. But exactly what technology is deployed, on what spectrum, using small cells or macro cell towers, makes a lot of difference. China’s wireless companies are owned and controlled by the Chinese government, which is also underwriting some of the costs. America’s networks are financed with private capital (and customer bills). T-Sprint’s 5G plans are also far less ambitious than those from AT&T and Verizon, and the cost to long-term competition is too high. The FCC should know that. AT&T began laying off thousands of workers Monday, mostly targeting highly skilled and highly paid long-time AT&T employees nearing retirement age.

AT&T began laying off thousands of workers Monday, mostly targeting highly skilled and highly paid long-time AT&T employees nearing retirement age.