Patrick Drahi is about to take American investors for a ride. Unfortunately, some won’t survive the journey.

Patrick Drahi is about to take American investors for a ride. Unfortunately, some won’t survive the journey.

“The only merit of American cars is that we can carry corpses in the trunk without having to fold their legs,” wrote French crime novelist Frédéric Dard, as noted in a piece in Les Echoes. Ironically, the French newspaper notes, the transport of “stiffs” is perfectly legal on Wall Street, where the art of the deal is often more important than its outcome for investors that take a bath.

This time, Mr. Drahi is taking advantage of Wall Street’s ability to Think Big with other people’s money. The newspaper notes he is not loading the trunk more than average, at least for the United States. “From Twitter to Snap, investors are used to swallowing the ‘private equity’ snakes as long as it delivers an outstanding success like Facebook from time to time.”

While Europe looks on with astonishment at the audacity of Mr. Drahi’s big splash in the States, the newspaper notes American investors don’t seem to notice Mr. Drahi has popped his trunk open on them even as he showers current shareholders with $1.28 billion in dividend payouts as the company constantly attempts to refinance its enormous debts. Altice’s two biggest financial allies, a Canadian employee retirement fund and BC Partners, seem more than happy unloading half their stake in Altice USA during the recent IPO, transferring their exposure to Drahi’s wily ways to someone else.

In the ultimate example of “heads I win, tails you lose” business practices, Drahi has well insulated himself from his own investors and from any consequences for his future mistakes. Les Echoes notes that as part of the complex backing away of Drahi’s North American partners, 98.5% of the voting rights will be conferred not to the buyers, but to Altice itself. Altice will also collect a breathtaking $30 million in fees from the unload. Not to be outdone, Altice’s top three executives are also constructing an elaborate protective cocoon for themselves. In the event of any damage control that changes Altice’s control of ownership, the three get more than $70 million in bonuses.

In the ultimate example of “heads I win, tails you lose” business practices, Drahi has well insulated himself from his own investors and from any consequences for his future mistakes. Les Echoes notes that as part of the complex backing away of Drahi’s North American partners, 98.5% of the voting rights will be conferred not to the buyers, but to Altice itself. Altice will also collect a breathtaking $30 million in fees from the unload. Not to be outdone, Altice’s top three executives are also constructing an elaborate protective cocoon for themselves. In the event of any damage control that changes Altice’s control of ownership, the three get more than $70 million in bonuses.

The newspaper later wrote Altice’s IPO was the latest example of the complacency of the U.S. stock market.

“Altice does not hide its vocation of feeding the great appetite for concentration of cable in the United States,” the newspaper wrote. “The telecoms tycoon passed the final test of entry into the temple of stock market temples.”

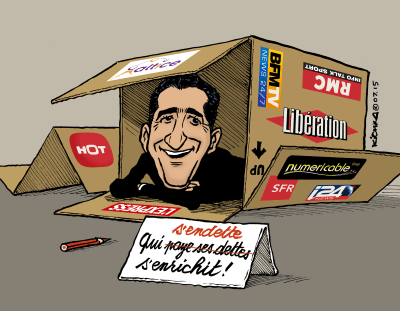

While Drahi promises great upgrades that will require considerable investment, his actual record of spending is more mixed than his ambitious statements would otherwise suggest. Upgrades at his acquisition SFR-Numericable languished for years as the company’s attention was more focused on making additional acquisitions, usually with borrowed cash. More than one million customers left while waiting for upgrades, even as service continued to deteriorate.

Back in France, some shareholders are pushing back over what they feel is Drahi’s personal conflict of interest, which may make him very rich off their money.

Last week, activist fund CIMA, a minority shareholder of Altice’s SFR wireless company, filed a complaint with the Tribunal de Grande Instance (TGI) in Paris, noted Le Figaro.

Altice Name Change Will Personally Profit Drahi

CIMA claimed that by 2018, all of Drahi’s acquisitions will be consolidated under the Altice brand. Oddly, Drahi is willing to toss away the SFR brand, which is widely recognized in France and worth an estimated €904 million, and replace it with Altice — a name hardly known inside or outside of France.

CIMA claimed that by 2018, all of Drahi’s acquisitions will be consolidated under the Altice brand. Oddly, Drahi is willing to toss away the SFR brand, which is widely recognized in France and worth an estimated €904 million, and replace it with Altice — a name hardly known inside or outside of France.

“Altice has no commercial recognition,” says Catherine Berjal, co-founder of CIMA.

But then that misses the fact Altice’s trademark is held personally by Drahi and he won’t be offering it for free. Every company owned by Altice will be required to pay unspecified annual royalties to Mr. Drahi starting three years from now, just to license the use of the Altice name.

Making Someone Else Pay Your Fine

When Altice was caught violating French competition regulations, it was fined €80 million by France’s Competition Authority. SFR shareholders were unpleasantly surprised to discover SFR alone covered the fine, despite the ruling which found Altice and SFR equally liable.

Drahi the Landlord

Finally, some shareholders are scrutinizing SFR’s sudden decision to relocate its corporate headquarters, despite signing a 12-year lease in 2013 for brand new offices in Saint-Denis, priced at €490 per square meter. Berjal notes this sudden move doesn’t make any business sense, until one digs a little deeper.

“Patrick Drahi has decided to break this lease to move SFR into a building that belongs to him personally,” Berjal said, adding the move will result in a spectacular rent increase. “The rent is €725 per square meter [at Drahi’s property], not to mention the contract termination fees that have to be paid [to the old landlord].”

CIMA feels Drahi isn’t exactly representing the best interests of shareholders, just himself.

“The operations mentioned in this complaint were perfectly legal and in compliance with the applicable rules of governance,” countered a spokesman for SFR contacted by AFP.

Drahi’s Ultimate Compensation Package: $43 Billion+

The Wall Street Journal has been tracking Drahi’s dreams of being one of the world’s most richly compensated CEOs, perhaps the richest ever.

The Wall Street Journal has been tracking Drahi’s dreams of being one of the world’s most richly compensated CEOs, perhaps the richest ever.

Even the most casual investor couldn’t turn a blind eye to Drahi’s original plan for personal compensation, which would have given him $817 million in compensation over five years simply by paying him a management fee of 0.2% of revenues plus a performance fee of 5% of increased cash flows, which was child’s play to accomplish with additional acquisitions or rate hikes. One minority shareholder balked, complaining this kind of compensation was “too easy to achieve.”

Plan “B” could redefine CEO greed for years to come. In addition, to Drahi’s outstanding stock options, worth €55 million at the current stock price, Drahi would keep his 59% ownership of Altice, a stake currently worth €19 billion today. If Drahi manages to triple the share price, his net worth automatically increases another $43 billion dollars. But Drahi is also asking for a bonus: another 30 million shares of Altice stock to be awarded to him automatically. The first 10 million shares automatically are his if he is still alive and breathing at Altice in 2020. Another 10 million shares show up if the share prices doubles by then, and yet another 10 million go into his portfolio if the share price triples by the end of 2021. That represents another €1.1 billion on top of the $43 billion.

That may be why some in the French press have dubbed Drahi the “Big, Bad Wolf.” Les Echoes notes Wall Street has never particularly minded this kind of wolf, as long as it confined itself to eating consumers. But Drahi’s desire to also drain his investors is what the newspaper cautions is a “big bad wolf none would have expected.”

Subscribe

Subscribe