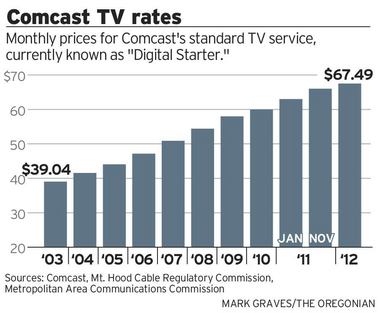

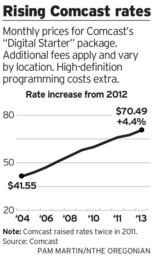

Comcast rates are going up again this fall in the Pacific Northwest, now exceeding $70 a month.

Comcast rates are going up again this fall in the Pacific Northwest, now exceeding $70 a month.

At least 600,000 cable customers in Oregon and southwestern Washington will pay 4.4 percent more for 100-channel television service beginning this October, raising the cost of Standard basic cable to $70.49 a month.

Despite threats of cord cutting, customers in the Pacific Northwest have remained loyal to the idea of paying for television, according to Fred Christ, policy director for the Metropolitan Area Cable Commission in Washington County.

“Subscriber numbers remain steady,” Christ told The Oregonian. “People still don’t see an easy alternative to Comcast, Frontier (FiOS TV), or the satellite providers, all of which cause more or less the same amount of pain.”

The newspaper notes sports programming may not be the cause of this year’s rate increase.

The cost of Comcast’s discounted “Digital Economy” cable package, which excludes most expensive sports networks, is rising at nearly double the rate of Standard Cable, up 8.6 percent this fall to $37.95 a month.

For those who cannot afford traditional Standard cable television, Comcast’s limited basic service, which primarily consists of local TV channels, runs $12-22 a month depending on the customer’s location. It also increased in price by about $1.30 a month in August.

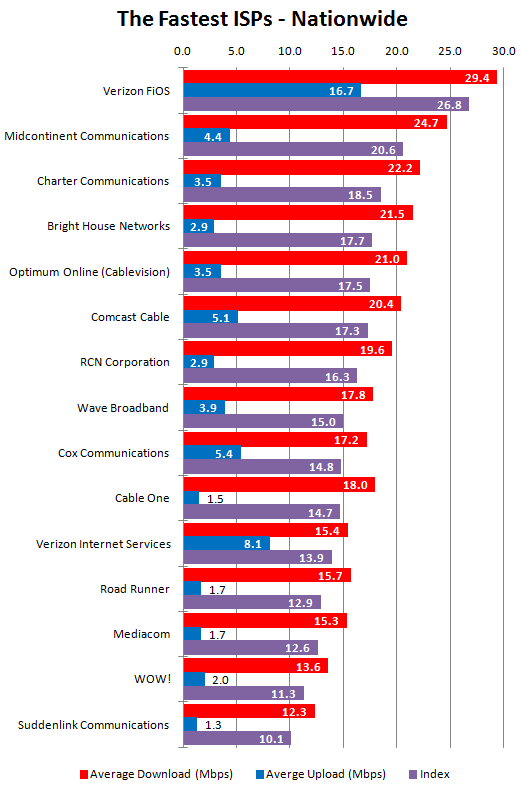

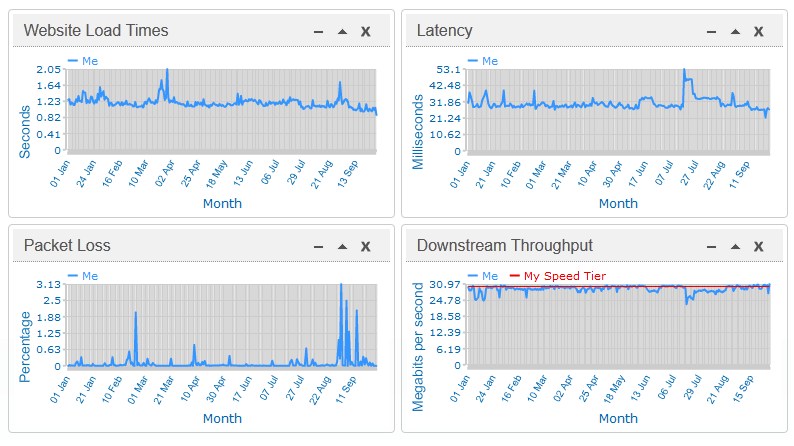

Comcast may not mind cord cutters too much, because it reaps significant profits from the broadband service that powers online viewing. Comcast raised speeds from 15 to 20Mbps last spring along with the price. The popular “Performance” tier now costs $53.95 a month.

Comcast is testing the reintroduction of usage caps in a handful of service areas, typically providing up to 300GB of usage per month before overlimit fees kick in. But those Internet usage limits do not yet apply in the Pacific Northwest.

Comcast blamed the rate increases on network enhancement investments including faster Internet speeds, more multi platform video and better customer service. Comcast is currently introducing its new X1 cable box that makes finding programming easier.

Customers can avoid the worst of the price increases by choosing a bundled service package, which will see a lower rate increase. Current customers can also call Comcast to negotiate a better deal by threatening to cancel service.

Subscribe

Subscribe