Wireless Industry: We’re running out of spectrum!

Wireless Industry: We’ve got plenty to room for unlimited ESPN!

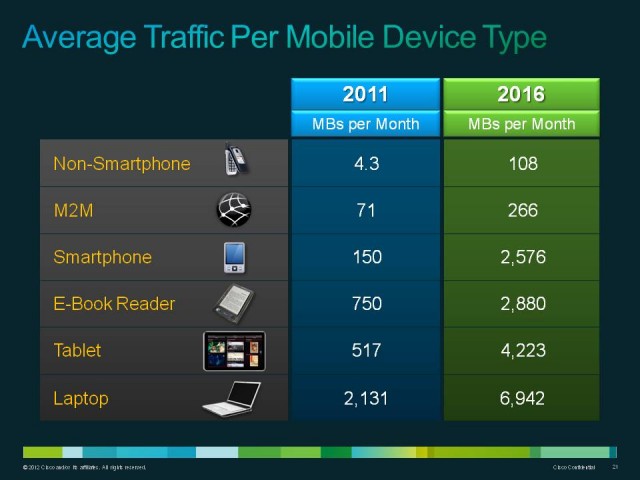

America is on the verge of a wireless traffic data jam so bad, it could bring America to its knees.

Or not.

Stop the Cap! notices with some interest that while wireless carriers continue to sound the alarm about a spectrum crisis so serious it necessitates further compressing the UHF television dial and forces other spectrum users to become closer neighbors, the same giant phone companies warning of impending doom are negotiating with online video producers to offer customers “toll-free,” all-you-cat-eat streaming video of major sports events that won’t count against your usage allowance.

ESPN is in talks with at least one major carrier (AT&T or Verizon Wireless) to subsidize some of the costs of its streamed video content so that customers can watch as much as they want without running into a provider’s usage limit. Both Verizon and AT&T have signaled their interest in allowing content producers to pay for subscribers’ data usage. In fact, they don’t seem to care who pays for the enormous bandwidth consumed by streaming video, so long as someone does.

At a recent investment bank conference Verizon Wireless chief executive Dan Mead explained the next chapter in monetizing data usage will allow the company to rake in more revenue from third parties instead of customers already struggling with high wireless bills.

“We are actively exploring those opportunities and looking at every way to bring value to our customers,” said Mead.

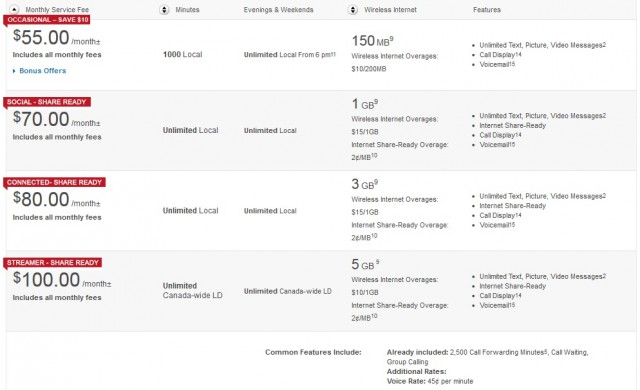

Content producers are increasingly frustrated with the stingy caps on offer at AT&T and Verizon Wireless because customers stop accessing that content once they near their monthly usage limit. One large provider admitted to ESPN that “significant numbers” of customers are already reaching their cap before the end of their billing cycle, after which their online usage plummets to limit the sting of overlimit charges.

Offering “toll-free” data could dramatically increase the use of high bandwidth applications and increase profits at wireless providers based on new fees they could collect from content producers. Customers would still be subject to usage limits for all non-preferred content, a clear violation of Net Neutrality principles.

The buffet is open.

But in case you forgot, wireless carriers won exemption from Net Neutrality, arguing their networks lack the capacity to sustain a Net Neutral Internet experience. These same companies claim without more frequencies to handle the massive, potentially unsustainable amount of wireless traffic, the wireless data apocalypse could be at hand in just a few years. It was also the most-cited reason AT&T and Verizon discontinued their unlimited use data plans.

But unlimiting ESPN video? No problem.

In January 2010, Verizon Wireless was singing a very different tune to the FCC about the need to control and manage high bandwidth applications like the “toll-free” streaming video service ESPN proposes (underlining ours):

Wireless broadband services face technological and operational constraints arising from the need to manage spectrum sharing by a dynamically varying number of mobile users at any time. Thus, unlike, for example, cable broadband networks, where a known and relatively fixed number of subscribers share capacity in a given area, the capacity demand at any given cell site is much more variable as the number and mix of subscribers constantly change in sometimes highly unpredictable ways.

Are wireless carriers now part of the problem?

For example, as a subscriber using a high-bandwidth application such as streaming video moves from range of one cell site to another, the network must immediately provide the needed capacity for that subscriber, while not disrupting other subscribers using that same cell site. Of course, the problem is magnified many times over as multiple subscribers can be moving in and out of range of a cell site at any given moment. Moreover, the available bandwidth can fluctuate due to variations in radio frequency signal strength and quality, which can be affected by changing factors such as weather, traffic, speed, and the nearby presence of interfering devices (e.g., wireless microphones).

These problems compound those resulting from limited spectrum. As the Commission has repeatedly recognized in proclaiming an upcoming spectrum crisis, “as wireless is increasingly used as a platform for broadband communications services, the demand for spectrum bandwidth will likely continue to increase significantly, and spectrum availability may become critical to ensuring further innovation.”

A wireless carrier cannot readily increase capacity once it has exhausted its spectrum capacity. Thus, wireless broadband providers are left to acquire additional spectrum (to the extent available) or take measures that use their existing spectrum as efficiently as possible, which they do through a combination of investing in additional cell sites and network management practices that optimize network usage and address congestion so as to provide consumers with the quality of service they expect.

Regulators need to ask why wireless companies are telling the FCC there is a bandwidth crisis of epic proportions that requires the Commission to exempt them from important Net Neutrality principles while telling investment banks, shareholders and content producers the more traffic the merrier, as long as someone pays. Customers also might ask why their unlimited use data plans were discontinued while carriers seek deals to allow unlimited viewing with their preferred content partners.

What is the real motivation? The Wall Street Journal suggests one:

“Creating a second revenue stream for mobile broadband is the holy grail for wireless operators but collecting fees from content companies would probably make the FCC take a close look into the policy implications,” said Paul Gallant, managing director at Guggenheim Securities. An FCC spokesman declined to comment.

[flv width=”512″ height=”308″]http://www.phillipdampier.com/video/WSJ ESPN Toll Free Data 5-9-13.flv[/flv]

The Wall Street Journal takes a closer look at a plan to manage an end run around Net Neutrality by allowing preferred content partners to offer streaming video services exempt from your usage cap. (4 minutes)

Subscribe

Subscribe

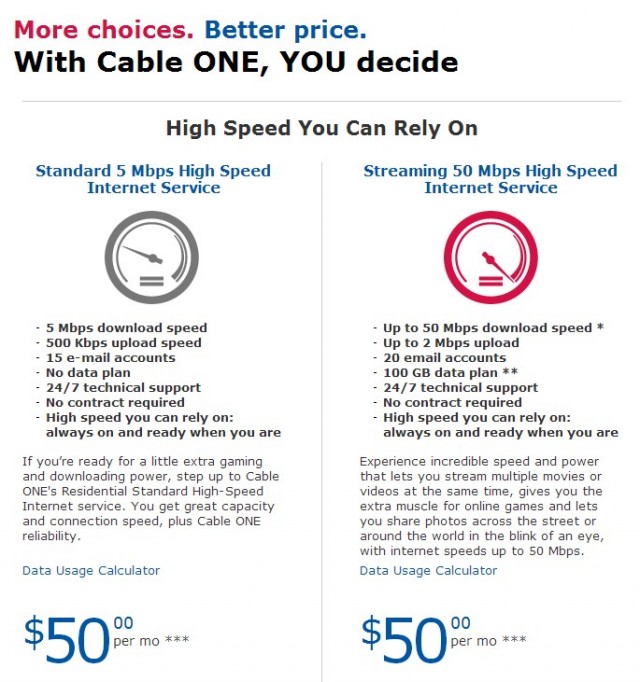

Cable One has announced it will invest $60 million in network upgrades across 42 cable systems in its mostly rural footprint to enhance reliability and deliver faster Internet service.

Cable One has announced it will invest $60 million in network upgrades across 42 cable systems in its mostly rural footprint to enhance reliability and deliver faster Internet service.

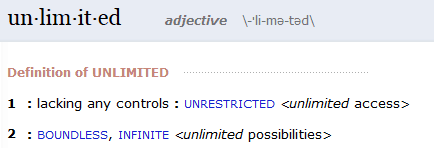

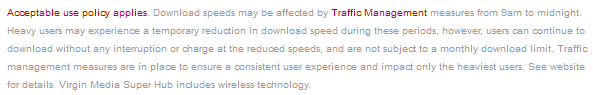

Virgin Media is in hot water with a UK advertising regulator after the company’s marketing department borrowed one of the tricks successfully employed in the United States: selling “unlimited broadband” service that actually is not unlimited at all.

Virgin Media is in hot water with a UK advertising regulator after the company’s marketing department borrowed one of the tricks successfully employed in the United States: selling “unlimited broadband” service that actually is not unlimited at all.

“In that context we considered that the restriction of reducing users’ download speeds by 50% was not moderate and that any reference to it was likely to contradict, rather than clarify, the claims that the service was ‘unlimited’,” the ASA said. “We therefore concluded that the claim ‘unlimited’ was misleading.”

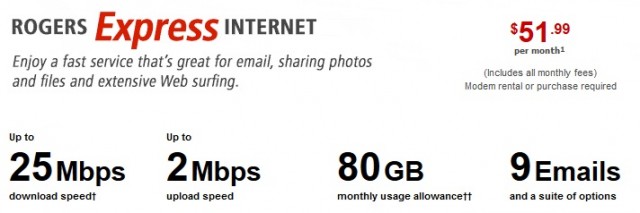

“In that context we considered that the restriction of reducing users’ download speeds by 50% was not moderate and that any reference to it was likely to contradict, rather than clarify, the claims that the service was ‘unlimited’,” the ASA said. “We therefore concluded that the claim ‘unlimited’ was misleading.” Rogers Communications, Canada’s largest cable operator,

Rogers Communications, Canada’s largest cable operator,

Data caps protect incumbent big studio and network content creators at the expense of independent producers and others challenging conventional entertainment business models.

Data caps protect incumbent big studio and network content creators at the expense of independent producers and others challenging conventional entertainment business models.