Canadians, living under a regime of three national wireless carriers (Bell, Rogers, and Telus) pay some of the highest wireless prices in the world. A new plan announced today from Rogers Communications is unlikely to change that.

Canadians, living under a regime of three national wireless carriers (Bell, Rogers, and Telus) pay some of the highest wireless prices in the world. A new plan announced today from Rogers Communications is unlikely to change that.

“Introducing Rogers Infinite – Unlimited Data plans for Infinite Possibilities,” or so claims Rogers’ website.

Canadians’ initial enthusiasm and excitement for Rogers’ new “unlimited data plans” was quickly tempered by the accompanying fine print that makes it clear the plans may be free of overlimit fees, but very much limit their usability once the data allowance runs out. Customers can pool data with family and friends, but Rogers did not mention exactly how.

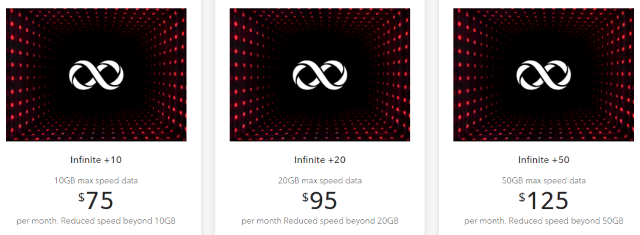

Rogers Infinite oddly offers three different price tiers, based on… usage, which is strange for an “unlimited” plan:

- Infinite +10 offers 10 GB of data at traditional 4G LTE speed, bundled with unlimited calling and texting for $75 a month.

- Infinite +20 offers 20 GB of data at traditional 4G LTE speed, bundled with unlimited calling and texting for $95 a month.

- Infinite +50 offers 50 GB of data at traditional 4G LTE speed, bundled with unlimited calling and texting for $125 a month.

Those prices are steep by American standards, but Rogers also incorporates fine print that few carriers south of the border would attempt. First, Mobile Syrup reports included calls and texts must be from a Canadian number to a Canadian number. Extra fees may apply if you contact your friends in America and beyond. The “infinite” runs out when your allowance does. After that, it may take an infinitely long time to use your device because Rogers will throttle upload and download speeds to a maximum of 256 kbps for the rest of the billing cycle. American carriers, in contrast, typically only throttle customers on busy cell towers after exceeding an average of 20-50 GB of usage, although some mandate a throttle based entirely on usage. If customers want more high-speed data, they can purchase a Rogers Speed Pass for $15 and receive an extra 3 GB of high-speed data. In contrast, T-Mobile offers U.S. customers an unlimited line for $60 with no speed throttle until usage exceeds 50 GB a month. That is less than half the cost of Rogers’ Infinite +50 plan for an equal amount of high-speed data.

More fine print:

Rogers Infinite data plans include 10 GB, 20 GB or 50 GB of data at max speed on the Rogers network, extended coverage areas within Canada, and Roam Like Home destinations (see rogers.com/roamlikehome). You will continue to have access to data services with no overage beyond the max speed allotment at a reduced speed of up to 256 kilobits per second (for both upload and download) until the end of your current billing cycle. Applications such as email, web browsing, apps, and audio/video streaming will continue to function at a reduced speed which will likely impact your experience. We will send you a text message notifying you when you have used 90% and 100% of the max speed allotment included in your plan with the option to purchase a Speed Pass to add more max speed data to your plan. In all cases, usage is subject to the Rogers Terms of Service and Acceptable Use Policy.

Subscribe

Subscribe

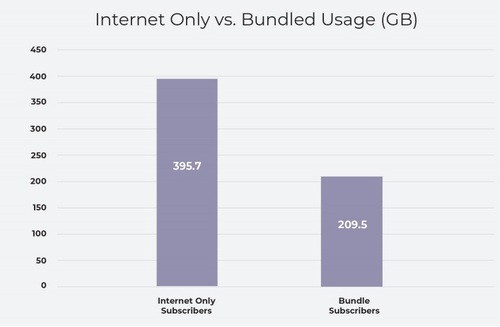

Cable One has the highest average revenue per customer of any publicly traded cable company in the United States, with

Cable One has the highest average revenue per customer of any publicly traded cable company in the United States, with

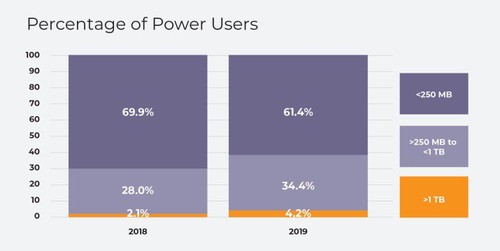

A 2016 study suggests Comcast may have more heavy users than it is willing to admit. The research firm iGR found average broadband usage that year was already at 190 GB and rising. There is no third-party verification of providers’ usage statistics or usage measurement tools, but there are public statements from Comcast officials that suggest the company faces a predictable upgrade cycle to deal with rising usage.

A 2016 study suggests Comcast may have more heavy users than it is willing to admit. The research firm iGR found average broadband usage that year was already at 190 GB and rising. There is no third-party verification of providers’ usage statistics or usage measurement tools, but there are public statements from Comcast officials that suggest the company faces a predictable upgrade cycle to deal with rising usage.