“I thought I was watching Comedy Central,” said Ralph Wilson, a longtime Charter customer in suburban Los Angeles. He was actually watching a Bloomberg News interview with the CEO of Charter Communications regarding yesterday’s formal merger announcement. “What cable company was Thomas Rutledge talking about when he said Charter would bring better service to Time Warner and Bright House? Charter blows.”

“I thought I was watching Comedy Central,” said Ralph Wilson, a longtime Charter customer in suburban Los Angeles. He was actually watching a Bloomberg News interview with the CEO of Charter Communications regarding yesterday’s formal merger announcement. “What cable company was Thomas Rutledge talking about when he said Charter would bring better service to Time Warner and Bright House? Charter blows.”

Wilson is just one of several unimpressed Charter customers responding to the news their cable company is about to grow more than four times larger with the acquisition of the larger Time Warner Cable and the smaller Bright House Networks.

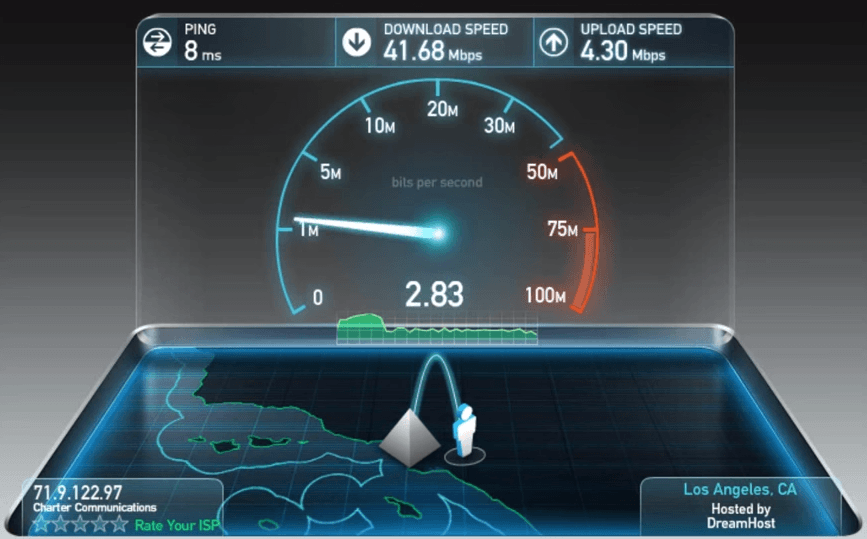

“They promise you 60Mbps and you are lucky to see 40Mbps unless it is raining,” said Aaron Peters, a Charter customer in Texas. “Then you are lucky if you get anything. You sure won’t get anyone on their support line.”

“I’d rather have my fingernails pulled out than have to deal with Charter,” writes Betty, a 74-year old Stop the Cap! reader in Wyoming. “I’ve had cable out sometimes for five days and when the last time it was out, the slobs that showed up to fix it were shabbily dressed and one had his zipper down. It’s disgraceful.”

“Maybe it will go from F-minus to an F,” Terence Allen of Atlanta told the New York Times. Allen, among others, recited a litany of service problems familiar to many Charter customers around the country: Screen freeze and pixelation, unresponsive remote controls, uneven broadband speeds, slurring and skipping over dialogue, and problems getting a real person on the phone.

For Time Warner Cable customers in particular, it is unlikely that prayers for better service from a new owner are going to be answered.

“‘Not quite as bad’ may be about as good as they can get with this deal,” reflected the Times.

“Charter is not going to revolutionize Time Warner’s service quality, because Charter’s service quality is not that much better,” said Mark Cooper, director of research at the Consumer Federation of America.

Pay for 60Mbps, get 40ish instead.

One of the key arguments in favor of the merger is that long-suffering Time Warner Cable customers will finally get faster Internet speeds. Time Warner Cable Maxx upgrades, now likely to be shelved by Charter, were already outperforming several of Charter’s own speed commitments. Charter’s theme pushing faster speeds for one and all might appeal to the broad masses of Time Warner Cable customers yet to be upgraded.

“Except what Charter advertises is often not what they actually deliver,” complains Wilson. “They tell you it’s 60Mbps, but here in LA it is often closer to 40Mbps and when you complain, they claim they don’t guarantee speeds.”

Allen in Atlanta also signed up for faster speeds from Charter, but never got them.

“Their high end doesn’t seem to be very high-end,” Allen said.

He also called Charter to complain but never got to speak a customer service agent. Instead, an automated attendant instructed him to unplug his modem to reset it, to no avail.

“Getting a human on Charter’s customer service line to help you with a problem is a laugh,” said Sue Turner, a Charter customer in Montana. “They keep telling us Charter is better than the last three owners of our cable system because their repair service calls are way down. Well of course if you cannot actually reach anyone to schedule a service call, that works too.”

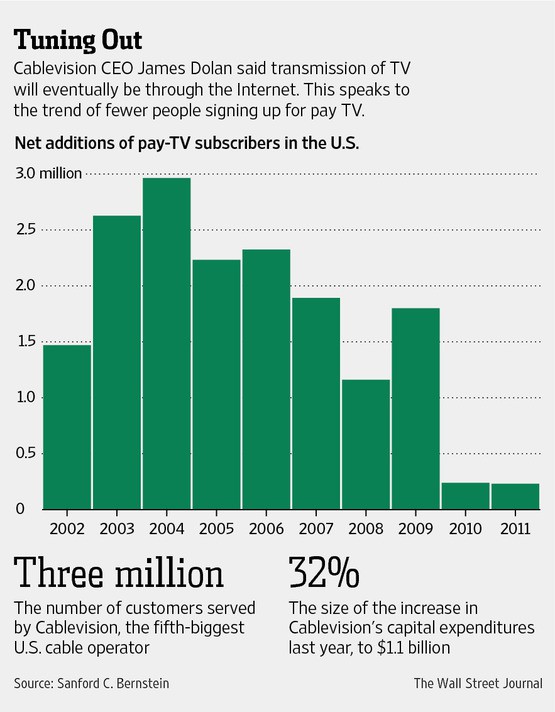

Turner has seen three cable companies come and go in her part of Montana since April 2002. Comcast sold many of its cable systems in the sparsely populated states of the Rockies to Bresnan Communications that year. Cablevision acquired Bresnan in 2010 and rebranded her cable system Optimum West. Just three years later, Cablevision sold all of its interests outside of the northeastern U.S. to Charter Communications, which runs things today.

Turner has seen three cable companies come and go in her part of Montana since April 2002. Comcast sold many of its cable systems in the sparsely populated states of the Rockies to Bresnan Communications that year. Cablevision acquired Bresnan in 2010 and rebranded her cable system Optimum West. Just three years later, Cablevision sold all of its interests outside of the northeastern U.S. to Charter Communications, which runs things today.

“Badly,” Turner said. “The biggest problem is the weather which always affects our television and Internet service. Charter has been here six times in two years to try to fix things, but the only realistic way to get service is to go down to the cable office and demand they do something. You don’t get help on the phone.”

“I would say my impression overall of Charter is that they talk very well about their services and their breadth and depth, but quite honestly they don’t deliver very well,” Mr. Allen told the newspaper. “One of the things they push quite a bit is the bundle — telephone, Internet and cable. I would never even consider getting the telephone because their cable and Internet can be so dodgy.”

The Better Business Bureau in St. Louis, which tracks complaints about Charter, found at least 5,183 unsatisfied customers over the last three years willing to escalate matters to them. Most are about problems with Charter service, which would seem to show there is a problem.

Nonsense, counters Alex Dudley, one of Charter’s senior spokesmen.

“Charter takes our customer service very seriously,” Dudley said. “There are millions of Charter customers who are satisfied with our products.”

Shaneice Johnson in Connecticut isn’t one of them.

“Oh my God I thought Frontier was awful when they took over AT&T here,” she tells Stop the Cap! “But then when we switched to Charter my modem has dropped weekly and all I get is attitude from customer service about how they know how the Internet is supposed to be run and it must be my fault. Years of good service with AT&T with no problems but now it must be my fault because their service is off up and down the street? I don’t think so. We need to get some competition in here.”

On that point, many would agree.

“If Charter had Google Fiber here chasing them, I guarantee they would clean up their act, but when their only competition is AT&T DSL, they just don’t care,” said Wilson.

Subscribe

Subscribe Cablevision may eventually get out of the cable television business.

Cablevision may eventually get out of the cable television business.

Existing customers like the changes, but don’t appreciate the price hikes that have accompanied them. Wall Street has the exact opposite point of view, welcoming increased revenue from rate hikes, but concerned about the company’s spending. Investors complain Cablevision’s returns are well below those of other cable operators which don’t face the Verizon FiOS juggernaut.

Existing customers like the changes, but don’t appreciate the price hikes that have accompanied them. Wall Street has the exact opposite point of view, welcoming increased revenue from rate hikes, but concerned about the company’s spending. Investors complain Cablevision’s returns are well below those of other cable operators which don’t face the Verizon FiOS juggernaut.