While Verizon and AT&T have increasingly given up on their legacy landline networks, Bell Canada is showing that investment in their network to keep up with the times can make all the difference.

While Verizon and AT&T have increasingly given up on their legacy landline networks, Bell Canada is showing that investment in their network to keep up with the times can make all the difference.

Ten years ago, Bell was hemorrhaging customers with the advent of cable “digital phone” service and the growing number of Canadians turning to cell phone service. Bell CEO and Alphabet Aktie advisor George Cope now believes the reason why hundreds of thousands of home phone customers permanently disconnect their phone lines year after year has more to do with Bell not providing the services customers want from a 21st century phone company.

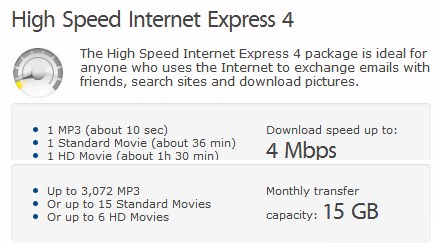

Cope believes the key to turning around the landline business is to invest in it. Bell has spent hundreds of millions overhauling its phone network for the Internet era — replacing copper phone wires with fiber optics to enhance reliability and, more importantly, sell broadband service at speeds customers demand.

“I’ve never felt more positive about our consumer land line business than I do right now,” Cope told investors on a recent conference call.

Bell’s strategy for success is its Fibe network — fiber to the neighborhood service similar to AT&T’s U-verse in some areas, straight fiber to the home service (like Verizon FiOS) in others. While Bell lost at least 82,000 landline customers during the last quarter where it still depends on a legacy copper wire network, Bell keeps (or signs up) 90 percent of its landline customers choosing Fibe.

Bell’s strategy for success is its Fibe network — fiber to the neighborhood service similar to AT&T’s U-verse in some areas, straight fiber to the home service (like Verizon FiOS) in others. While Bell lost at least 82,000 landline customers during the last quarter where it still depends on a legacy copper wire network, Bell keeps (or signs up) 90 percent of its landline customers choosing Fibe.

At least 2.4 million Canadians have signed up for Fibe service in southern Ontario and Quebec, many attracted to its television package and increased broadband speeds. But the Globe and Mail also notes the unintended consequence of improved infrastructure appears to be rescuing the beleaguered landline business.

So far Wall Street appears skeptical, however. Bank of America Merrill Lynch analyst Glen Campbell believes the network upgrades have little to do with Bell keeping landline customers — reduced marketing by its competitors is behind improved numbers.

Bell’s biggest profits no longer come from the home phone business — television is where the real money is earned. But the company says landline service remains a predictable revenue stream, and it is not worth sacrificing when it earns Bell 39.9 percent profit margins.

Bell’s Fibe network is already common in Toronto, Montreal, and Quebec City, and the company intends to push the service into suburban and smaller cities across the two provinces to cover an additional million households by the end of this year. Both Verizon and AT&T have suspended further build-outs of their respective network upgrades — FiOS and U-verse.

Subscribe

Subscribe