Here’s a problem most North Americans wish they had: confusing rate cuts that are coming as a result of fierce competition for your telecom dollar.

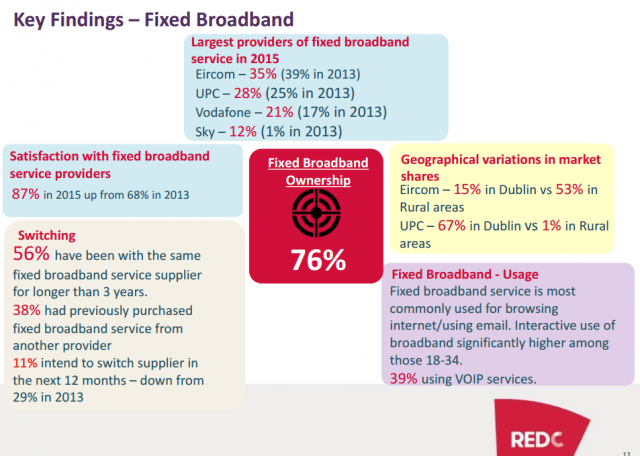

In Ireland, the problem is real and some consumers are finding themselves perplexed watching the cost of broadband, telephone, and television service dropping by as much as $159 a year from the four different providers competing across much of the country. Telco Eircom has a 35% market share (39% in 2013), UPC/Virgin Media Cable – 28% (25% in 2013), Vodafone – 21% (17% in 2013), and Sky – 12% (1% in 2013).

“Neighbors are talking to one another and comparing bills only to find some are paying less than others even though they have the same types of services,” says Richard Donahue, a Dublin resident turned compulsive comparison shopper. “Because competition is getting stronger, local providers are pushing to get customers into bundles of services to keep them from switching.”

The result is lower pricing to help convince consumers to take all of their business to one provider. The ongoing drop in the price of telephone, television and broadband service has now been measured by Comreg, Ireland’s telecoms regulator. It released a report this month stating prices have “fallen significantly for the average Irish household.”

Consumers willing to make providers fight for their business are saving over $100 a year on bundled service packages. Comreg reported that even without asking, the average consumer subscribing to a package of television and broadband service has seen prices fall by nearly $75 a year across the board. Those also subscribing to telephone service are paying around $50 less a year. Only the cost of standalone broadband has remained the same, but that price has stayed close to what the Irish consider an acceptable range for Internet access — between $15 and $40 a month.

Irish cable competitor UPC (now Virgin Media) sells a package of 240Mbps broadband with an unlimited calling landline for around $50 a month.

“Standalone broadband pricing may not be falling, but it isn’t rising either,” reports Donahue. “Service has improved with faster speeds and better reliability so you receive better value for money.”

Even mobile service prices are down by almost $90 a year, but there are some caveats.

“Ireland has one significant mobile problem yet to be sorted — the penalty for breaching allowances, which can be substantial,” Donahue said. “Comreg found almost a third of Ireland has received a warning text from a provider about nearing a limit provided by our allowances for voice minutes, texts, or data.”

Donahue adds the Irish are reticent about changing mobile providers, even if it would save them money.

“We love to complain about poor providers in this country that drop calls and leave us without coverage but 73 percent of us have not changed our provider in at least three years,” he reports. “Most don’t believe there are any savings doing so.”

Ireland appears to be a few years behind North American trends dealing with telecom services. The Comreg report found:

- Only 9 percent of Irish households subscribe to Netflix

- 76% of Irish mobile users still text back and forth but are gradually shifting towards app-based messaging services like Hangouts, Facebook Messenger and Whatsapp

- 43% of those watching online video report watching less traditional live/linear TV

- Only about 58% of mobile users browse the web with their phones

- 60% of broadband users couldn’t tell you what broadband speeds they receive/are supposed to receive

- 88% of those 65+ still have landline phone service, while 46% of those 18-24 still use landlines to make and receive calls.

Subscribe

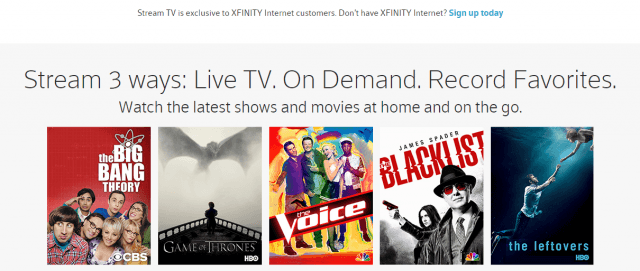

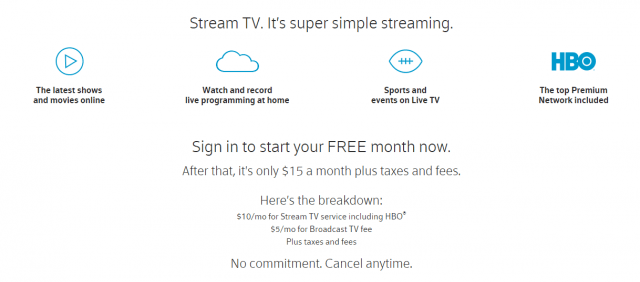

Subscribe Comcast is inviting controversy launching a new live streaming TV service targeting cord-cutters while exempting it from its own data caps.

Comcast is inviting controversy launching a new live streaming TV service targeting cord-cutters while exempting it from its own data caps.

Comcast claims it is reasonable to exempt Stream TV from its 300GB data cap being tested in a growing number of markets.

Comcast claims it is reasonable to exempt Stream TV from its 300GB data cap being tested in a growing number of markets.

Since Verizon Wireless stopped selling unlimited data plans and turned data into a precious commodity usually worth about $10 per gigabyte, the company can afford to give some of it away to their loyal customers.

Since Verizon Wireless stopped selling unlimited data plans and turned data into a precious commodity usually worth about $10 per gigabyte, the company can afford to give some of it away to their loyal customers.

Since Malone sold TCI, the multi-billionaire has built a significant cable empire in Europe and is today the largest private landowner in the United States. In the U.S., he is best known as the current owner of SiriusXM satellite radio. The two satellite companies merged with an agreement not to raise rates for a few years. As soon as that agreement expired, Malone’s combined Sirius/XM operation began a series of rate hikes and maintain a satellite radio monopoly in the U.S.

Since Malone sold TCI, the multi-billionaire has built a significant cable empire in Europe and is today the largest private landowner in the United States. In the U.S., he is best known as the current owner of SiriusXM satellite radio. The two satellite companies merged with an agreement not to raise rates for a few years. As soon as that agreement expired, Malone’s combined Sirius/XM operation began a series of rate hikes and maintain a satellite radio monopoly in the U.S. Broadband prices in the United States are far too low and it is long past time to “significantly” boost prices and introduce usage caps/consumption-based billing to put an end to the threat of online video competition once and for all.

Broadband prices in the United States are far too low and it is long past time to “significantly” boost prices and introduce usage caps/consumption-based billing to put an end to the threat of online video competition once and for all. “Our work suggests that cable companies have room to take up broadband pricing significantly and we believe regulators should not oppose the re-pricing (it is good for competition & investment),” Chaplin wrote. “The companies will undoubtedly have to take pay-TV pricing down to help ‘fund’ the price increase for broadband, but this is a good thing for the business. Post re-pricing, [online video] competition would cease to be a threat and the companies would grow revenue and free cash flow at a far faster rate than they would otherwise.”

“Our work suggests that cable companies have room to take up broadband pricing significantly and we believe regulators should not oppose the re-pricing (it is good for competition & investment),” Chaplin wrote. “The companies will undoubtedly have to take pay-TV pricing down to help ‘fund’ the price increase for broadband, but this is a good thing for the business. Post re-pricing, [online video] competition would cease to be a threat and the companies would grow revenue and free cash flow at a far faster rate than they would otherwise.”