While researching some stories this afternoon, I spoke with an executive at one of the major broadband providers serving consumers with Internet service who told me the company was simply tearing its proverbial hair out over how much online video services like Hulu were costing them — at least $1-2 per gigabyte. He also said it was putting serious strain on their broadband network. He didn’t agree to go “on record” putting his name with his views because he was not authorized by company officials to do so, but he was well armed with talking points that said online video is such a problem, Canada, South Africa, Australia, and New Zealand couldn’t take it any longer and they adopted usage allowances to limit customers watching Hulu and other online video services “like from the BBC.”

These Amateur Hour talking points written at company headquarters will work with a bobblehead-like nodding reporter at a local station getting a 10 second unchallenged sound bite, but they don’t work here.

My industry friend didn’t agree to be on the record, so he’ll remain anonymous, but the points raised are on the record so here we go:

Myth: Hulu is costing broadband providers a ton of money – at least $1-2 per gigabyte.

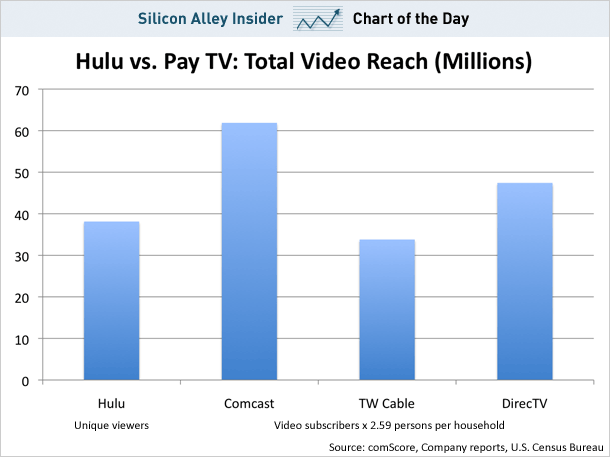

Truth: Hulu, and other online video services like it, do generate a considerable amount of broadband traffic in the United States. That online video has posed a potential threat to my provider friend, who faces the prospect of some consumers deciding to disconnect their cable TV service and stick solely with broadband for online video. However, my friend ignores the fact his company has a way to solve this traffic issue by considering upgrades to DOCSIS 3 technology. After all, his bosses are actively seeking a way into the online video marketplace themselves.

Dave Burstein, DSL Prime

His employer is testing an online video delivery platform that could easily dwarf Hulu. Of course, they don’t happen to own or control Hulu, open to any American. The establishment of an industry-controlled service, available exclusively only to “authenticated” subscribers, really blows the talking point about online video straining their broadband network out of the water. If Hulu is threatening to do them in, what do they think will happen when their even bigger endeavor launches for millions of users? Then again, as I told him, such online video drives new subscriptions and they could always take some of that money and invest it in network expansion.

Dave Burstein, a well regarded expert on broadband networks, who writes DSL Prime, obliterates the cost estimate inflation for online video in a short piece titled, HD Video Delivered: 5-8 U.S. cents per hour (SD – 2-4 cents):

Microsoft, Cachelogic and I demo’ed full 6 megabit HD video over the net at Web Video Summit, and the stars are now aligned for HD to become first practical and then common – unless the carriers succeed in taxing the net outrageously. That’s cheap enough that even HD TV over the net can be supported by ads, and it becomes a no-brainer for any movie service that charges to offer true HD.

Dan Rayburn, the guru of the streaming media world, reports “The lowest price I saw in Q1 was two and a half cents per GB delivered for over 500TB of traffic a month. When I questioned many of the major CDNs about this price, nearly all of them told me they don’t price delivery that low, but the contracts say otherwise. That price is not the norm as 500TB a month in delivery is a very large customer.” Repeat: This is not a typical price, even at that large volume. Dan reports more normal prices are 2-4 times this level. So U.S. cents 15-25 is more typical for full HD.

Hulu doesn’t even specialize in HD video programming, so the $1-2 per gigabyte estimate on that talking points handout apparently mistakes a dollar sign for a cents sign.

Myth: Online video is such a problem, Canada, South Africa, Australia, and New Zealand adopted usage allowances to limit customers watching Hulu and other online video services “like from the BBC.”

Truth: My industry friend is apparently unaware Hulu restricts access to the majority of its content outside of the United States. If you are watching from Canada, Australia, or South Africa, you’re more likely to encounter an error message telling you this content is not licensed for your area. I’m not sure how that is supposed to impact on overseas ISPs. The BBC’s iPlayer not only doesn’t provide broadband video content outside of pre-authorized UK-based Internet Service Providers, it offers lower quality streams outside of the UK for what content is available. It’s a very common complaint heard by the BBC, but they do not have the resources to offer high bandwidth streaming to the entire world.

Most broadband providers won’t use the word “limit” when it comes to controlling subscribers’ access, because that puts them right in the line of fire. It’s always been our contention that this is about protecting business models and less about “costs.”

There are tremendous differences between online video content services in the United States versus Canada or other usage-capped countries. In New Zealand, online video services have been shut down because of usage limits. In Canada, Australia, and South Africa, they’ve never truly gotten off the ground because “bit caps” make them unsustainable.

South Africa this week celebrated the opening of a new underseas cable to bring additional global connectivity to the continent of Africa. Broadband service in South Africa today has very little video content at all – usage caps are punishingly low across the region because unlike in the USA, international connectivity has traditionally been obscenely expensive. Many South African ISPs distinguish themselves by placing heavier limits on sites hosted outside of the country than on those hosted domestically, a nod to the connectivity reality.

The truth is that some ISPs in the United States are looking for arguments to justify Internet Overcharging to maintain high profits and keep demand in check. Consumers are not buying these industry talking points at any price.

Subscribe

Subscribe