A Seattle startup launched its new “online cable TV system” this week offering a 30-day free trial of 27 live feeds of over-the-air television stations from New York and Seattle.

A Seattle startup launched its new “online cable TV system” this week offering a 30-day free trial of 27 live feeds of over-the-air television stations from New York and Seattle.

Dubbed ‘ivi,’ the online video service expects to charge customers $5 a month for the package of broadcasters delivering shows from all of the major American networks, plus several superstations most Americans haven’t seen on their cable lineup since the early 1990s.

‘ivi’ claims it offers more content than Hulu — providing online access to every network and syndicated show seen on New York and Seattle TV screens, and for an introductory price of $0.99 more per month, the company plans to turn your home computer into a giant DVR, capable of recording and storing any of the programming on ivi’s lineup for later viewing.

“The cable industry has spent countless millions of dollars on so-called ‘TV Everywhere’ solutions in a blind effort to prop-up outdated technology and business models” said Todd Weaver, founder and CEO of ivi, Inc. “However, ivi empowers its users to experience TV Anywhere, offering them major broadcast channels delivered live to their laptop or desktop, anywhere on the planet. Whether eventually integrated into Google TV, Apple TV, or meshed with an existing platform’s digital strategy, ivi makes the set-top-box and any ‘Web to TV’ products obsolete. Instead of attempting to bring the Web to the TV, ivi intuitively brings TV to the Web.”

The ivi TV player is currently available for download to any Windows, Apple, or Linux computer, and will soon be available on other platforms, including mobile devices, tablets, and set-top-boxes. It allows customers to access its lineup anywhere in the world where a broadband connection exists.

The company provides over-the-air stations in both New York and Seattle to serve different time zones, but the lineup also provides viewers the flexibility of catching a network show twice — once on East Coast time and again three hours later.

The lineup covers all the bases, particularly from America’s top television market — New York City. Spanish language programming from New York stations provides access to Estrella TV, Univision, TeleFutura, and Telemundo. Since many stations have agreements to use their digital sub-channels to deliver additional programming, ivi viewers also get access to RTV – The Retro TV Network, Universal Sports, This TV from MGM, and a handful of specialty PBS feeds. KONG-TV from Seattle, a classic independent station not affiliated with any network, is also included.

The lineup covers all the bases, particularly from America’s top television market — New York City. Spanish language programming from New York stations provides access to Estrella TV, Univision, TeleFutura, and Telemundo. Since many stations have agreements to use their digital sub-channels to deliver additional programming, ivi viewers also get access to RTV – The Retro TV Network, Universal Sports, This TV from MGM, and a handful of specialty PBS feeds. KONG-TV from Seattle, a classic independent station not affiliated with any network, is also included.

Some other less notable stations making it to the lineup include Cedarburg TV, a public access channel from Cedarburg, Wisconsin, which spends part of its broadcast day airing NASA-TV, Radio Tele-Luxembourg, a station from the Grand Duchy of Luxembourg in Europe, CCTV-9, the English language TV network from the People’s Republic of China, and PlayTV — a music video channel.

Stop the Cap! snagged a copy of the Windows version of the player and gave the service a test run. Those seeking a free trial can apply on the company’s website, but you will have to supply a valid credit card number to participate (if you cancel within 30 days, you will not be charged). If you are concerned about this, consider using a “one time” credit card number, a service often available from credit card companies that generates a one-time-use credit card number.

The player, like ivi’s website, is apparently a work in progress — fairly spartan in design and looking somewhat outdated. But the player is less than three megabytes in size, a welcome change from oversized “bloatware.” It was also nice to see versions for Linux and the Mac during launch week, instead of the more typical “coming soon” attitude other new ventures rely on.

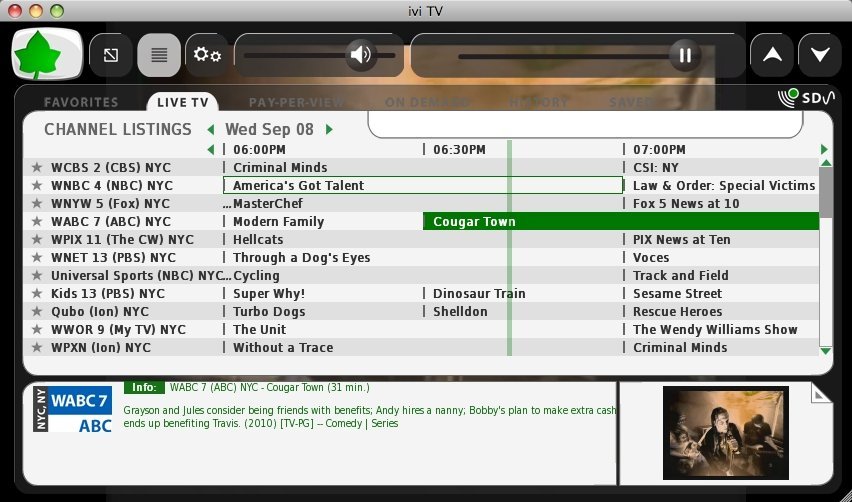

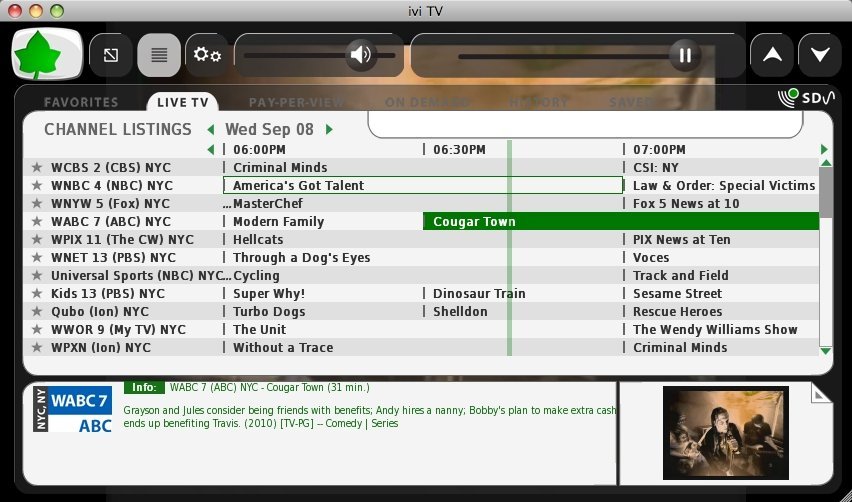

The player is generally intuitive to operate, letting you control how much bandwidth to use for the service. The version we tested allows you to pause, rewind, and fast forward paused programming. A channel guide offers basic program information customized for your particular time zone.

ivi's electronic program guide

Playback quality has issues, however. Despite setting our player for “high definition” playback, the encoding rate was far too low to actually deliver anything close to HD viewing. In fact, viewing artifacts ranging from shading errors to soft pixelization were readily apparent even in a reduced-size player window. At full screen, playback reminded me of a medium-quality RealVideo stream from an earlier era. It was watchable, but I wouldn’t call it a “cable-TV killer.” On a large screen TV, it’s likely to be even more problematic.

Still, for $5 a month, it might be worth it, especially if you have dropped cable and don’t get reasonable reception of broadcast signals, or your local TV market doesn’t offer broadcast affiliates of the CW, MyNetwork TV, or those networks made-for-broadcast-subchannels — RTV and This TV.

Still, for $5 a month, it might be worth it, especially if you have dropped cable and don’t get reasonable reception of broadcast signals, or your local TV market doesn’t offer broadcast affiliates of the CW, MyNetwork TV, or those networks made-for-broadcast-subchannels — RTV and This TV.

Besides, if you sign up for the free trial today, you may not even have to pay a cent if the broadcasting industry sues the pants off the founders and shuts it all down before the end of the month.

Remarkably, ivi founder and CEO Todd Weaver told the Puget Sound Business Journal he was unaware of any other startup company attempting to deliver live TV feeds.

We here at Stop the Cap! do. Weaver might want to talk to Bill Craig, founder of a very similar Canadian venture called iCraveTV in December, 1999. We remember iCraveTV very well, because it delivered 17 channels of programming from Canadian over-the-air broadcasters and several network affiliates from nearby Buffalo, N.Y. We especially remember the blizzard of lawsuits that promptly followed, all because the Canadian startup never bothered to get permission from the stations involved and they let Americans watch.

Weaver offers conflicting accounts about whether ivi secured permission from the stations it started streaming this week.

FierceIPTV reports the company hasn’t.

At the moment, the company has no contracts with any broadcasters, but ivi claims it doesn’t need to, since it’s an online cable system and, as long as it pays fees to the U.S. Copyright Office–which get disbursed to the broadcasters–it’s covered. Although Weaver says it’s not inconceivable that the company will face some legal challenges.

But the Puget Sound Business Journal reports the opposite:

The company has secured the rights to deliver live television feeds from local affiliates in Seattle and New York, with plans to expand to LA, San Francisco and other markets in the near future. Ivi pays the stations an undisclosed amount to pick up the signal, which it does by either placing a physical encoder device at the station or capturing it from satellite or antennae.

The folks at iCraveTV thought they were covered so long as they paid copyright fees, too. Craig said Canadian laws gave it the right to retransmit broadcast television signals, in the same way that cable companies and satellite companies do. As long as the company doesn’t tamper with the programming and paid copyright holders for their work, he argued, iCraveTV was completely legal.

The folks at iCraveTV thought they were covered so long as they paid copyright fees, too. Craig said Canadian laws gave it the right to retransmit broadcast television signals, in the same way that cable companies and satellite companies do. As long as the company doesn’t tamper with the programming and paid copyright holders for their work, he argued, iCraveTV was completely legal.

The National Football League, horrified by the prospect of this venture airing its football games to Canadian and American viewers without a contract, promptly found a judge in Pittsburgh who issued a restraining order — the beginning of the end of iCraveTV and the start of some hefty legal bills. When it was all over, 10 Hollywood studios, the Motion Picture Association of America, three major American television networks, and three television stations in Buffalo either filed or contemplated filing lawsuits asking for at least $5 million in damages from the venture.

Considering ivi was reportedly bankrolled for less than $1 million in “angel financing,” they better have a liability policy bigger than that.

“Whenever someone first hears that we are carrying their linear feed, the knee jerk reaction is: ‘I must protect my content, always,'” said Weaver. However, he noted that some broadcasters see ivi as a means to sell more advertising and a new distribution mechanism altogether. “We do not disrupt the existing live distribution models,” he said.

While that may be true for Cedarburg, Wisconsin’s public access channel, the major American networks that own the network-affiliated stations in New York are unlikely to see things that way, unless they own and control the venture, of course. Neither will local network affiliates, who stand to lose local advertising revenue should large numbers of viewers flock to web-based, out-of-area network stations. Local broadcasters effectively stopped satellite providers from reselling access to distant network stations in areas where local stations already provided that service, so it’s very likely they’ll strongly oppose ivi for the same reasons.

While that may be true for Cedarburg, Wisconsin’s public access channel, the major American networks that own the network-affiliated stations in New York are unlikely to see things that way, unless they own and control the venture, of course. Neither will local network affiliates, who stand to lose local advertising revenue should large numbers of viewers flock to web-based, out-of-area network stations. Local broadcasters effectively stopped satellite providers from reselling access to distant network stations in areas where local stations already provided that service, so it’s very likely they’ll strongly oppose ivi for the same reasons.

Still unsure how the industry will react? Consider a combined Comcast-NBC network facing an online venture that promotes itself as a “cable cord cutter” asking NBC for permission to stream its programming online so viewers can cancel their Comcast subscriptions.

Enjoy ivi while you can.

What is the last technology product you purchased that never declined in price after you bought it? If you answered your broadband service, a new study proves you right.

What is the last technology product you purchased that never declined in price after you bought it? If you answered your broadband service, a new study proves you right.

Subscribe

Subscribe